China, Powell and economic indicators: what to expect?

09 May 2024 _ News

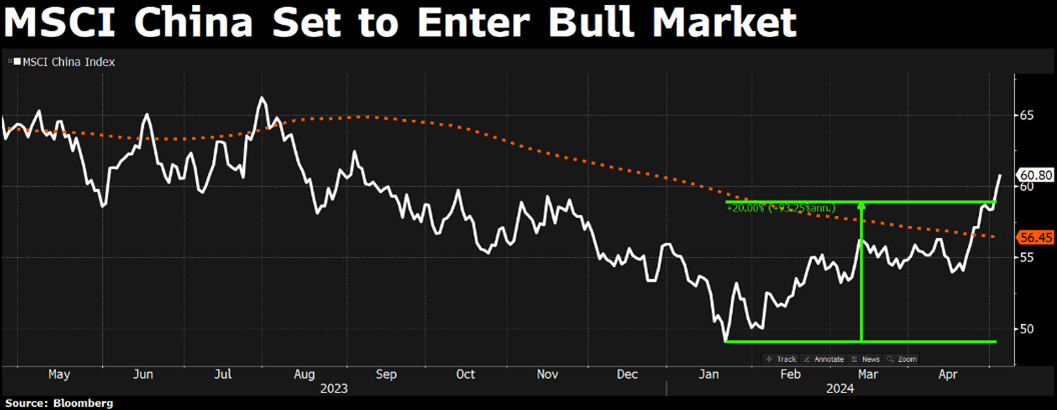

A positive week closes for equity markets with global indices up about 1 percent. Outperforming continues to be China, up 3 percent, with Chinese indices breaking upward from the 200-day average providing (for technical analysis enthusiasts) an encouraging sign of the potential start of a new bull market. A positive contribution to performance also comes from the bond component with rates accelerating to the downside in both America and Europe.

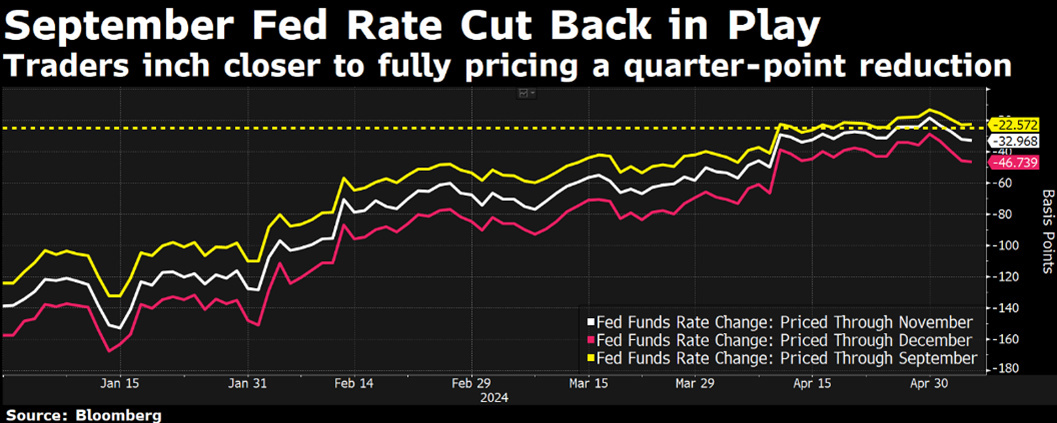

The focus this week was mainly on the FED meeting and related monetary policy decisions. As widely expected, the Federal Reserve left rates unchanged. Powell's tones were less hawkish than expected, although we cannot call them dovish. First of all, he explicitly ruled out further monetary tightening, a hypothesis that the market was beginning to veiledly consider, but on the other hand he was forced to admit that confidence in lowering rates is still far off as inflation in the latest data has shown no further progress.

However, Powel reiterated that rates are already "restrictive" and that kept at current levels will be sufficient to curb inflation. It is true that he ruled out cuts any time soon, but at the same time in an unexpectedly accommodative development he said that he will not let the market run out of liquidity by significantly reducing the balance sheet reduction, more than halving it (from 60 billion to 25 billion a month starting in June), and this probably matters more to traders than a rate cut.

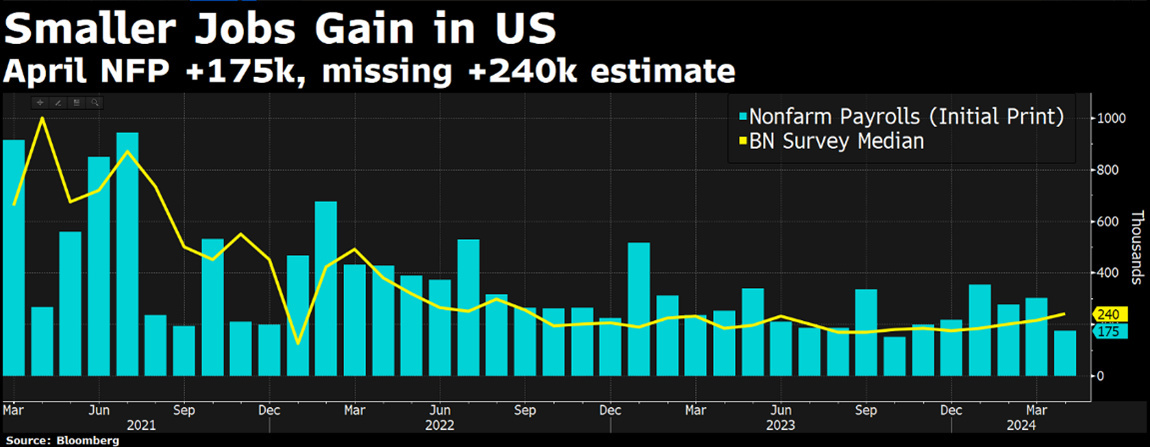

Some surprises, however, came from the macro data, and in particular the expected labor market data released on Friday. Payrolls for the nonfarm sector came out much lower than expected, in what is one of the lowest figures in years, at 175,000 compared to expectations of 240,000. The unemployment rate was also higher than expected, coming out at 3.9 percent compared to 3.8 percent expected.

Two unexpectedly below-expected labor market data, which, by the way, follow last week's ugly GDP figure, testify to the early effects of high rates on economic growth.

These data are read by us as the natural time lag effect of monetary policy actions, and we would not be surprised if the narrative from the resilient economy soon shifts to one of economic slowdown, resulting in a rate cut before November. Following last Friday's data release, implied expectations of a rate cut for 2024 increased from 1 to 2.

Good signs for a rate cut have also come from unit labor costs, simply hourly wages divided by productivity. It is the most important measure of the inflation rate in the labor market and is highly correlated with the CPI. According to the latest data released, unit labor costs fell to 1.8 percent during the first quarter, suggesting that consumer price inflation could fall to 2.0 percent in the coming months.

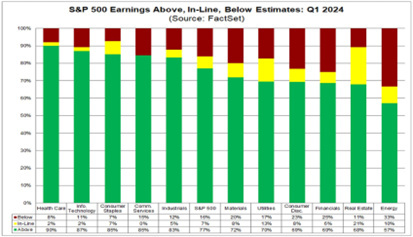

While macro data and Powell remain topics of debate and a source for different interpretations, once again it is the reporting season that is able to give us the most valuable information. The earnings season continues in full swing, to date about 80 percent of U.S. companies and 50 percent of European companies have reported. In the U.S., a good reporting season is confirmed with 77 percent of companies beating estimates by reporting untili of about 9 percent above expectations.

The trend in Europe is also very similar to the U.S., where almost all of the magnificent seven have reported at this point, with even Apple surprising upward estimates by reporting a return to growth after as many as 5 quarters of declines, and confirming the rule that the investor should feel comfortable when expectations are low, just being patient that these are surprised to the upside, not the other way around, running after the fads of the moment when expectations often rise irrationally.

Worthy of mention is the announcement of a paper-for-paper merger between Spain's second and fourth largest banks with BBVA launching on Sabadel a 12 billion euro bid from which the fourth largest European banking group would be created, a deal that by the way also rekindles among Italian banks some hope of further aggregation. A banking sector to be tested by the accounts in the coming days, where a continuation of excellent numbers is expected and where expectations have risen greatly, bringing valuations to levels that are beginning to fully discount any good fundamental data.

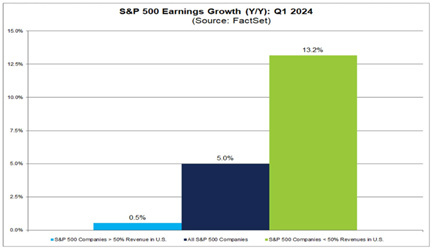

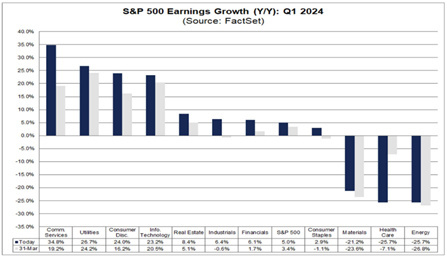

Among the most interesting dynamics that emerged from the earnings season we highlight the weight of inflation on companies with the most exposure to the U.S. domestic market: companies with predominantly U.S. market revenue experience the same revenue growth as more global companies, but have virtually zero earnings growth, compared with earnings growth of 13 percent for the latter.

The weakness of the U.S. market, which for many companies is even the weakest market compared to all other geographic areas, was highlighted by many companies reporting during the week. In particular this weakness appears evident in the reporting of some big companies in the European market, such as Capgemini or Stellantis just to name a few, which report double-digit declines for the U.S. market and show clear signs of slowing down. Many businesses are beginning to report significant slowdowns in the U.S. and this most likely means deteriorating macro data in the coming months.

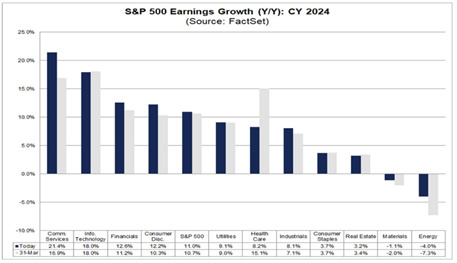

For the time being, the consensus does not incorporate these dynamics and has even revised upward the earnings estimates for the first and second quarters now expected to grow 5% and 9.6% respectively and up from the respective +3.4% and +9% expected at the end of March.

Even for the end of the year, we continue to speak of 11 percent earnings growth, a number about which we are more cautious and which seems to us to incorporate an overly generous economic growth scenario that is not in line with much of the guidance provided by the companies themselves.

For this reason, we continue to consider U.S. mid-cap companies, European companies and in particular Chinese companies to be the most attractive because they are at a greater valuation discount, and within these markets we particularly favor the more defensive sectors that in addition to discount valuations, should also be rewarded in a potential phase of slowdown or otherwise lower-than-expected growth. Defensive sectors with, for example, utilities and nondiscretionary consumption being the only positive sectors in the last month and which we believe can continue to lead. On the bond side we continue to see opportunities on both the U.S. and European government components, where in particular we favor the long end of the curve that allows us to lock in a very good flow for the next few years and benefit with significant capital appreciation when rates are cut.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.