The difficult balance of the markets

21 March 2024 _ News

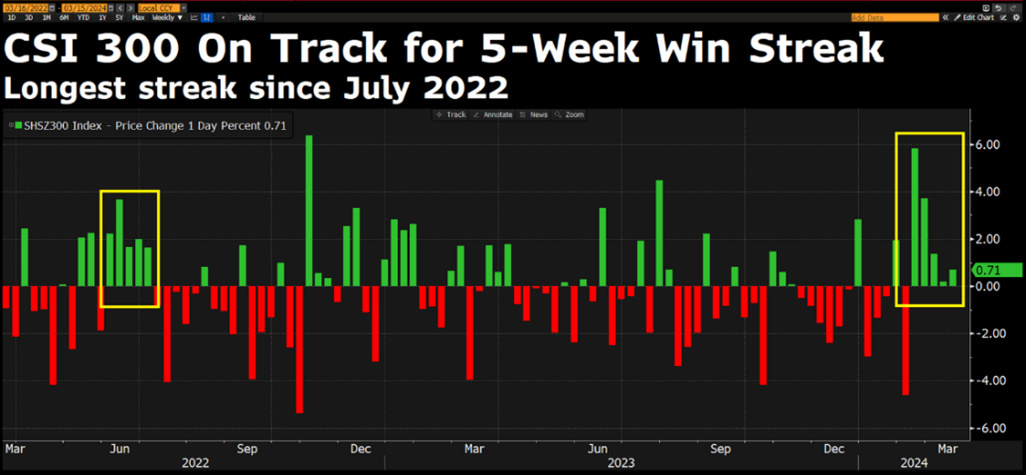

An unchanged week ended for global equity indices, with Europe outperforming the US thanks to the banking sector, and a recovery in the Chinese market led in particular by the tech sector, which is instead one of the worst sectors in the US market.

It is worth highlighting how, against a backdrop of indices that are overall little moved, and in a context of extremely optimistic sentiment indicators, there is instead a rise in volatility, an indication that perhaps the rally from the vertical momentum on many equities is losing its strength, also in correspondence with the first quarter that is drawing to a close and that very often lays the foundations for a rotation of themes and dynamics on the markets.

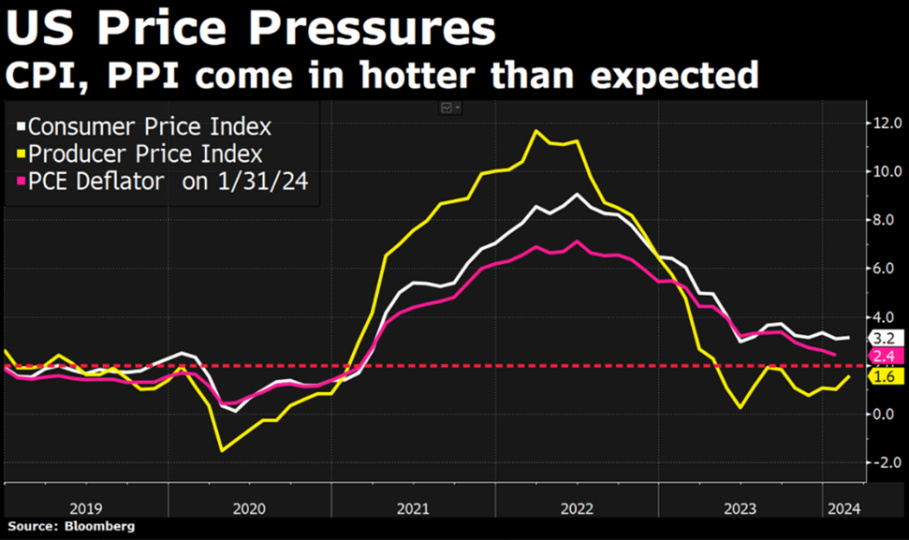

This week we had the inflation data that catalysed the debate among investors. The CPI, i.e., overall consumer-side inflation, for the month of February rose by 3.2%, slightly above expectations of 3.1% and in line with the previous month. The same dynamics on core inflation came out at 3.8%, above the 3.7% expected but down from the previous month.

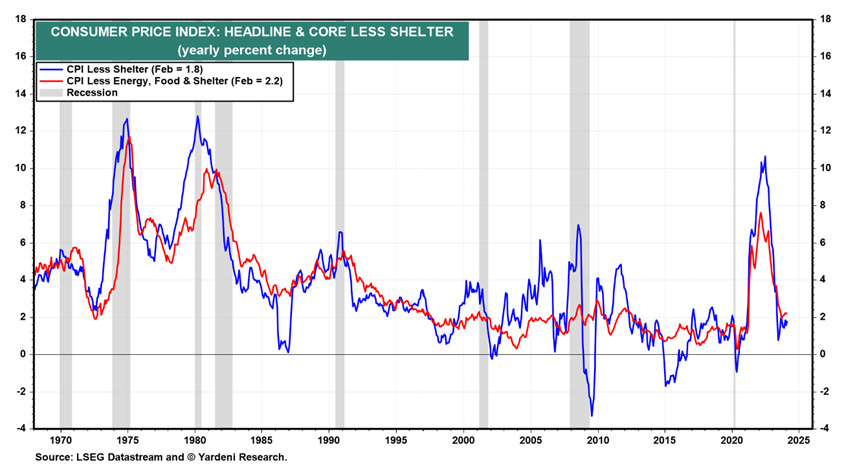

These values remain above the Fed's 2% target. However, excluding housing the so-called shelters (a lagged component of the inflation calculation and moreover an incorrect measure of current real market rents), the overall and core inflation rates would only be 1.8% and 2.2% respectively, thus already in line or even below the Fed's target. It is no coincidence that the Fed prefers the inflation figure measured by PCE, where this distortionary component of rents weighs much less.

Equities seem not to worry too much about inflation and instead see its upside, namely nominal growth in corporate turnover and profits. They also see a rhetoric of the FED that, while wanting to avoid a new entrenchment of an inflationary psychology, is on the other hand trying to prevent recession in any way possible and is moreover increasingly alert to possible negative events that may be beyond their control, such as the health of regional banks. Evidently it will not have escaped Powel's notice to read the recent article in the Financial Times highlighting that in the first three months of 2024 there were a very high number of defaults, at the highest since the financial crisis.

Economic growth on the other hand seems solid and the Atlanta Fed's model calculates it for the US at 2.3%, down from 3.1% last week, but still a very good number, which when analysed individually gives an idea of a very strong economy, but which when observed in its evolution, sees a clear tendency to slow down that could be projected over the remainder of the year.

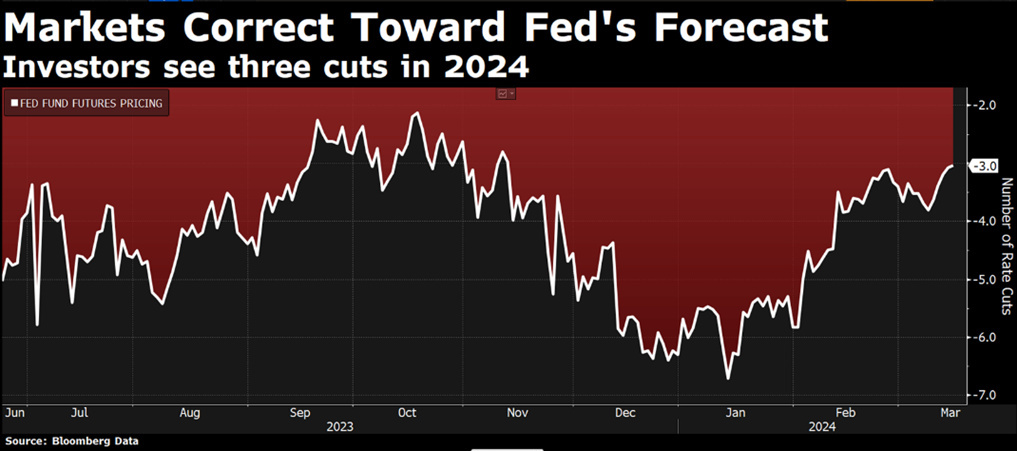

The macro data did not shift the balance, the markets continued to think about the idea of a downward trend in inflation, but increasing the likelihood that the Fed's rate cuts will be lower and later than most investors expected at the beginning of the year, also contributed the data on inflation measured on the production side, the so-called PPI, which showed an increase of 0.6% m/m, twice as much as expected.

This led rates on the US ten-year to rise to around 4.3%, putting pressure on the bond component of portfolios with a weekly increase of 20 cents not seen since last October.

Interestingly enough, this rise in US rates, which also carries over to the European curve, comes at a time when several ECB members have stated that there is now agreement to cut rates in the spring as the battle against inflation has been won.

The topic of the rate cut is always on the table, it is understood that it will not be in March, but maybe we will find out that it will not be in June either, for now the market is positioned for 3 rate cuts in 2024 starting in the summer.

But beyond short-term expectations on rate dynamics, we seem to be finally witnessing a change of course in the markets.

Over the past two years, risk assets have moved in total synchrony, perhaps even excessively so, with interest rates. In recent weeks, the previously observed relationship seems to have broken down. Although interest rates remain a central topic among investors, they are no longer the only factor driving the markets. A rise in rates is manifesting itself in parallel with a rise in stocks, as variables such as corporate profits, balance sheet data and the business cycle as a whole are taken into account. There is still a great polarisation in the markets between topics that are on everyone's lips (such as artificial intelligence or anti-obesity drugs), on which expectations have been raised a great deal, and topics that have been literally forgotten, but which in the last few days are giving the impression of having started to recover.

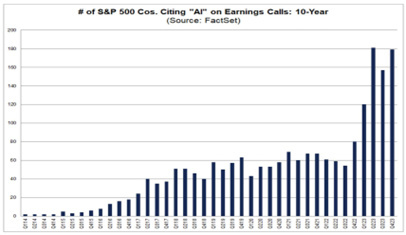

Speaking of high expectations, an interesting study by GS opens our eyes to how unreasonable it is to think of a business, no matter how innovative, growing at high rates for a long time. The strategists of the American investment bank analysed all American companies from 1985 to the present day and came to the conclusion that the expectations incorporated by the market today on certain AI stocks and on Nvidia in particular, with turnover growth rates above 20% have only been realised in history for a consecutive period of 5 years by just over 100 companies and even, of these, only 4 have had ebit margins above 50% for more than 5 consecutive years. No company in the history of the markets seems to have been able to maintain such growth for more than 5 years, something the market is now considering for many stocks belonging to the mentioned sector, with the term 'AI' being mentioned by almost 200 companies during the last reporting season.

Meanwhile, in the artificial intelligence sector, anticipation is rising for the Graphics Technology Conference 2024 underway in California, where Nvidia will present to the market the latest advances in artificial intelligence, and where we will see if they are able to surprise the market further.

Investor attention on the world of artificial intelligence will pass the baton on Wednesday to the FED, which will meet for its usual rate decision. A meeting that is expected to keep rates at current levels, with the market paying close attention to Powel's rhetoric as to whether there will be a change following last week's inflation data, and perhaps focusing more on the issue of balance sheet reduction, rather than rates.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.