US elections and the winning financial sectors

09 November 2020 _ News

- Expansion of the budget deficit

- Increased spending on infrastructure

- Reduction of costs related to health care expenditure

- Potential break-up of some of the US tech giants

- Strong focus on intellectual property protection

- ESG

Debt Expansion

We believe that fiscal stimuli will be an issue that, together with the dynamics of profit growth, will have to be closely monitored by investors as market drivers.

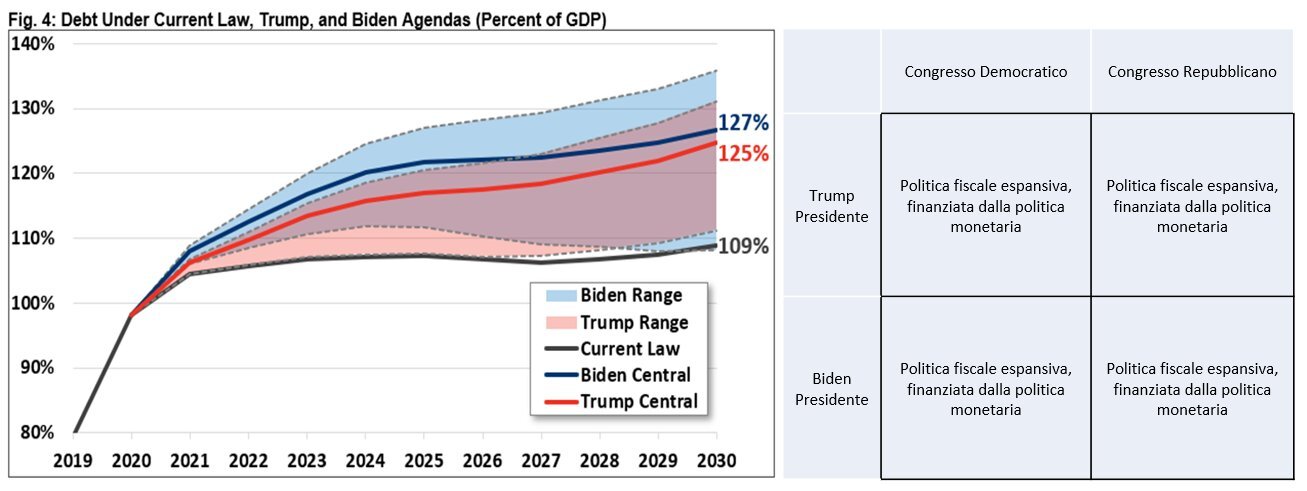

In the graph below you can see that it is estimated that debt as a percentage of GDP will reach 130% by 2030 under either candidate and that, irrespective of the president or the composition of Congress, the real dominant common theme will be the same: an expansive fiscal policy financed by monetary policy.

These stimuli will have a positive effect on the entire stock market and in particular on cyclical stocks.

Increased spending on Infrastructures

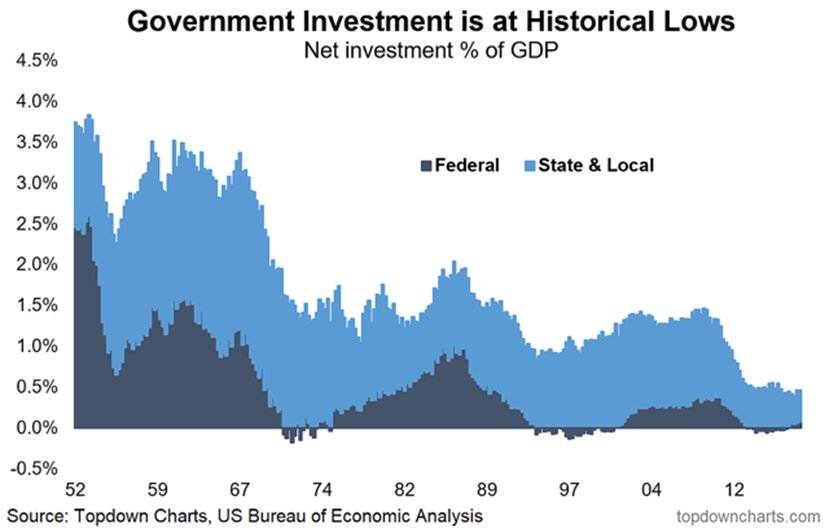

Infrastructure spending will probably be the theme that comes out as the real winner of the presidential election. The reasons are not only that both candidates foresee this in their programme, but also and above all because the economy needs it.

In the United States, investment in infrastructure in relation to GDP has been at an all-time low for decades. Suffice it to say that Ray Lahood, Transport Secretary in the Obama administration, has defined the United States as “third world” in terms of infrastructure, with a forecast of at least 2 trillion dollars of spending needed by 2025 to fill the infrastructure gap which could otherwise negatively affect GDP by about 4 trillion dollars with 2.5 million jobs lost.

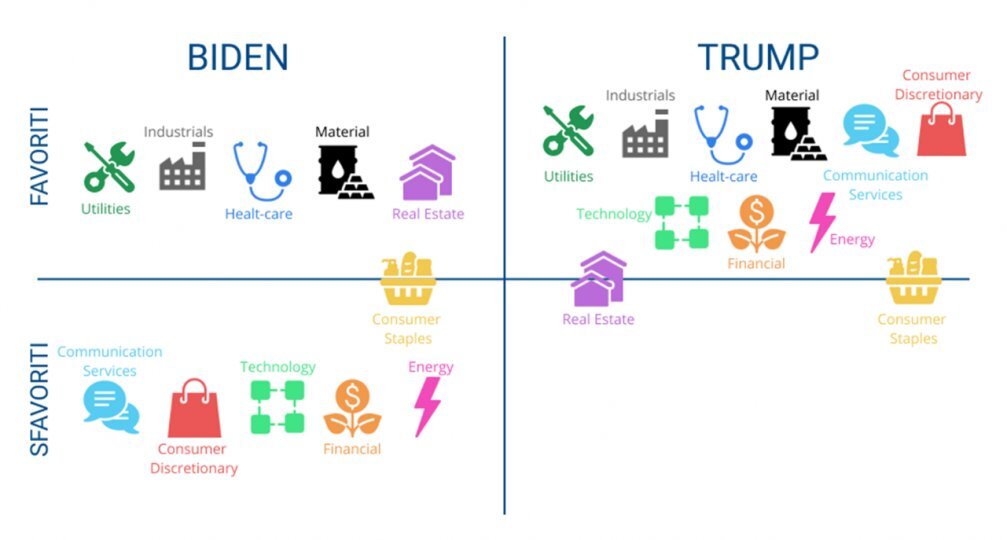

Precisely because of the multiplier effect on GDP characteristic of infrastructure investment, both candidates propose major spending plans, which in the case of Biden will be more focused on the world of decarbonisation and the green economy, with the newly elected president already saying that the United States will return to the Paris climate agreement within days of his term in office. The sectors that will benefit most from these issues are: industrial, materials, utilities, renewable energy and green energy.

Technology e digitalization

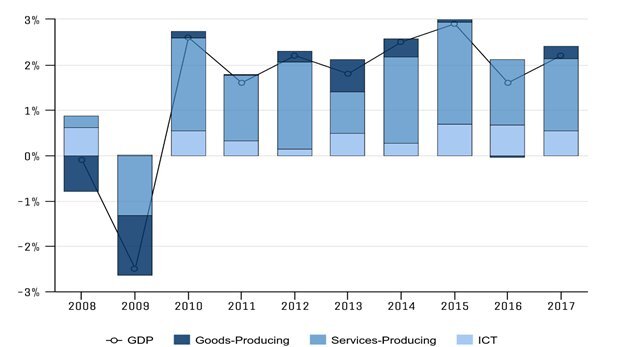

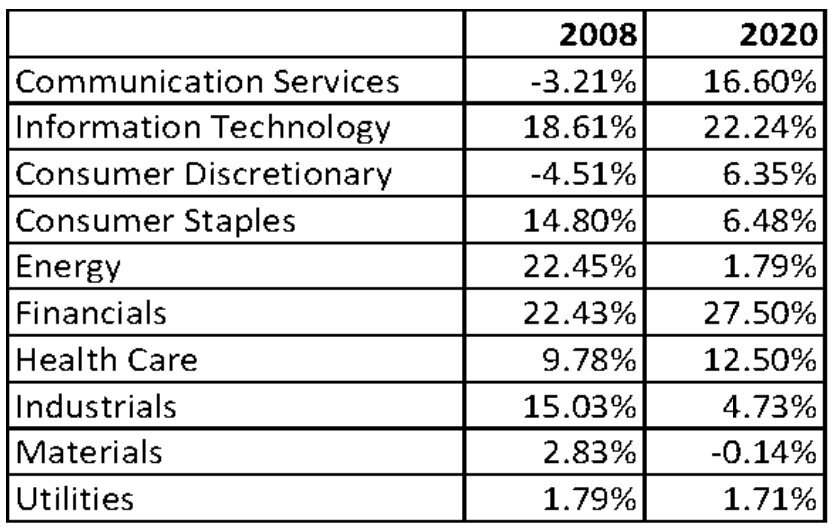

The technological world, or in any case the digital world, today plays a decisive role in the economic and competitive balances of the various world powers and, as can be seen from the graphs below, has driven global GDP growth in recent years. Currently, R&D expenditure in the sector is equivalent to 50% of GDP and technology contributes 40% to the overall profits of the American market.

We believe that the sector, in the medium to long term, will continue to be among the most interesting in the market and we do not believe that antitrust interventions in large monopolies are necessarily negative for the sector as a whole. In this scenario, the reference sectors to consider will be cloud services, smart payments, IT security, digital marketing, robotics and semiconductors.

ESG

Sustainability policies will become more important globally as investors increasingly press for greater disclosure of ESG practices. The Democrat victory also accelerates these issues and in particular will mark an important step forward for the climate and the environment.

When we talk about ESG we do not have any specific winning sectors, but all sectors or stocks that are sensitive and committed to the principles emerge as such.

Conclusion

Within the market there are some sectors that are winners from the election result, and among the main ones are the industrial sector, the basic materials sector, the technology sector and finally the utilities sector.

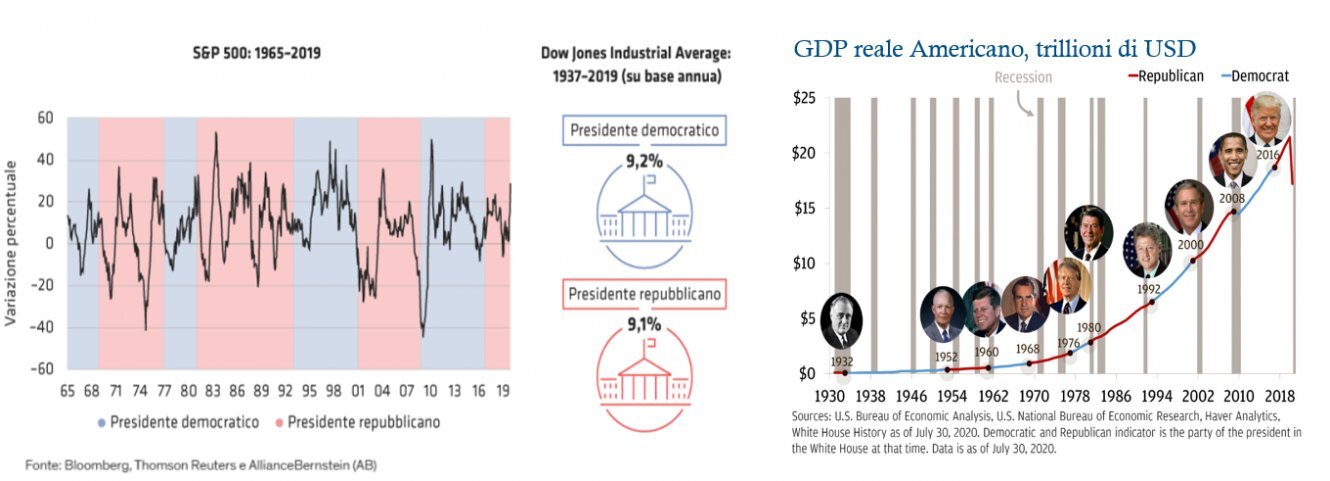

All these considerations must finally be put into context in a broader context: the real certainty we have, and history teaches us this, is that politics does not ultimately influence the financial markets that much. At the right time, the market always manages to reward the investor, despite short-term uncertainties and the political leadership in the White House.

In the long term, market performance is virtually the same for both Republican and Democrat presidents, just as US GDP growth follows a steady upward trajectory, irrespective of who is leading the country.

There will therefore be some sectors to prefer to others, but overall, we can say that a result with Biden as president and the Senate divided, is probably the best investors could expect. The markets will now return to focus on changes in earnings growth expectations and fiscal stimuli that will be coordinated with monetary stimuli - elements that will provide the right conditions to continue to support the growth of the stock market.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.