How to deal with complexity in markets

16 May 2024 _ News

Markets are by definition always and continuously characterized by various complexities that lead to uncertainty. These complexities can arise both from factors external to the system and from internal ones.

Today, for example, we have as external complexities conflicts, from Ukraine to Gaza, and U.S. elections. As internal market complexities we have the balance between inflation and economic growth, which will influence the FED's choices on interest rates.

Thus, complexity weighs differently on markets, based on the margin of safety. In fact, where the margin is higher, it implies that there are valuation discounts and, in this case, the complexity of both external and internal factors has less weight than in expensive markets where little complexity is enough to bring about sharp corrections.

In all this uncertainty, the key, we believe, is not to question too much about the future, which will always be uncertain, but to accept the uncertainty and be ready.

Internal complexities

We will not talk about the external complexities, conflicts and elections, as we are not experts on these issues, but we will focus on the internal complexities, particularly the balance between inflation and economic growth.

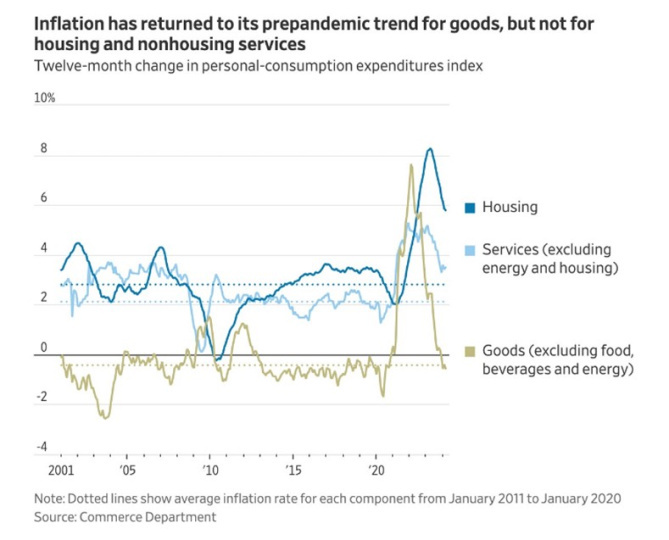

First, the inflation figure that came out on Wednesday shows us that inflation is continuing to fall. Today we worry a lot about inflation, but extending the time horizon to the past, we note that in the decade before the pandemic, core inflation was slightly below 2 percent, the result of goods inflation around -1 percent, housing between 2.5 and 3.5 percent, and non-housing services slightly above 2 percent. Much of the slowdown in inflation last year was due to the fact that goods prices returned to their pre-pandemic trend. For inflation to return to 2 percent, non-housing services inflation must fall to less than 3 percent from the current 3.5 percent, and rental inflation must fall from 5.8 percent to about 3.5 percent. Now this 5.8% is taken from a survey that is given to citizens, asking them how much they would be willing to rent their houses for; if we take the market figure instead, we are closer to 3%. So actually inflation is already in the 2.5 percent range (as shown by the PCE figure, by the way, which is less affected by the rent figure).

Second, economic growth data, show lower than expected results, particularly GDP.

This puts the FED's focus on the balance between growth and inflation, a balance that will lead Powell to focus more on growth than inflation and continue the easing of restrictive policies.

Accepting the uncertainty of markets

What should the investor do in this environment of continued uncertainty? First and foremost, accept uncertainty and thus volatility in the markets. Uncertainty and volatility affecting both the equity and bond segments.

Regarding equities, in this context of uncertainty in which the market narrative continues to focus on economic growth, the investor must in our view ask himself: but how much is already discounted by the market in prices and valuations?

To answer this question, we need to take the valuations of the S&P500, and as we see from the chart they are in very dangerous territory and close to the highs of 2021.

Why do we think high values are dangerous?

Because they imply very high investor expectations, and when expectations are high it takes little to surprise negatively.

Similar discussion with regard to corporate bonds, where spreads are at their lowest in the last 20 years thus highlighting that expectations are very high.

Different discourse on government bonds, on the other hand, which instead have very attractive yields and are also insurance in case these uncertainties increase.

How to prepare

Preparation does not come from questioning these uncertainties, which are these today and will change tomorrow, but it does come from understanding that complexity has a different weighting based on the margin of safety, and for this we need to be prepared to select sectors and markets that have discount valuations.

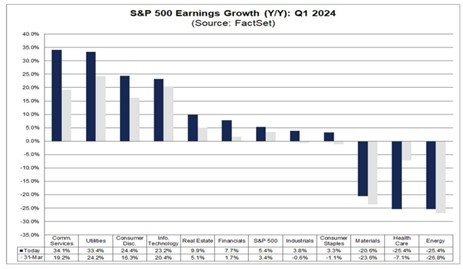

Starting with sectors we continue to prefer defensive sectors, such as utilities-consumer nondiscretionary and healthcare.

We start with utilities being the best sector in the second quarter, the sector continues to be at a discount as evidenced by valuations.

Let's move on to non-discretionary consumption, so those that are not affected by economic growth. Again, the sector has very attractive valuations. Finally, the healthcare sector, which suffered a sharp decline in earnings, of about -25.4 percent year-on-year (chart below).

Within the sector we find value on both pharmaceuticals and medical devices, particularly health insurance. On health insurance, opportunity has arisen for two reasons:

- higher costs resulting from inflation

- a Biden policy that has revised less upward for the sector.

Turning to markets, we believe China continues to show a very good margin of safety. The Chinese market continues to be at a valuation discount with companies in traditional sectors such as utilities-highways, etc.

In addition to China, Europe also shows valuations at a steep discount compared to the United States.

Within the U.S. we prefer the careful selection of companies, particularly small and medium-sized ones.

Conclusion

In conclusion, we believe that by definition the market, stock and bond, is full of complexity. Complexity also weighs differently on markets based on margin of safety. Markets characterized by margin of safety are less affected by complexities, helped by the parachute of valuations. In this context, therefore, the investor should not question these complexities too much but be prepared with the right margin of safety.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.