Tagli Fed in vista e trimestrali migliori delle attese

11 August 2025 _ News

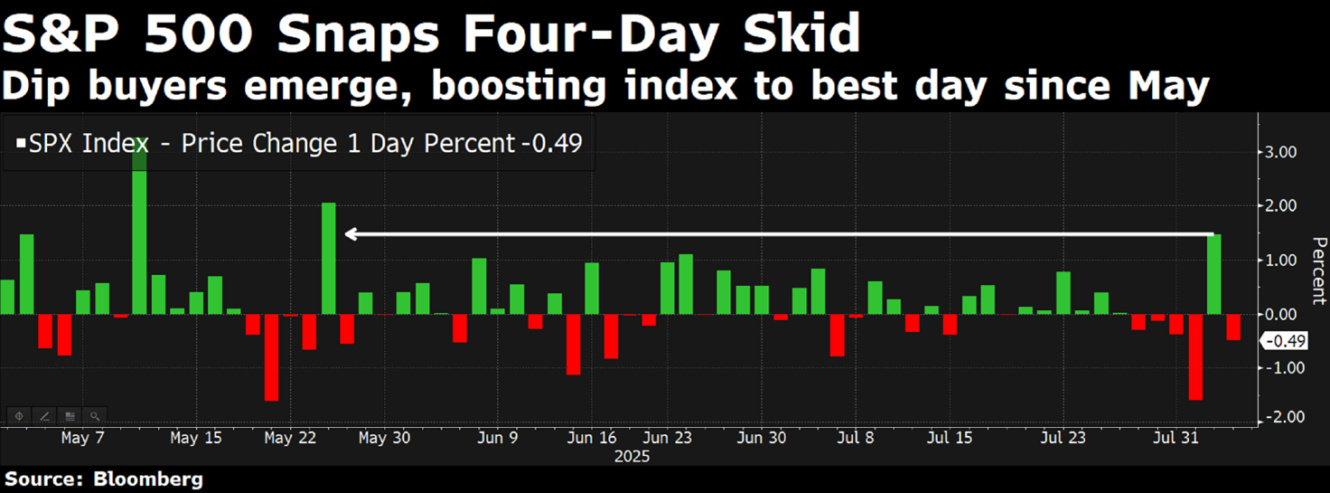

So far, the markets have absorbed the slight correction and concerns about growth that emerged from last week's employment data without any major shocks, continuing to perform well. They are supported by a solid financial reporting season and macroeconomic indicators which, despite mixed signals, continue to point to a soft landing for the US economy.

The rally of the S&P 500, which has already updated its historical highs 15 times, finds new impetus both in corporate results and in the political and monetary framework that is taking shape.

From a corporate perspective, Apple led gains in the technology sector after the Trump administration announced an agreement to avoid tariffs on imports from India. In exchange, the company led by Tim Cook promised a 0 billion investment plan in the US, bringing the total domestic commitments made by the company to 0 billion. The message is clear: the American tech industry intends to remain at the center of the geopolitical arena, and technology continues to be the main driver of earnings growth.

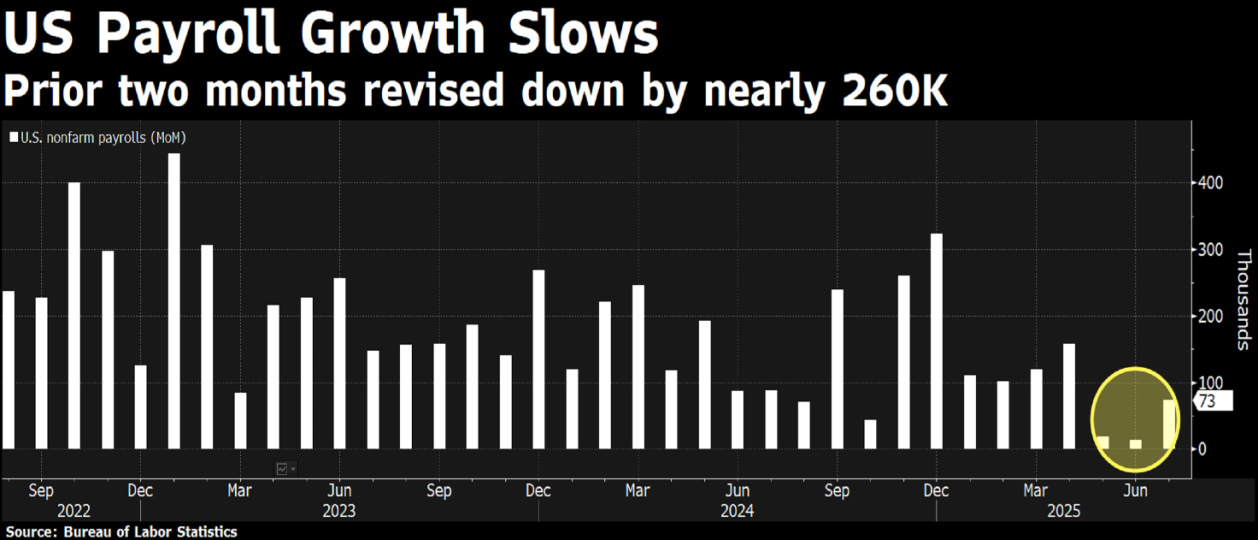

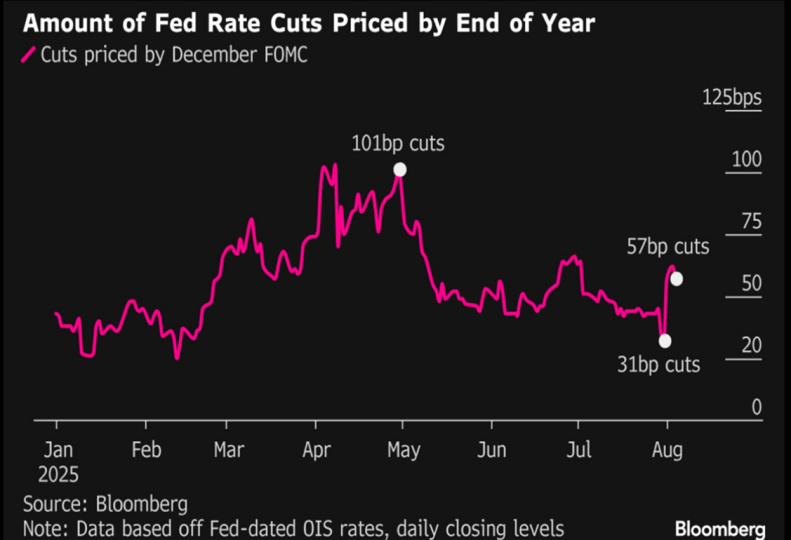

Meanwhile, the market is closely watching developments in monetary policy. July's employment data—which, as we saw last week, was weak and accompanied by significant downward revisions for May and June—has reinvigorated expectations of rate cuts.

Fed Fund futures are now pricing in a more than 90% probability of a first cut in September and at least two further cuts by the end of the year. The narrative is changing: from fighting inflation to managing the cyclical landing.

Reinforcing this outlook, on Thursday President Trump nominated his advisor Stephen Miran to fill the vacant term of Fed Governor Adriana Kugler, who resigned to return to her academic career. If confirmed, the FOMC could count on at least three members in favor of a more accommodative monetary stance. Meanwhile, the chances are growing that Christopher Waller – a figure respected by the markets and by Powell himself – will become the next Fed chair, a scenario that would be positive news for both the bond and stock markets.

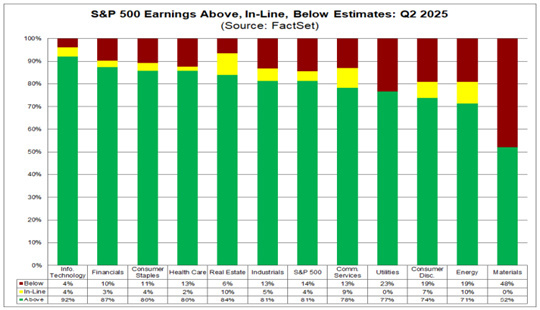

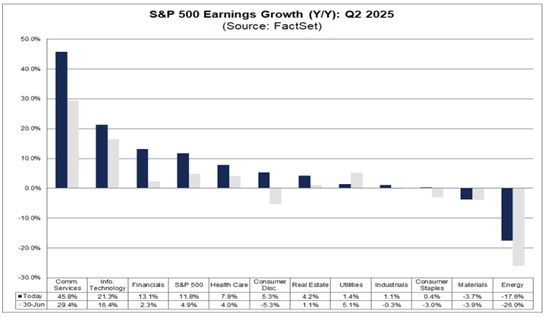

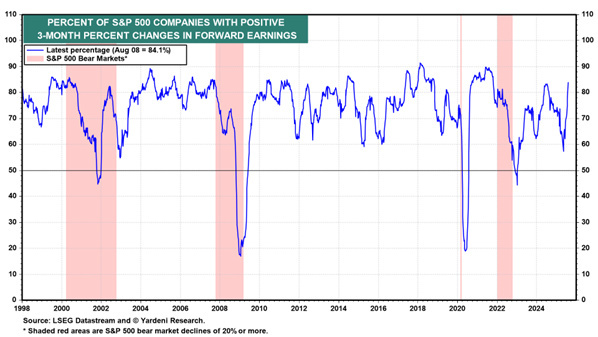

But it is above all the quarterly reporting season that dominates the scene. According to FactSet, with over 75% of S&P 500 companies having already reported, more than 80% have beaten earnings expectations.

EPS growth stands at +12% so far. This is a significant figure, confirming the solidity of companies in a context of surprisingly resilient margins.

Uber performed well, announcing a billion buyback; McDonald's and Walt Disney also performed well, albeit with some concerns about traditional television segments. In the industrial sector, there were positive signs from Caterpillar and Cummins, confirming the resilience of demand linked to the infrastructure and data center sectors. The healthcare sector was weaker, however, penalized by regulatory concerns related to new pharmaceutical tariffs.

On the technical front, positioning is declining. The market is resuming its upward trend but remains selective: participation in the rally remains limited, with only slightly more stocks rising than falling. In other words, the rally continues, but with limited momentum and low volumes. In short, the markets remain resilient but increasingly dependent on a handful of sectors and a positive narrative that coexists, day after day, with political risks and stretched valuations. The summer season, with thinner volumes and statistically less favorable conditions, increases the risk of corrections, even physiological ones.

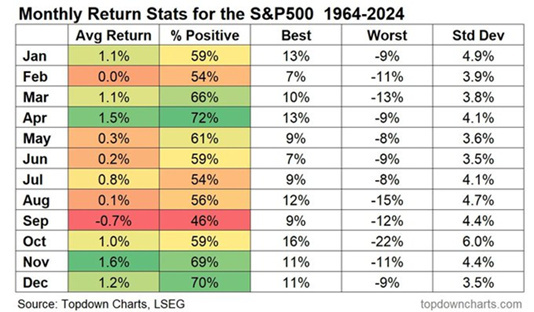

And it is precisely on this issue that it is worth opening a more statistical parenthesis: August and September are statistically the weakest months of the year for stock markets. Catalysts disappear, liquidity decreases, and it takes very little to trigger amplified movements. It is not uncommon to see corrections of between 5% and 10% even within structural bull markets.

In this context, it becomes crucial to distinguish between short-term noise and medium-term substance. And the substance is that the US economy continues to surprise on the upside.

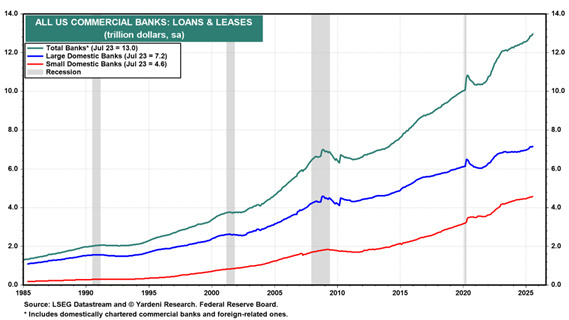

Another factor that strengthens confidence in the resilience of the US economy is the weekly reading of commercial bank balance sheet data compiled by the Fed. Bank lending, often underestimated as a macro indicator but in fact one of the most relevant, reached a new record high at the end of July, with growth involving both large and small banks.

In a context of high interest rates and quantitative tightening, this kind of data is far from trivial. It is a sign that the credit machine continues to function, that demand exists, and that the banking system still has the capacity—and the will—to provide credit to the real economy. Of course, we know that bank credit is a lagging indicator, yet despite predictions of a credit crunch that will be fatal for the economy from 2022 onwards, the figures continue to contradict this narrative. Commercial and industrial loans, after a period of stagnation between 2022 and 2024, have returned to growth, particularly at large banks. Consumer loans also remain at record levels, signaling a social fabric that is still capable of sustaining consumption and personal investment. The real estate sector is also showing signs of resilience, and the same goes for mortgages. This is a sign that should not be underestimated: when credit is flowing and banks are willing to take risks, it is difficult to imagine an economy on the brink of recession. In short, like a canary in a coal mine, the financial sector tends to give early warning signs: it chirps when things are going well and croaks when something is wrong. And today, it is definitely chirping.

In conclusion, we remain of the opinion that the second half of the year could still offer positive returns, but with greater selectivity. Equity valuations are high, but in the absence of a recession, a new inflationary shock, or a sharp geopolitical deterioration, the upward trend in the markets could continue by inertia. Macro resilience and solid earnings justify equity exposure, but discipline in risk management is necessary. Periods of euphoria, such as the current one, are when it is easiest to deviate from one's strategic asset allocation. As history reminds us, corrections of 5-10% are not uncommon in August-September, even within long-term uptrends.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.