Consumers, earnings and equity markets: What can we expect in the months ahead?

16 November 2023 _ News

Earnings season in the USA and Europe has given us a clear message: pay attention to consumer health. The market focus is indeed shifting from inflation to the health of the consumer, who accounts for about 70% of US economic output.

Earnings season

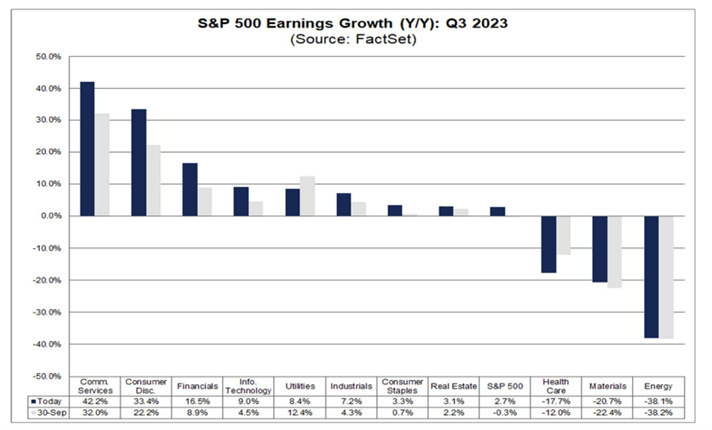

Starting with the US earnings season, around 92% of companies reported earnings with growth of 4.1%, confounding analysts' expectations of -0.3% at the end of September. The figure is +10% if we exclude the energy sector. Overall, companies are beating analysts' expectations by 7%, with earnings growth after one year.

Value teaches us that price decreases point to earnings ahead, so investors should create positions when prices have low expectations. For example, in 2022, the sectors with the worst earnings growth were communication and discretionaries, with decreases of 15-20%. These sectors had driven expectations considerably and, in 2023, they managed to beat them and thus emerged as the best performers. Today, expectations are particularly low in the defensive sectors and especially in health care, with an earnings correction of -20%. This has led earnings to normalise after the strong growth of the last three years, resulting in great opportunities in the sector.

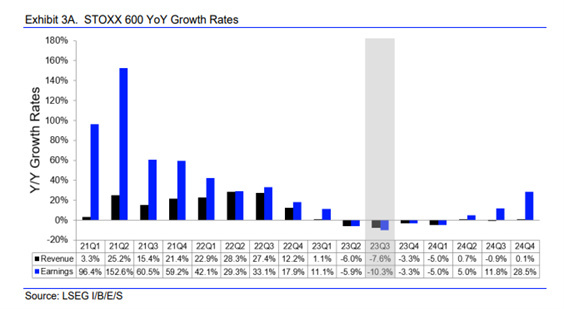

For its part, the European earnings season is showing worse-than-expected figures, as we have been saying for several weeks now. Third quarter earnings are expected to decline by 10.3% compared to Q3 2022, but if we exclude the energy sector, the figure will actually be an increase of 1.8%. Therefore, looking at the market from a value perspective, the drop in earnings has raised negativity, and this has lowered expectations, which has in turn created value. We see this value in particular in leading companies that offer excellent returns on capital and sharply discounted valuations.

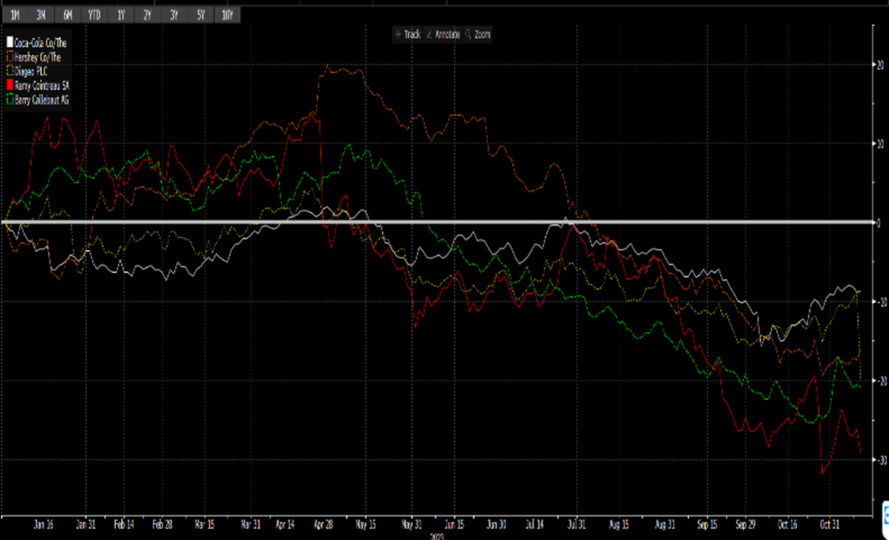

Earnings Season and Consumers

Economic growth depends a great deal on consumer health – now the main topic of the earnings season. The word from large payment processors Visa and Mastercard is that consumer activity remained stable in Q3. However, US and European non-discretionaries, from McDonald's to Coca Cola and from Rémy Cointreau to Campari and Diageo, reported that Q3 spending came under pressure due to adverse macroeconomic factors, in particular excessively high interest rates. Very high rates have wiped out consumers' surplus savings, causing US consumers to get into more debt and delaying payments on credit cards as a result.

Conclusion

In conclusion, as we mentioned a few weeks ago, value returned to the market at the end of October, and this has been a big support for the equity markets.

The recent earnings season has shown us how companies are shifting their focus from inflation to consumer health. We shouldn't be frightened by the weaker macro data that will emerge in the coming weeks with a slowdown in consumer spending that is quite normal considering that the valuations of some markets and sectors are already in an economic slowdown. Many parts of the market still have discounted valuations ranging from defensive sectors to financials and even including some geographic areas such as Europe. Europe, in fact, has a price/earnings ratio of around 12x, one of the lowest levels in the last ten years, discounting a strong recession.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.