FED & Soft landing: how to invest in the excess

08 February 2024 _ News

The first month of the year ended with a positive global stock market and monetary policy doubts gripping the FED regarding the timing of the rate cut. These doubts are also fueling the narrative among investors, who are increasingly certain of a successful soft landing, that is, of a FED that will succeed in the feat of reducing inflation without driving the economy into recession.

Let's see together whether this soft landing scenario is achievable or if it will become increasingly difficult as time goes on, and more importantly what the investor needs to do to manage this complexity.

What the FED monitors in deciding when to cut

The FED's decision on when to cut will drive investors' expectations of interest rates for the coming months. We believe the main parameters the FED will look at in deciding are three: inflation, financial stability, economic performance, and the labor market.

1. Let's start with inflation, where Powell's words last week outlined a wait-and-see FED that wishes to have more confidence from reducing inflation before it starts cutting. As for inflation, we do not expect any surprises and believe it will continue to fall.

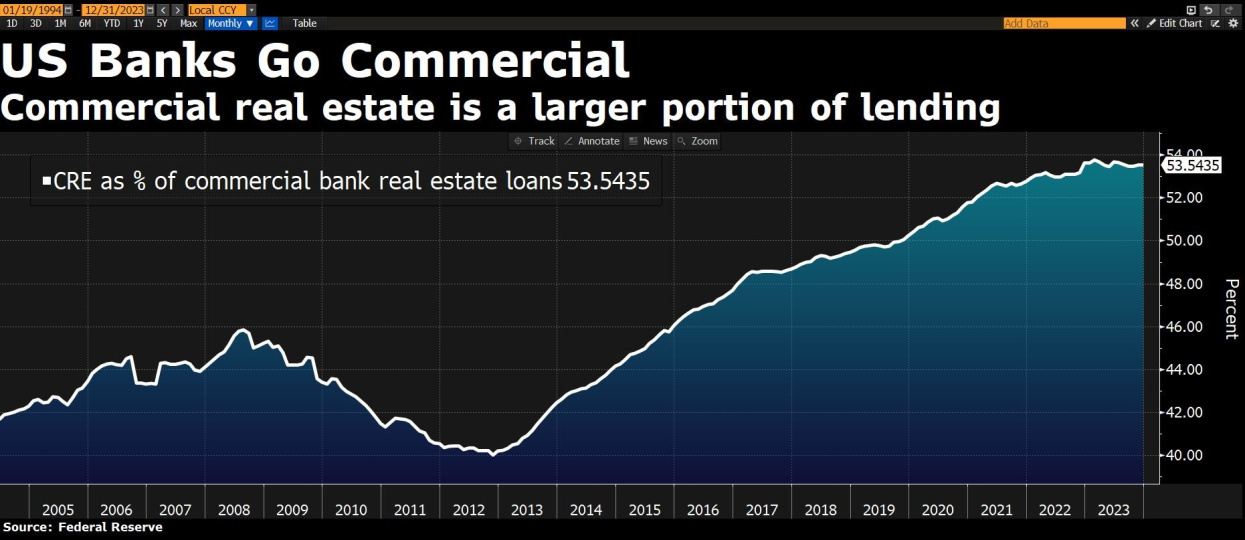

2. The second aspect monitored concerns the financial stability index, an index that is, for now, at subdued levels, aided by corporate spread indices that remain very low. In our opinion, however, attention needs to be paid not so much to the financial stability index but to the performance of regional banks, which, from the latest data, would appear to have about 53 percent of their loans focused on commercial real estate. In recent weeks some of these regional banks, particularly New York Community Bancorp, have come under attack from the market again, and this leads us to be cautious about the dangerous level of interest rates.

3. The third data point is the performance of the U.S. economy, a performance that is apparently proving to be very strong. We highlight "apparently" because PMI data were better than expected returning to expansionary territory for the first time, and the market has begun to estimate that PMIs will begin to expand, thereby driving economic growth. Statistical curiosity tells us that since 1960, it has never happened that PMIs reversed a contraction before rates were cut, so we expect that this time will be no different as well, and thus to see expansion again will need a rate cut as always.

4. The fourth data point that justifies the FED's expectation is the labor market, which piqued investor interest with the nonfarm payrolls figure released on Friday, which increased much more than expected. Only looking at this data, however, is wrong. In fact, more data must be analyzed to get a picture of the health of the labor market.

Let us look together at the different data to analyze.

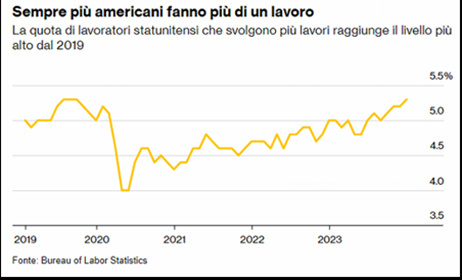

a. First, it is necessary to remember that the Department of Statistics compiles two different surveys on the state of the labor market: the labor survey by interviewing households and the survey by interviewing firms (of which last Friday's payroll data is a part). The difference we are interested in highlighting of the two surveys is that the household survey counts each person individually without double counting a worker doing more than one job. In fact, a record number of Americans held more than one job last year, and the percentage of multiple job holders confronted with the percentage of the total workforce recently reached its highest share since 2019. Nearly 40% of Americans in a Harris Poll for Bloomberg News in December said their family recently relied on additional income. Of those, 38% said the extra money barely covered monthly expenses with nothing left over, and 23% said it was not enough to pay bills.

b. The second data point that supports the fact that Americans have more than one job concerns full-time work, which has been falling sharply over the past three months. In fact, the three-month change in full-time employment has fallen by 1.4 million, one of the worst changes since 1970 along with 2020-2009-1994-1975. Given this, Americans have more jobs partly because they have increased part-time jobs.

c. The third data pointing to a not-so-strong labor market is the number of voluntary resignations, which fell to its lowest level in nearly three years in December.

d. The fourth data point is about what companies say in the earnings season.

- First, U.S. temporary employment company Robert Half, a global leader, showed lower-than-expected growth. The company suffered a drop in earnings of about 45 percent highlighting how demand for new workers in the U.S. is falling for both temporary and permanent workers in addition to prospective investments.

- Second, the number of company layoffs increased during the earnings season on the highest levels in years.

Considering this labor market analysis, we understand that Americans, in order to cope with the higher costs they face and the reduction in their savings, have increased the number of jobs, helped by the increase in part-time jobs, reduced the resignation rate, and also companies, in order to manage the reduction in margins, have begun to lay off workers. Given this, we are facing a less rosy labor market picture than the one painted by the market narrative.

What the investor must do

Investor's watchword: don't lose your compass. Earnings season has shown us once again that the major companies in the S&P500 index, have proven to be very good companies that were at a steep valuation discount last year, a discount that allowed them to grow strongly in price.

Today, however, this valuation discount is showing up on other sectors and companies that are in correction. We are talking about very easy-to-understand businesses that allow them to earn excellent dividends in the immediate term and in the future to take advantage of the bullish spring in valuations that has hit tech over the past year.

It sounds simple, doesn't it? Actually, being able to capture value is very difficult because the market narrative is always against it. At the end of 2022 tech seemed to be over, and we were talking about the departure of value for an infinite trend. Today we are just on the other side, and we are talking about tech being able to go up to infinity.

Job creation example: Price on Utilities profits at a 30 percent discount to the S&P500

Conclusion:

In conclusion, the investor should neither focus on what the FED will do, nor whether there will be a soft landing, but should focus, as always, on value. Indeed, the stock market always experiences excesses that create opportunities on the one hand and risks on the other. These excesses are often fueled by narratives that do not go too deep into the numbers, such as defining the U.S. economy as so strong or the labor market as so robust, like we do today. Seizing opportunities is always difficult for the investor because they are often against this market narrative.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.