PHARUS SICAV Liquidity

The right product to allocate excess liquidity with attractive returns in an environment characterized by negative rates. Pharus Liquidity invests mostly in corporate bonds with an initial or residual maturity of no more than 3 years and 20 days with an average rating of BB and an average yield of 1.5%, and for 20 yeast it has represented Pharus’ alternative to savings immobilization.

Key information and performance

Class A

ISIN: LU0159791275

CATEGORY: EUR Money Market

Class A

ISIN: LU0159791275

CATEGORY: EUR Money Market

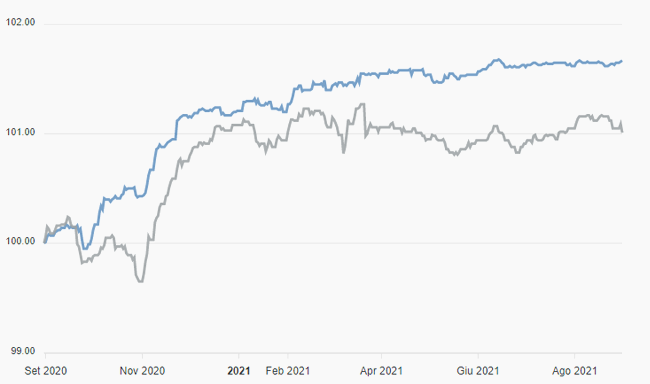

30.07.2020 - 30.07.2021 Pharus Sicav Liquidity Benchmark

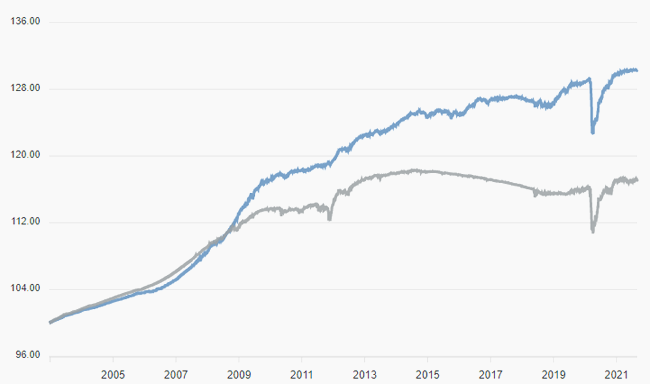

23.12.2002 - 30.07.2021 Pharus Sicav Liquidity Benchmark

Net Asset Value

130.29 EUR

Fund Size

18.15 EUR

Launch Date

23.12.2002

Benchmark

Banca Fideuram Indice Fondi di Mercato Monetario (EUR)

Sicav

Pharus Sicav

Management Company

Pharus Management Lux SA

Investment Company

Pharus Asset Management SA

Fund Manager

Davide Pasquali

Lower RiskPotentially lower return

Higher RiskPotentially higher return

1

2

3

4

5

6

7

Performance since launch FIRST 10 YEARS

Performance since launch LAST 10 YEARS