What's moving under the surface of the Rally?

01 July 2025 _ News

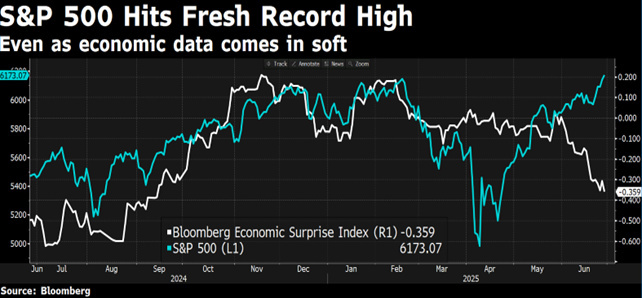

A fragile truce between Israel and Iran helped commodities and bond yields fall, while equity markets accelerated toward the end of the quarter and for the first time since early February, indexes are at highs and technical analysis enthusiasts are celebrating a new “golden cross” (the cross between the 50-day and 200-day moving averages).

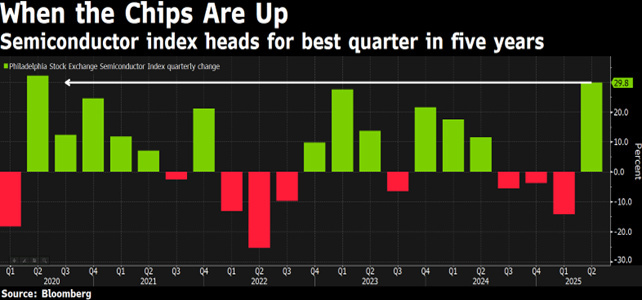

The rally following “Liberation Day” was largely driven by the tech sector, large caps, and concentrated on the U.S. market. For some, this is simply a return to normalcy; for others, it is a sign of still fragile and underwhelming enthusiasm.

Both concerns that drove the market correction between February and April, namely tariffs and the advent of DeepSeek, have subsided and the bullish market has resumed. Indeed, Trump began to moderate his stance on tariffs on April 9, and U.S. artificial intelligence companies reaffirmed their commitment to spend tens of billions of dollars on capital investments in artificial intelligence during the first quarter earnings season.

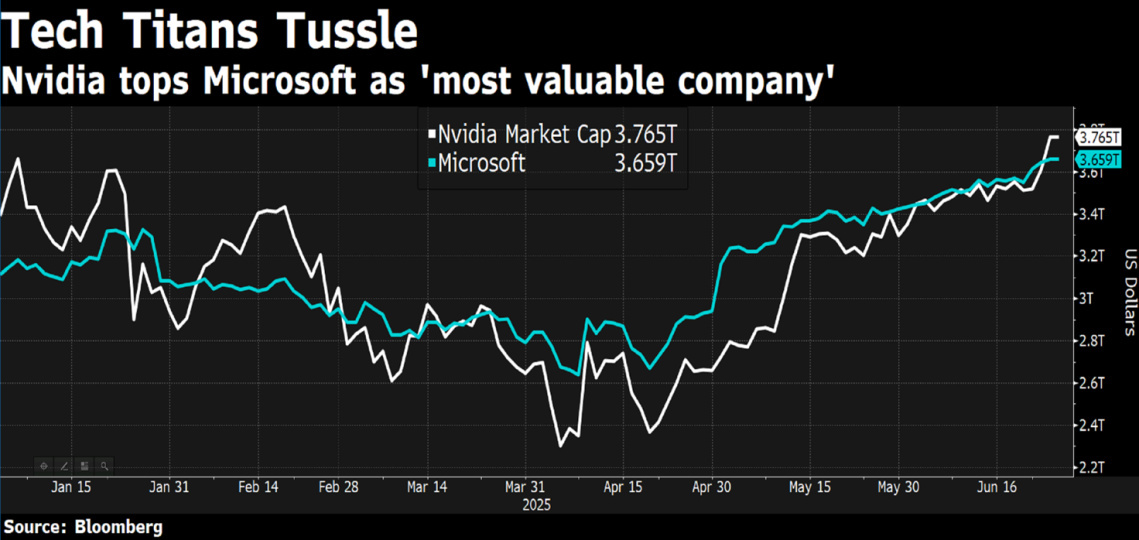

Nvidia's stock touched new highs this week for the first time since January. Nvidia's current market capitalization is .8 trillion; we are talking about the most valuable company in the world, surpassing Microsoft and Apple.

This is an impressive achievement considering that last month Nvidia's CEO stated that “The billion Chinese market is effectively closed to the U.S. industry.” Despite this The semiconductor industry has proven to be not only resilient, but driving, and NVIDIA's CEO himself delivered a very bullish message at the annual shareholder meeting this week stating that we are only at the beginning of a decade of artificial intelligence infrastructure development with government demand for AI growing worldwide, with “multi-billion dollar opportunities” in artificial intelligence and robotics.

But this week the main catalyst was another namely the end-at least formally-of the so-called “12-day war” between Iran and Israel. Trump declared a truce, although exchanges of accusations and tensions between the two countries have not completely subsided. However, the market reacted positively with the S&P 500 returning to all-time highs, helped also by the sharp drop in oil prices, which fell below .

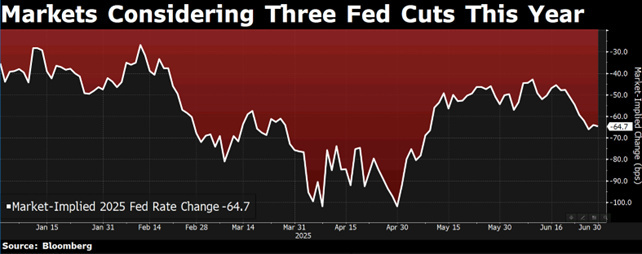

Powell expressed concern about the possible inflationary effect of the Trump administration's desired tariffs, but for now this is more of a theoretical alert than operational guidance. The Fed maintains a cautious stance, even in light of employment data indicating a moderate but not alarming slowdown and a PCE that remains slightly above expectations. Meanwhile, the yield on the 10-year Treasury fell to 4.25 percent, reflecting growing skepticism about the real resilience of the economy. The downward movement began after the first quarter real GDP was revised down from -0.2 percent to -0.5 percent.

Meanwhile, within the Fed the debate intensifies: Powell remains cautious, but some FOMC members say they are ready to act as early as July if inflation is confirmed to be under control. Also helping to reinforce the narrative of more accommodative monetary policy has been Morgan Stanley, which is forecasting as many as seven rate cuts in 2026-a much more aggressive estimate than the Fed and markets expect. The divergences are growing, and the political pressure is becoming more apparent.

Indeed, the Fed's monetary policy (moderately restrictive, in Powell's definition) would appear to have its hours numbered. On the one hand, Trump is preparing to nominate Waller or Warsh as the next governor well in advance. Waller, remember, is poised to make 6-7 rate cuts between now and the end of 2026. On the other hand, deregulation is coming, with the reform of U.S. bank leverage limits, strongly advocated by Bessent. It is a kind of anti-Basel that increases the leverage space of banks, which will be able to buy more Treasuries and extend more loans to the private sector. Increasing bank leverage will basically have the same effects as Quantitative easing without attracting as much attention and criticism as QE has always done and without depending too much on the Fed.

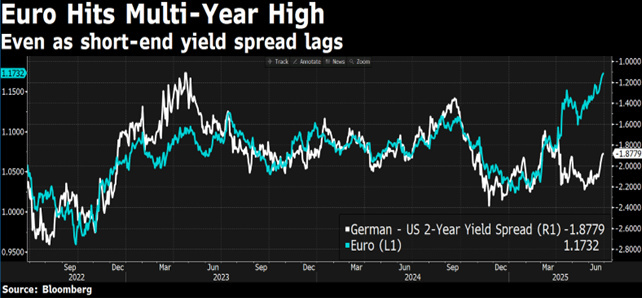

The real issue today is the dollar. We are witnessing a gradual weakening of the greenback, a phenomenon that, as we have already analyzed in a previous podcast, may be just beginning. Driving it are not just Trump's policies, nor even a simple repricing of U.S. assets, but deeper dynamics related to currency hedging flows from large international institutional investors.

Historical correlations between the dollar and equity are jumping, and this could lead to major selling of USD to rebalance positions that are too exposed to exchange rate risk.

The week also marks Trump's diplomatic victory in the NATO arena-with the European Union pledging to raise defense spending to 5 percent of GDP, and as is only natural among European investors, there is nothing but talk of defense stocks.

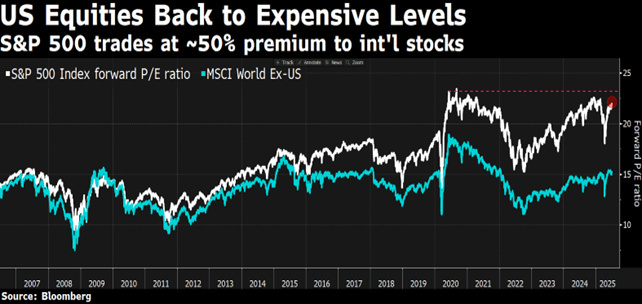

The real sticking point remains overconfidence in the markets. Today the risk premium on U.S. equity is very low and credit spreads are compressed to historic lows. Everything seems priced in at levels that cannot yet be called bubble but that leave little margin for safety and little room for disregard.

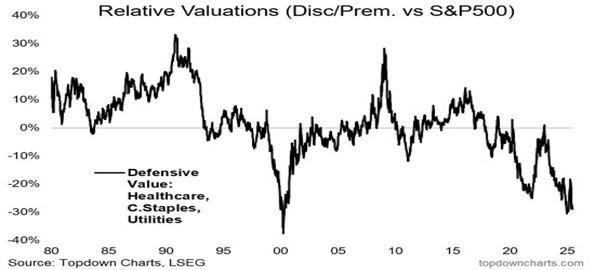

The best opportunities are moving, quietly, outside the traditional perimeter of U.S. exceptionalism. It is in this context that defensive sectors, which are certainly not characterized by the hyper-growths of the tech sector, become attractive, but which are to date undervalued and totally snubbed by investors with the relative valuations of defensive sectors now at historic lows and at levels seen only in the tech bubble of 2000.

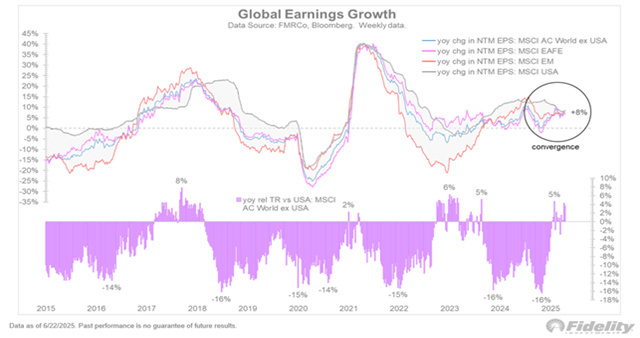

And the same is true for small caps and global equities relative to U.S. equities. Meanwhile, earnings growth outside the U.S. continues to converge to a generalized 8 percent growth for virtually all global economies.

Even in terms of earnings growth The playing field is thus leveling off globally, which could provide the long-awaited catalyst to trigger a more lasting reversal in favor of international markets.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.