Net 4% safe investments. Do they exist?

18 July 2023 _ News

There has been a lot of talk in recent weeks about the opportunity that some deposit accounts offer, ranging from about 3 percent to 4 percent gross.

But is this really an opportunity? In our view, no.

First of all, because these returns are gross (the taxation applied is 26 percent) and net soon turns into a much more modest 2.28 percent to 2.96 percent, always provided that one respects the deposit restriction of the amounts that some of these accounts provide. Basically, you do not disinvest until the scheduled maturity, otherwise you lose the promised return.

Now, leaving aside the Btp which, at one year, today yields about 3.39 percent net, let's consider a more park German Bund: at one year yields about 3.18 percent, unconstrained.

The deposit account initiative is successful, thanks in part to the publicity battle and the strength of the brands on duty, but in the marketplace with short maturities there are alternatives like there have not been in a long time, and with the help of a professional one can easily set a yield to maturity of 4.50 percent gross over a 4-year time frame.

A proposal without sequins and glitter but certainly more effective.

On the other hand, with regard to the concept of security of returns for the benefit of those less informed savers/investors who are about to make investment choices, a conceptual clarification must first be made, since the terms of variability of an outcome can be distinguished, for our purposes, into two categories:

- Safety of the institution issuing the financial instrument (probability of default, i.e., bankruptcy).

- Consistency of investment income (dividends or coupons).

Those who typically ask questions such as whether safe investments exist at the net 4 percent level tend to be investors with a fairly low risk profile who, as a result, seek bond-type returns.

Given the dearth of variable-rate bond issues, we will focus on risks of the first type, that is, bankruptcy risks, excluding all those cases in which the flow (coupon or dividend) would be non-determinable in advance with certainty.

The field is now narrow enough to give a more or less definitive answer to the original question.

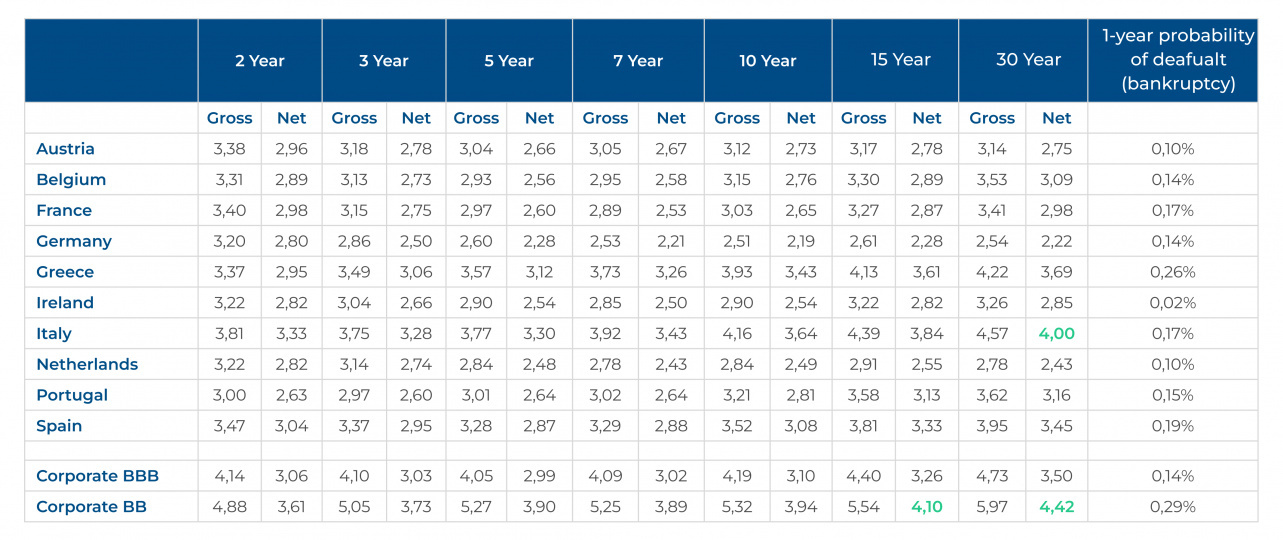

The answer is in the table below, which contains the main gross and net yields by maturity for the main government issuers in the euro zone. As an additional benchmark we also find average data for corporate bond issues by BBB and BB ratings.

In the table, the answer is quite obvious.

Right now 4% net yield is offered by a few instruments. Specifically, the 30-year Italian government bond (4.57% gross and 4.00% net) and 15- and 30-year BB-rated corporate issues with average net yields 4.10% and 4.42% respectively.

In addition, in terms of security, the probability of default at 1 year is low, we might even say unlikely, but not "0." Not to mention that this probability (at 1 year) nothing ensures for the holding period of the bonds given the long maturities to achieve the much desired yield.

Ultimately the answer to the question is no, there are no safe investments at 4% net. No surprises in this though, "it's the market baby."

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.