Credit crunch tests balance sheets

17 May 2023 _ News

The deflationary trend is now well established. The latest U.S. inflation data showed CPI and core CPI indices falling to 4.9 percent and 5.5 percent respectively, values that are similar to those recorded last month, but down sharply from last summer's peaks of 8.9 percent and 6.6 percent. This trend could bring overall year-on-year inflation to 3.5 percent by June.

As inflation has returned, the market's attention has shifted to the tightening of corporate credit access conditions, the so-called credit crunch. Indeed, the high level of rates has had a threefold effect on corporate credit.

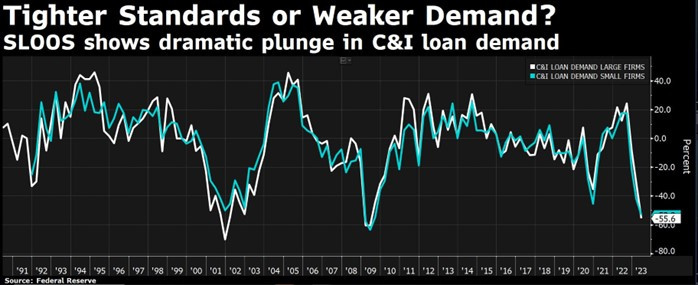

First, it reduced the demand for credit, with a negative contraction recorded only in 2008 and 2001.

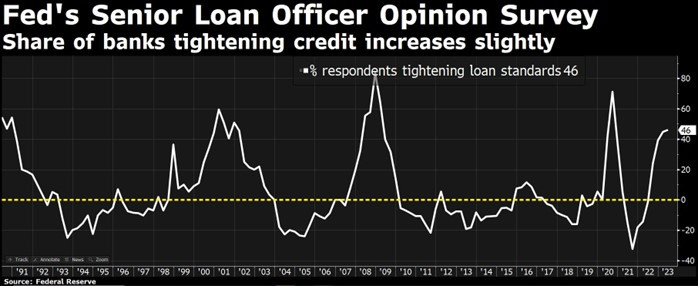

Secondly, it has increased banks' restrictions on lending, conditions that reached highs recorded in 2001, 2008 and 2020.

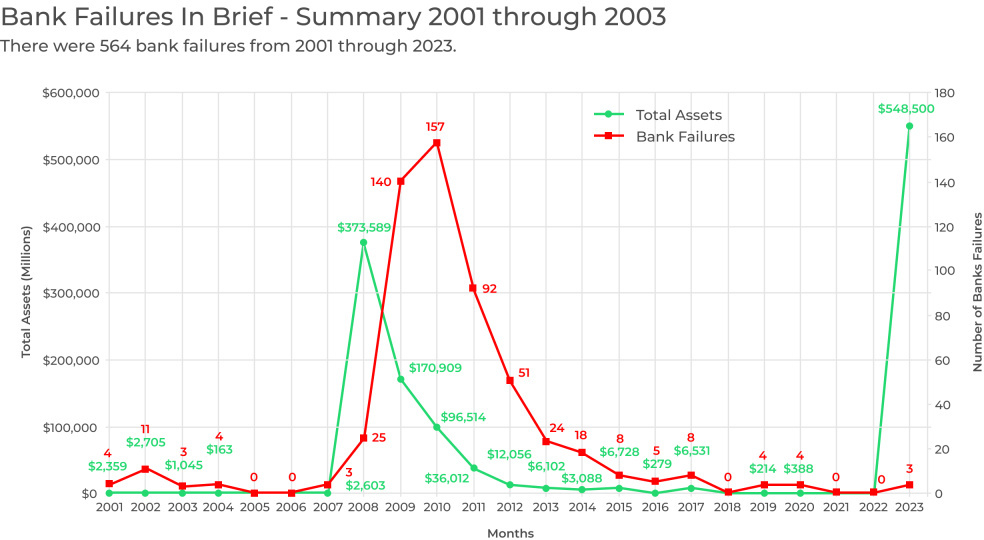

Finally, rising rates have increased the number of bank failures. Since the beginning of the year, 3 U.S. banks have failed, a number, however, that is lower than the historical average. The failures have involved nearly 0 billion in assets, which on an absolute level is higher than 2008, but when related to GDP is lower than 2008.

The main consequence of these failures has been to further worsen credit access conditions.

However, worsening credit conditions are counterbalanced by corporate balance sheets:

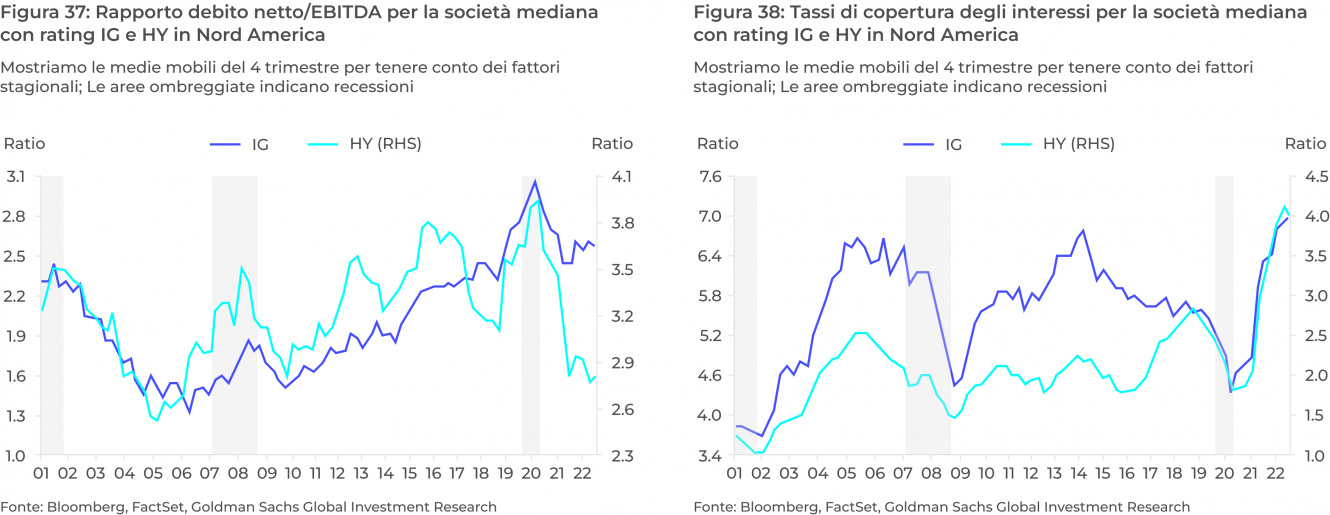

- The leverage ratio of high-risk (HY) companies is at its lowest since 2005

- The degree of coverage of interest paid is on the highest since 2001

In conclusion, the trajectory of inflation continues to be downward, but the key variable remains the tightening of credit. Corporate balance sheet conditions allow companies to have an important cushion of liquidity to deal with this period, but if this tightening should continue it could lead to an economic slowdown.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.