Markets rise despite fears: optimism amid uncertainty

28 April 2025 _ News

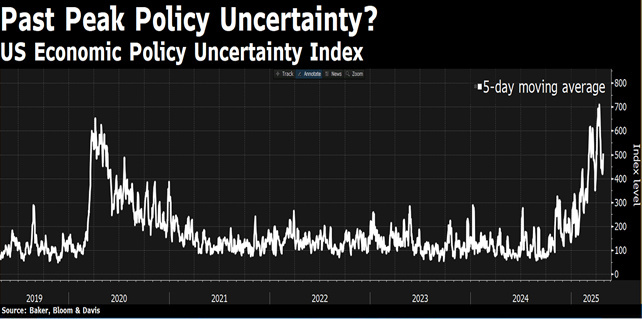

The central theme driving markets last week was once again the trade confrontation, particularly between the US and China, with developments marking a partial U-turn by the US administration. President Trump's first U-turn was to state that he had 'no intention' of removing Powell from the leadership of the Fed. A simple statement, but one that had a significant impact on market sentiment, especially after the harsh tones and explicit threats of the previous days. On the same day, Trump also toned down the rhetoric on tariffs, saying that tariffs on Chinese goods would not be as high as the current 145 per cent, but would be significantly reduced. The message, which was echoed and reinforced by Treasury Secretary Scott Bessent, who spoke of a "de-escalation in the very near future", gave the markets a breather, with tariffs likely to be reduced to around 60 percent, according to sources cited by the Wall Street Journal.

Investors have interpreted these words as a softening of Trump's positions, perhaps dictated by the realisation that America is not ready or willing to face a prolonged trade war with China, or perhaps simply because it is expected by the negotiating strategy adopted, the result has been a rally in the dollar, a recovery in stock indices and a scaling back of the rush to gold as a safe haven asset, with a relaxation in Treasuries and a general risk-on environment and decline in volatility.

The aggressive rhetoric from the White House has for now given way to a pragmatism more attuned to market signals, but the damage is visible and the environment remains fragile. The trade battle with China may not be over, but investors seem to welcome any signs of détente.

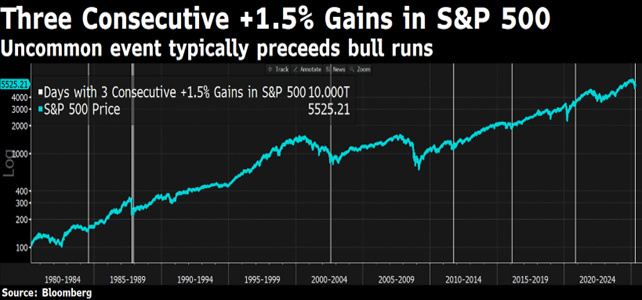

We continue to believe that equities are trying to consolidate a potential bottom, but the risks from the trade war are clearly still high and the Fed is in a situation that is not easy to manage. In this challenging environment, there is no shortage of positives and the market now seems more willing to listen to them.

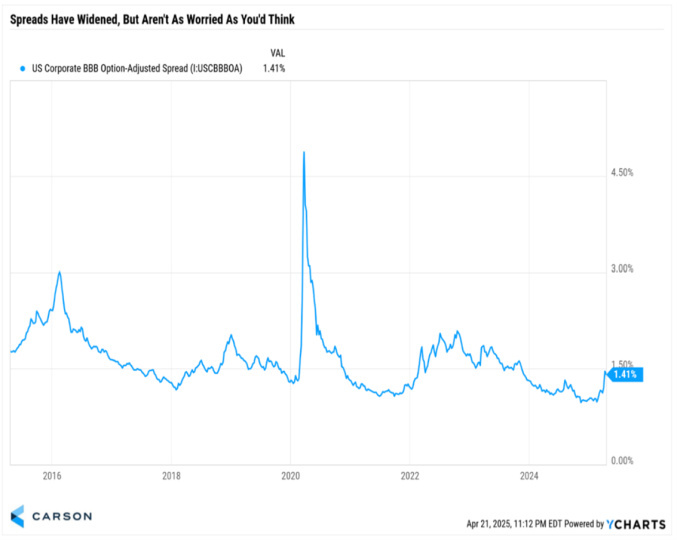

One potential silver lining is the tightness of the credit market; despite the volatility and concerns about the economy, we are not yet seeing major spread widening and it is hard to imagine a truly bearish market without credit deterioration.

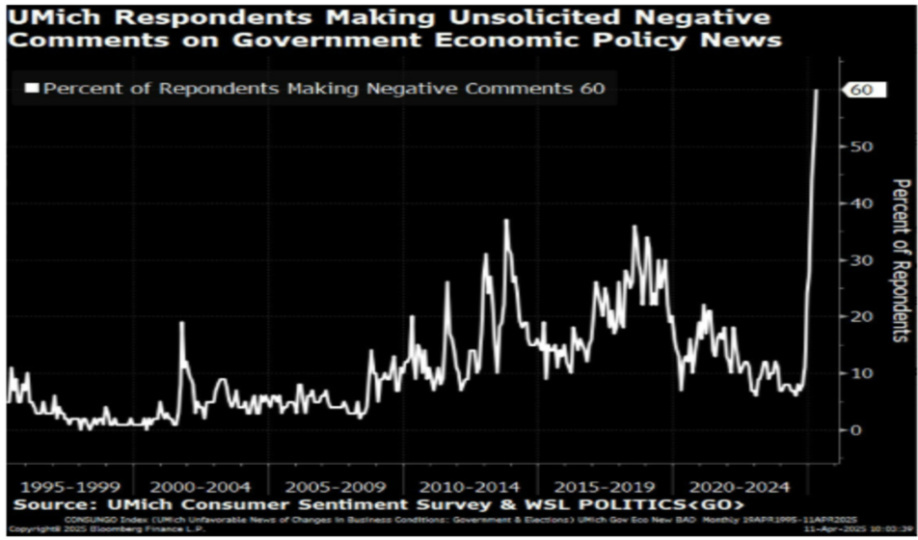

Another positive is sentiment, which is now at extremely low levels. Last week we saw Bank of America's Global Fund Manager Survey, which showed a record number of participants planning to reduce exposure to the US, the largest two-month increase in liquidity since April 2020 and the fourth highest recession expectation ever. Given that this survey is of managers managing real portfolios, this is a potentially very robust contrarian indicator. Meanwhile, the University of Michigan Sentiment Survey shows that consumers are expressing more negative sentiment than at any time in history.

But perhaps the strongest signal at the sentiment level comes from The Economist, which has published no less than four consecutive very bearish cover stories in April, including the latest this week, which shows an eagle shot and wounded by Trump's first 100 days, suggesting that the dollar may be on the verge of collapse and that the same is true for equity markets, Treasuries and the US economy in general.

What not everyone may know is that there is a study that analyses the contrarian behaviour of financial markets in relation to The Economist's cover stories. Two Citibank analysts looked at all the covers published by The Economist over the past 25 years, focusing on those that took a strongly positive or negative view of specific assets or markets. They found that in 70 per cent of cases, the forecasts implied by the covers turned out to be wrong within a year of publication. Specifically, buying negatively described assets over the next 12 months produced an average return of 18 per cent, while shorting positively described assets produced an average return of 8 per cent.

This phenomenon is known as "The Magazine Cover Indicator", which suggests that the covers of financial magazines can act as contrarian indicators. The idea is that when a financial theme makes the cover of a widely circulated publication such as The Economist, it may indicate that the market consensus has already reached an extreme, suggesting an imminent reversal.

Meanwhile, the latest US consumer data suggests that consumers are continuing to spend. Redbook retail sales rose 7.4% year-on-year in the week of 18 April, which bodes well for a strong April retail sales figure. The CEO of Capital One, a major credit card company that reported better than expected results, also spoke of the resilience of the US consumer and improving default rates.

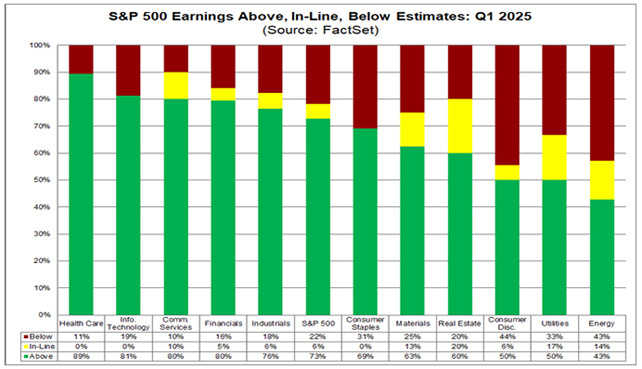

Finally, there are encouraging signs from the US reporting season, with around 35% of companies reporting so far, showing some mixed signals across sectors, but overall earnings beating estimates 73% of the time.

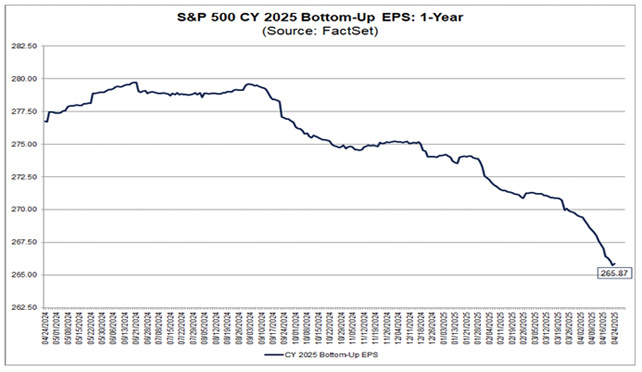

After the big banks, several tech companies have surprised the market, including LAM in semiconductors, but especially Google. There are also reassuring messages from the tech world on the growth of AI, but what investors like most is that there are no guidance cuts and comments on the macro environment and that prices are constructive with signs of anticipation and assessment of events rather than concern. Perhaps the most cautious signals come from some non-discretionary consumption, with PepsiCo and Procter & Gamble signalling pressure on margins and tariff-related costs. Investor expectations, on the other hand, have deteriorated sharply since the beginning of the year, with earnings estimates revised down by around 5% and multiples compressed to levels now in line with historical averages.

With an earnings season like the current one, without major discrepancies and accompanied by a more accommodating and relaxed Trump stance, markets could find arguments to consolidate current levels and perhaps test some upside signals. We continue to recommend taking advantage of this correction to selectively add to portfolios quality companies, often characterised by very high valuation multiples, which today have instead returned to average and in some cases even below their historical averages, offering very attractive expected future returns.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.