Beyond the Noise: How to Select Investment Opportunities in 2025

03 June 2025 _ News

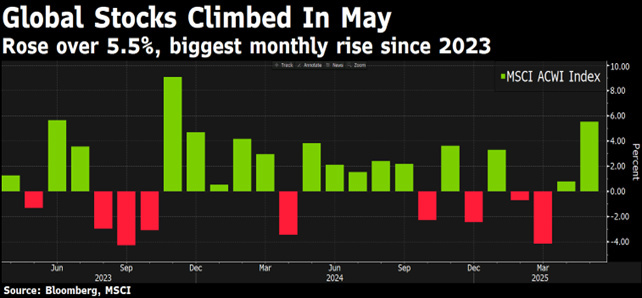

While last week the spotlight was on the bond market and growing concerns about the sustainability of US debt, today the focus shifts more constructively to the corporate front with the reporting season practically at an end. The month of May also closed with the S&P500 up 6.15%, the best May performance in over 30 years and one of the best for the global indices as well.

On the other hand, the current earnings season gives us an up-to-date snapshot of the resilience of the US corporate system, and perhaps, even some hints of optimism in a complex macroeconomic environment with very volatile economic surprise indices lacking clear directionality.

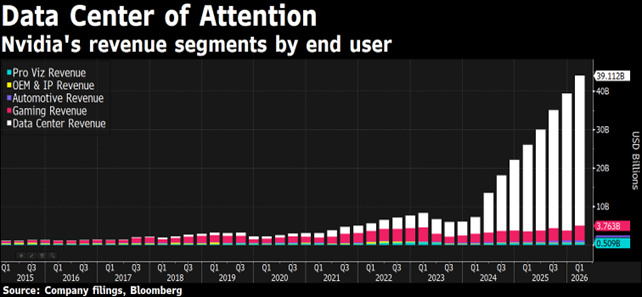

The market awaited with great interest the quarterly report of semiconductor giant Nvidia, symbol of the new era of artificial intelligence, and the numbers did not disappoint: the company reported revenues 12% higher than in the previous three months and 69% higher than in the same period last year. Even more impressive is the performance of the data centre segment, which now accounts for around 88% of total revenues, a sign of explosive demand from big tech, which continues to invest heavily in AI infrastructure.

Nvidia's results drove the entire technology sector and pushed up the aggregate earnings estimates for the entire S&P 500.

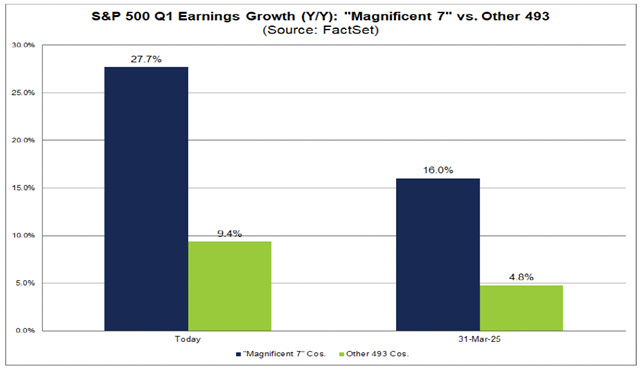

With the release of NVIDIA's results, all of the ‘Magnificent 7’ companies have now reported first quarter earnings growth of 27.7%, compared to +9.4% for the remaining 493 US companies.

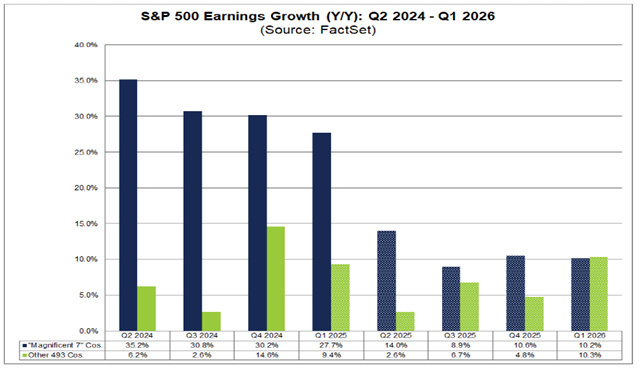

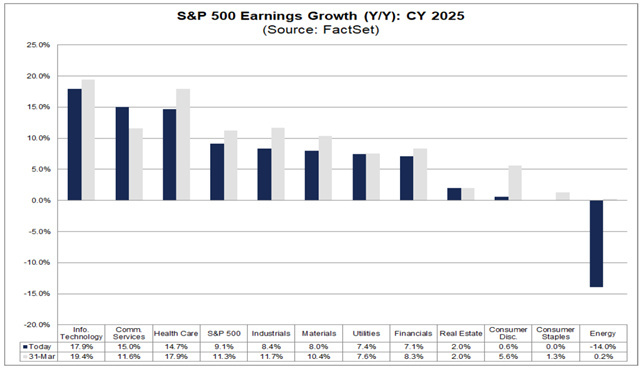

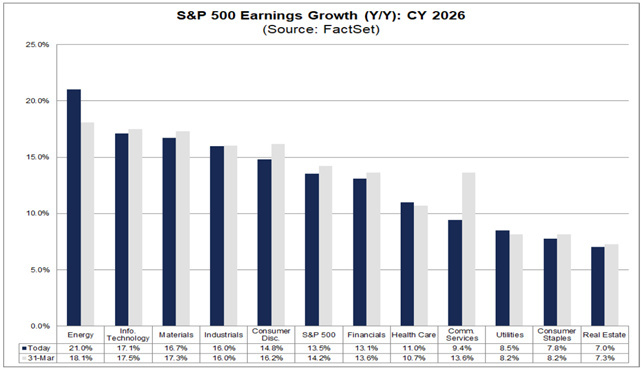

Analysts now predict a slowdown in earnings growth for the companies of the ‘Magnificent 7’ of 14.0%, 9% and 10% respectively for the coming quarters, accompanied instead by an acceleration in growth by the other 493 companies.

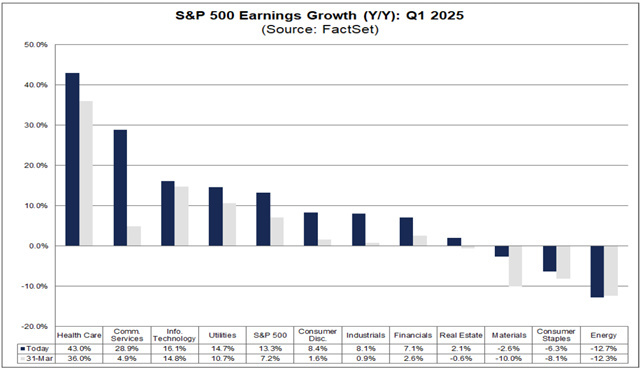

With 98% of the companies in the index having now released their first quarter results, we can draw a pretty solid picture of the current earnings season, with US corporate earnings per share up 13.3% year-on-year, the second consecutive quarter of double-digit growth and the seventh consecutive quarter in positive territory.

The quality of these results is also significant with 78% of companies beating analysts' expectations, which is above the average of the last ten years. Sectors such as technology, healthcare and communications stood out, with positive surprise percentages well over 85%. And, as mentioned, Nvidia alone had a major impact on the upward revision of the aggregate earnings growth rate.

The profit margin of the S&P 500 stood at 13.3%, up from the previous quarter, a sign that companies were able to effectively manage cost pressures. However, some unknowns remain on the horizon: first and foremost, the tariffs introduced by the Trump administration, which represent a kind of implicit tax on companies. Companies will have to decide whether to absorb the impact in margins or pass it downstream, to the end customer; many companies are also postponing investments and these affects will have to be closely monitored in the coming quarters.

The analyst consensus, for the time being, remains relatively optimistic with the earnings cut appearing to have stabilised and earnings growth estimates at +9% for 2025 and +13% for 2026.

Another important aspect is the market valuation. The forward price/earnings of the S&P 500 rose to 21.5, a level that is on the high side of the last 10 years. If we exclude the Magnificent 7, the P/E drops to 19, still above the historical average, but less extreme. This tells us that the market remains selective, rewarding businesses with higher growth, margin visibility and future earnings.

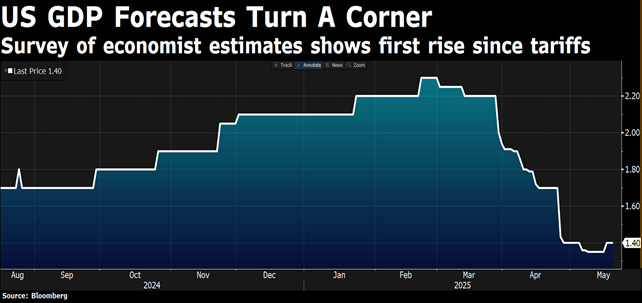

There are also signs of resilience on the macroeconomic front. The GDP revision for the first quarter shows a slight technical contraction, mainly related to the import boom in anticipation of tariffs. But net of this, domestic demand is holding up, employment remains stable and consumption - although slowing - continues to support economic activity.

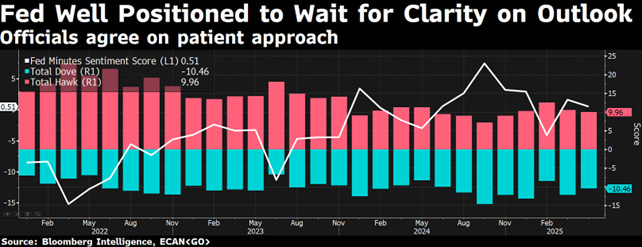

The Fed, for its part, seems to want to take its time. The minutes of the latest FOMC confirm a patient attitude: the central bank is waiting for more clarity before proceeding with any rate cuts. The futures market continues to price between two and three cuts within the next 12 months, but the Fed - at least for now - is in no hurry, as confirmed by the meeting this week between President Trump and Federal Reserve Chairman Powell. During the meeting, Trump expressed his desire to see interest rates lowered, but Powell reiterated the Fed's independence and stressed that monetary policy decisions will be based solely on objective, non-political analysis.

Also of note this week was the court battle over Trump's tariffs and the news of a federal court declaring Trump's tariffs illegal, stating that the president exceeded his authority by imposing tariffs on all imports. The Court of International Trade ruled that these tariffs exceeded any authority granted to the president to regulate imports through tariffs, however, an appeals court has temporarily suspended this decision, allowing the duties to remain in place while the battle is set to drag on to the Supreme Court.

In summary, the picture that emerges is one of a US economy that, despite being under pressure from expansive fiscal policy and tariffs, still manages to generate quality earnings and solid margins. It is a scenario that requires selectivity, attention to fundamentals and, as always, the ability to filter out the noise.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.