Are we close to a new Bull Market?

24 January 2023 _ News

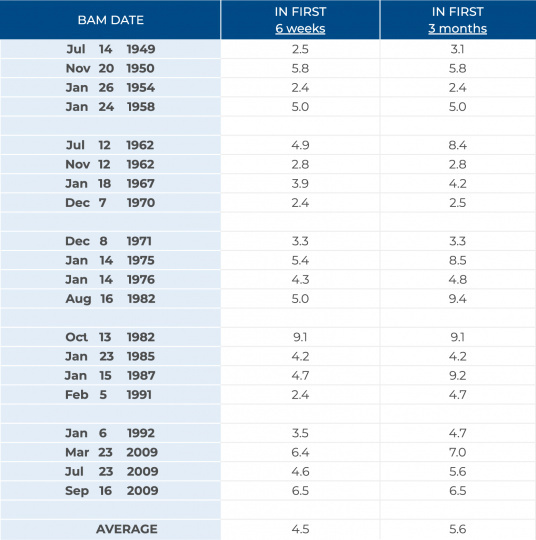

A relevant technical and statistical indicator, the so-called BAM indicator (The Breakaway Momentum breadth thrust signal), was triggered during the week. This indicator is activated when the number of companies in the U.S. market going up at 10 days is double the number of companies going down at 10 days. It is a phenomenon of no simple recurrence that has happened 25 times since World War II, and all 25 times it has indicated the end of the bear market and the beginning of a new bull market with a 100% probability of success, that was accompanied, as we see from the table, by positive performances in the following months.

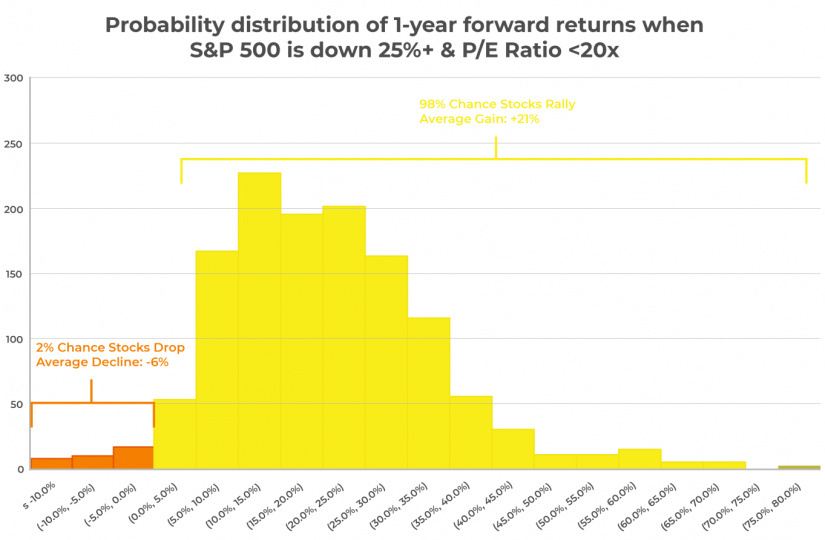

Positive signals also come from the analysis of other statistics highlighted in the following chart, where we see the historical distribution of the 12-month performance of the S&P500 after the market corrected by at least 25 percent and its P/E valuations came in below 20 times. According to the statistical analysis, each time the market has been in this condition (as last year) it has then rebounded 98% of the time, with an average performance of 20 percent.

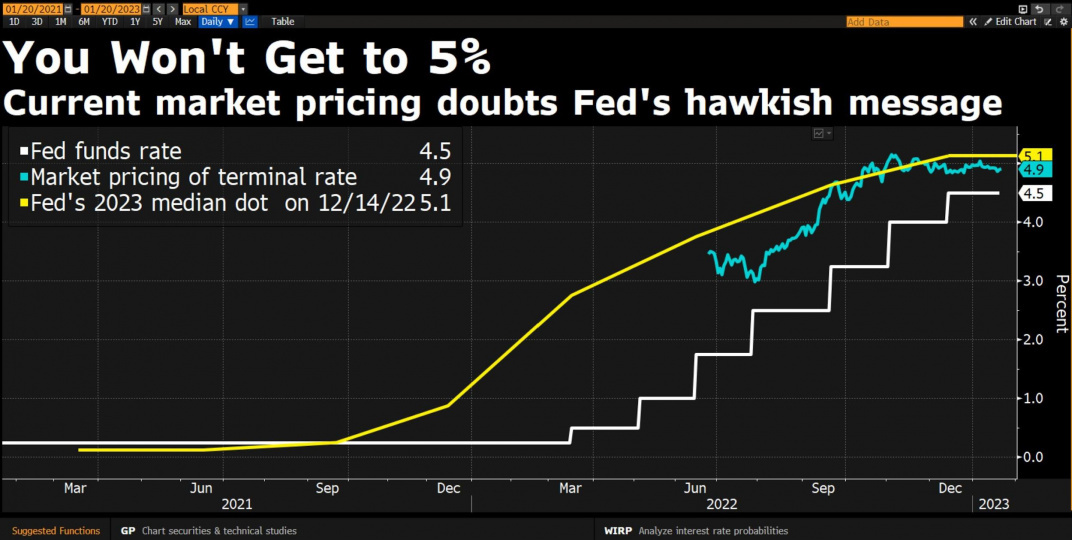

This is framed in a context where soft landing seems to be the basic scenario discounted by the market, which is pricing a terminal rate just below 5 percent.

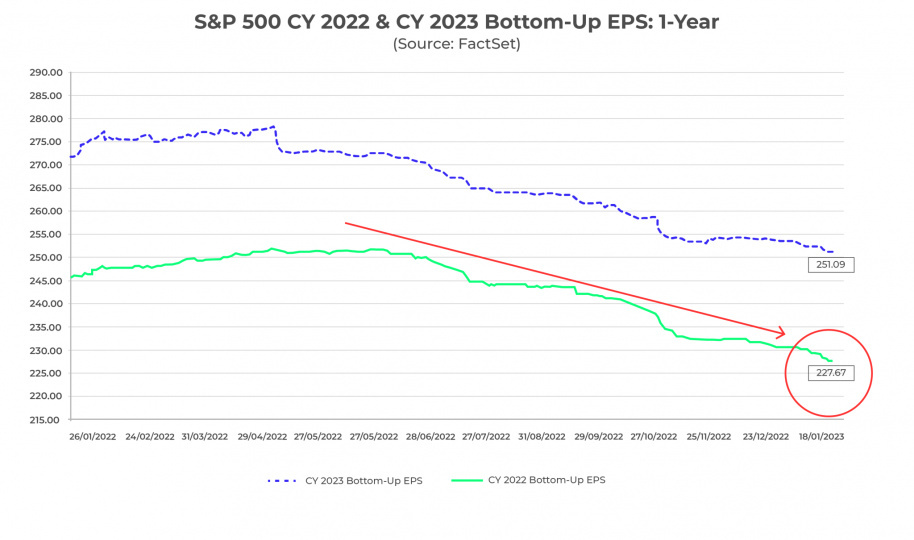

Strong doubts remain among many investors about the resilience of earnings, but we have been highlighting a backdrop of downward revisions to estimates for months and recall that earnings have already been cut 10 percent from their highs.

Is the revision of estimates therefore over? The answer to this question will be crucial to the performance of risky assets this year and will depend greatly on the magnitude of the economic slowdown. What our models suggest to us is that current index prices already incorporate an additional 10 percent cut in earnings, which would be added to the 10 percent already realized, with very little downside from current levels, and very attractive medium-term upside space.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.