Pharus Milan

Pharus Milano is the Italian branch of Pharus Management Lux SA, a Management Company under Luxembourg law.

Established in 2020, it offers institutional asset management services characterised by unique, innovative and highly integrated methodologies.

Investment and financial management expertise to develop disciplined, cutting-edge strategies.

Discover moreEach investment strategy becomes an integrated journey to be embarked together with both professional and institutional clients.

Discover moreOur clients benefit from our experience gained in the direct management of mutual funds.

Discover moreA culture of excellence

Pharus Sicav's experience has led to the creation of five investment models, each characterised by its own asset allocation and volatility, but all sharing the same core principles.

Risk management

Volatility as an objective in portfolio construction choices, for greater stability and predictability.

Diversification

Maximum diversification through a portfolio with a simultaneous multi asset and multi-style approach.

Decorrelation

Use of alternative strategy products as the key to decorrelation from financial markets.

Method and discipline

Consistency of principles for a disciplined, rational and repeatable portfolio construction process.

Un team internazionale ed eterogeneo.

Discover the TeamNews

all articles

2025 _ NEWS

Profits at the Top, Duties at the Gates: Who Wins?

2025 _ NEWS

Historical Maxims, But at What Price?

2025 _ NEWS

What's moving under the surface of the Rally?

2025 _ NEWS

Risk Off o Opportunità? Come i Mercati Reagiscono agli Shock

2025 _ NEWS

Narrativa vs realtà: la Geopolitica Rallenta il Rally?

2025 _ NEWS

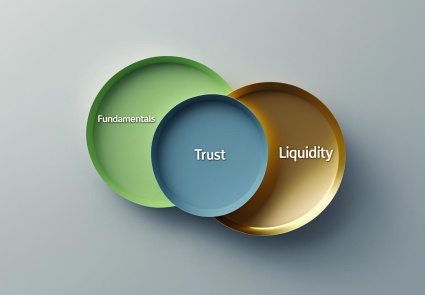

Fundamentals, confidence, liquidity: the real drivers of the market

2025 _ NEWS