December 2023: Margin of Safety and Duration

20 December 2023 _ News

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” - W.B.

The year 2023 is coming to a close with a stock market that has surprised investors with better-than-expected performance. We proceed in highlighting where we see value in the markets for the beginning of 2024. Value that drives our investment decisions, an approach that is inspired by many pivotal concepts in Value Investing that have been embraced by so many of the most successful managers of all time, including the celebrated Buffett.

Equity

Earnings

We are in a favourable earnings cycle environment. As we see from the first chart, the light grey line represents consensus earnings in the U.S. market, earnings that were cut in 2022 and, in 2023, started growing again.

If we look at analysts' estimates for 2024, we notice somewhat high estimates, around +12%.

Source: Bloomberg

Indeed, we believe they are a bit too optimistic, not least because, if we look at history, we notice that every year analysts' expectations have been proven wrong.

What to expect from U.S. earnings for 2024?

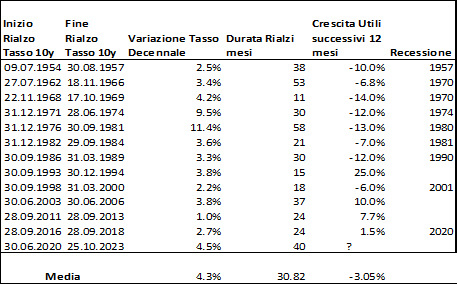

To answer this question, it is necessary to put earnings growth in context with the level of interest rates. Indeed, history teaches us that after average interest rate rises of 4.3 %, earnings tend to slow their growth and show average negative growths of -3%(see chart below).

As for Europe, we expect earnings growths in line with the historical average of 5%.

Ratings

After analyzing profits, the value philosophy focuses on understanding how much the market is pricing these profits, i.e., valuations. Analyzing the valuations of the major markets we note that the S&P500 appears to be fairly valued, while we find more value on the S&P500 equated (see chart below) and the Eurostoxx 600. This preference of the S&P equated and Europe is also evidenced by the value tables, tables that based on the three key ingredients, earnings, interest rates and risk aversion, show us a value target for these two markets of +12%.

Source: Bloomberg

Equity sectors

The favorite sectors in the United States are: Utilities, Non-Discretionary Consumption, Financials, Health Care, and Industrials. The preferred sectors in Europe are: Discretionary Consumption, Non-Discretionary Consumption, Health Care, Real Estate and Industrials.

Bond

On bonds we believe there are some great opportunities, particularly in European and U.S. long duration government bonds.

Government

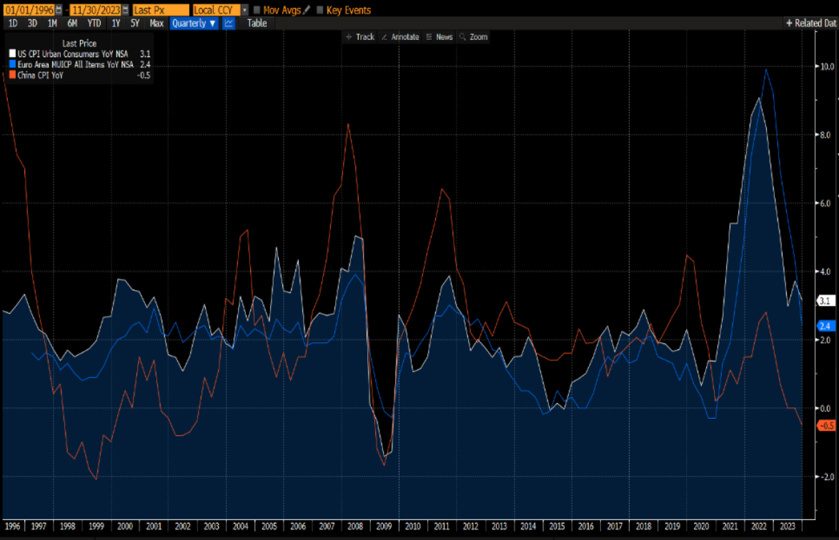

This view stems primarily from our assumption of an economic slowdown due to the effect of high interest rates on the economy. High rates are, in fact, acting on businesses and the consumer to reduce demand and also inflation. Inflation that we expect to fall back as early as September 2024 to around 2.5%.

Source: Bloomberg

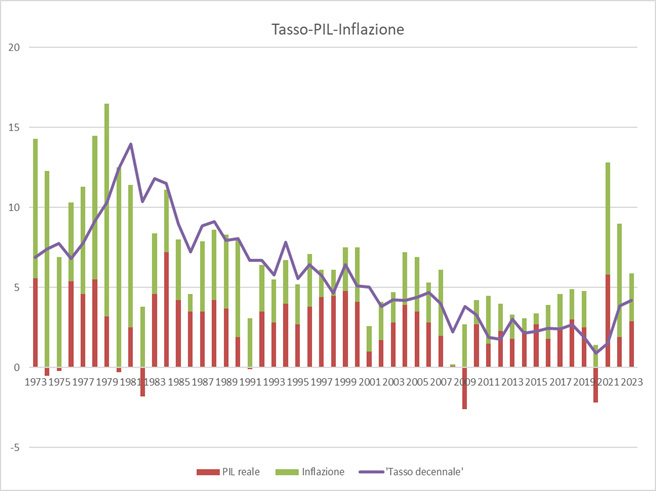

Where do we see the level of interest rates for 2024?

To answer this question, we rely on value analysis. Analysis that suggests to us that the best proxy for the interest rate is: expected inflation and expected real growth rate. For these reasons we expect a growth rate around 1.5 % and inflation around 2 %, so an expected rate between 3 and 3.5 % (see the chart below).

Corporate

On the corporate bond side, we prefer to lengthen the duration around 8-10 years on Investment Grade, and keep the duration around 4-5 years on High Yield.

The situation of corporate balance sheets shows us that the Investment Grade segment has increased leverage a bit too much in recent years while the High Yield segment has a bit too little liquidity compared to its history.

If we also analyse refinancing needs, we notice that both Investment Grade and High Yield need to refinance between 10-15% in the next 18 months, and between 25% and 35% in the next 3 years.

It is precisely this last aspect of refinancing needs that make us understand how rates are unlikely to remain high for a long time, as they would weigh too heavily on companies' economic growth.

Conclusion

In conclusion, we believe that we are within the favourable phase of the earnings cycle, but we think that the expected growths are a bit too optimistic and we expect a downward revision of the same. Therefore, on equities we prefer the S&P500 equated and Europe, favouring defensive sectors. On bonds, we focus on long duration government bonds.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.