There are the magnificent 7...then there is all the rest of the market

01 February 2024 _ News

We get used to everything, it is the nature of being human, so the new highs recorded every day by many stock markets hardly make the news. The S&P500 in the last 13 weeks has recorded as many as 12 positive ones, and apart from the early days of the year characterized by sectoral rotations that favored the defensives, it continues so far to be led by the same sectors and stocks on everyone's lips (tech, AI and the magnificent seven).

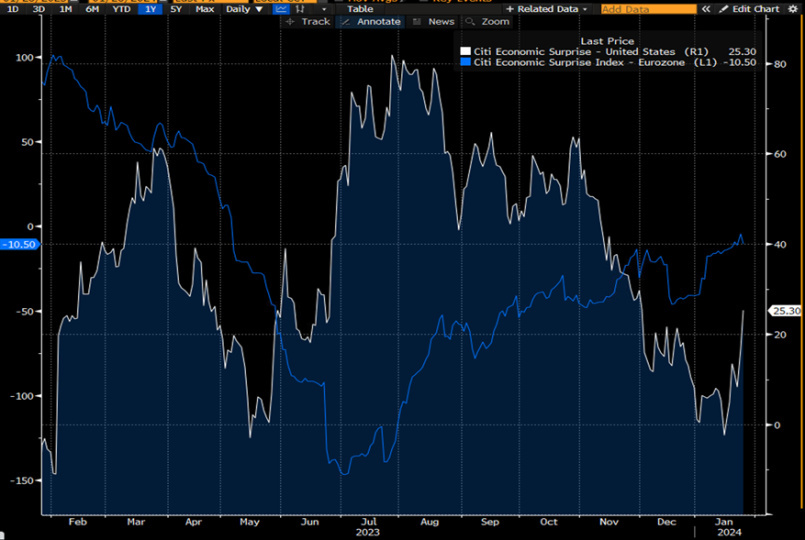

The rise in the markets is certainly not unwarranted; in fact, to drive the indexes we have had a series of strong U.S. macro data that have helped turn the U.S. CITI economic surprise index back into the positive and solidified in investors the scenario of an economy growing without generating inflation that should soon lead central banks to cut rates.

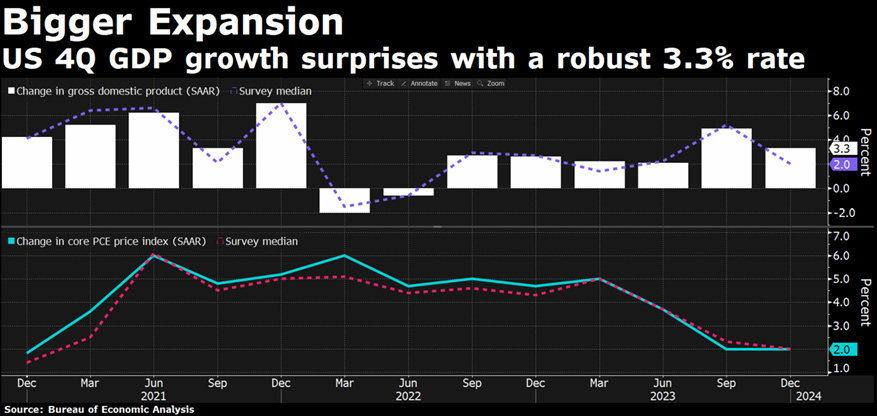

Among the macro data that came out above expectations we had the U.S. PMIs and in particular the GDP figure for the fourth quarter of 2023 that came out at +3.3%, slowing from the previous month's 4.9%, but higher than expectations of 2%.

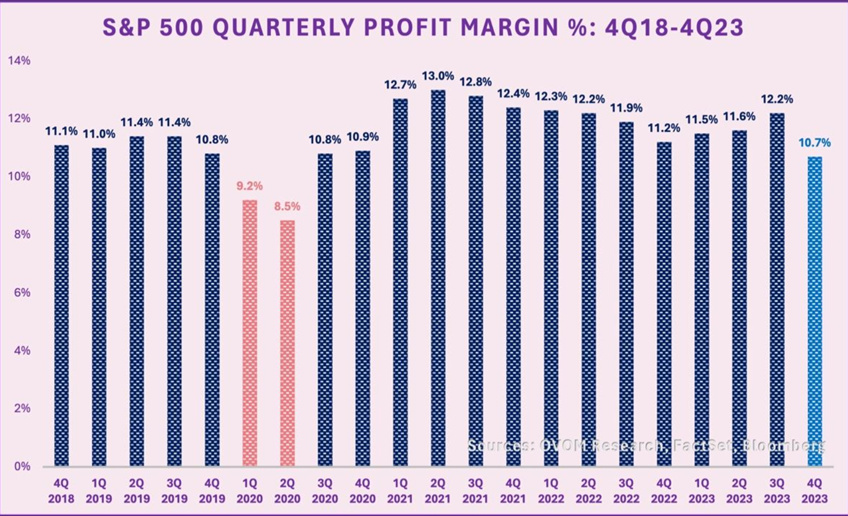

To be fair, there were also some data that came out below expectations, particularly unemployment claims that came out at 214K compared to expectations of 200K, up from the previous month, which again was revised worse than the previously reported figure. A dynamic that has become customary on labor data, which would show a labor market less strong than it appears, as many companies are already reporting to us. U.S. companies are expected to report a profit margin of 10.7 percent for this quarter, the lowest margin quarter in 3 years.

And how are companies responding to declining margins? In the first weeks of January, 85 technology companies laid off 24,000 employees, including Amazon, Google, eBay, Instagram, Microsoft, and even Blackrock and Citigroup announced major staff reductions. Just as substantial cuts have also been announced in Europe, for example by SAP cha announced 8,000 job cuts. This should lead us not to be surprised by possible deteriorating labor data. In macro data we will see this in a few quarters, but earnings analysis is already showing it to us.

This week will be full of macro events with the rate decision by the FED, the quarterly announcement on U.S. Treasury debt issues, and some labor data, pending the CPI inflation data expected next week. Inflation, which already last week calmed investors, on its path back. Indeed, we had on Friday the PCE, the FED's preferred inflation measure from which emerged a core figure at 2.9 percent that is below 3 percent for the first time since 2021. In addition to this we also had the GDP price figure that came out at 1.5 percent, which is way below expectations and already below the central banks' target of 2 percent. All data confirming the gradual return of inflation.

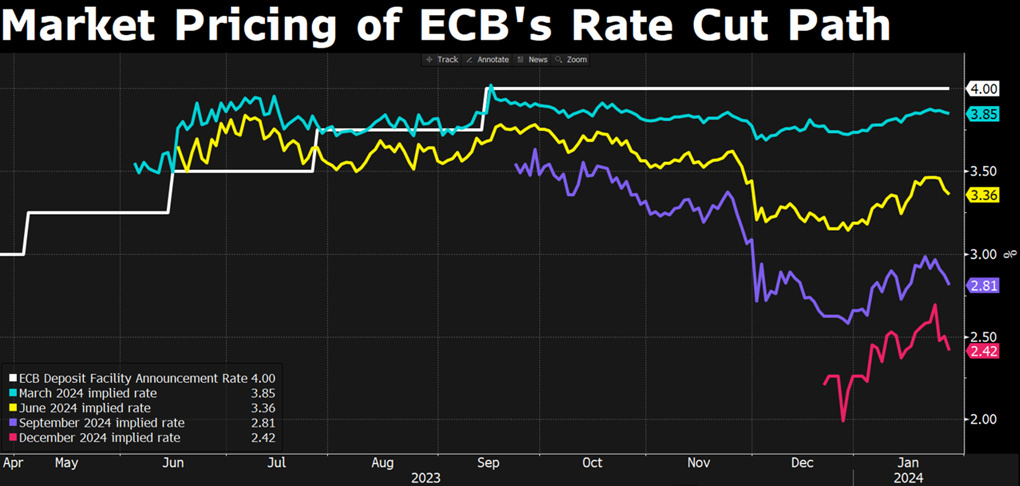

Not only macro data, but it was also the week of the ECB, which, as widely expected, left interest rates unchanged with President Lagarde confirming, after communicating in Davos, that "it is premature to discuss rate cuts." On the other hand, the market perceived an accommodative tone when it was stated that the evolution of the inflation trend and some independent wage trackers, allowed the committee members to gain more confidence that the current monetary policy is having the desired effect, effectively opening the door for a change of pace perhaps sooner than expected.

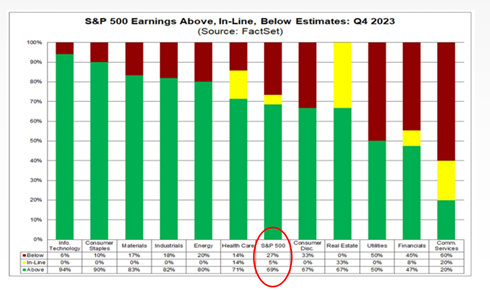

Last but not least, certainly not in order of importance, the U.S. reporting season continues, which will come into full swing this week with 40% of U.S. companies ready to report, including all the big tech companies. For the time being, 25 percent of U.S. companies have reported fourth quarter 2023 results, beating estimates by 69 percent but reporting aggregate earnings 5.3 percent below expectations.

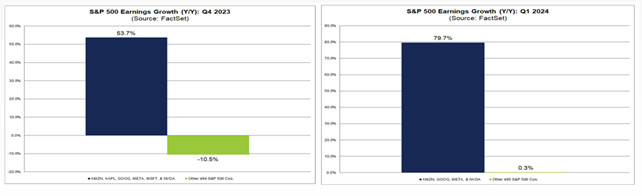

Significant contribution expected from the magnificent seven with estimated earnings up 54 percent for the fourth quarter, versus -11 percent expected from the other 493 companies. The magnificent seven are driving the performance of equity indices, and the consensus narrative is adjusting by attributing much of the expected growth to them. If we broaden this analysis to expected earnings growth for the first quarter 2024, the consensus expects earnings growth for the "magnificent 7" of 79% against the rest of the market expected zero growth.

So far among the big caps we have had good reporting from Netflix, Procter and Gamble, Verizon, and the staples in general. Disappointments, on the other hand, have come from Tesla, Intel, Visa confirming the rule that the greatest risks of disregard are found in companies where expectations had risen the most.

Instead, the value philosophy looks for a margin of safety to invest, preferring to buy where expectations are very depressed, conditions that we do not currently see in tech and that we do see in the absolute easiest sectors to understand, that is, in the defensives, with some pharmaceuticals and in particular staples and utilities, but also in some European luxury stocks, with LVMH releasing very good numbers during the week going up 12 percent the day after reporting.

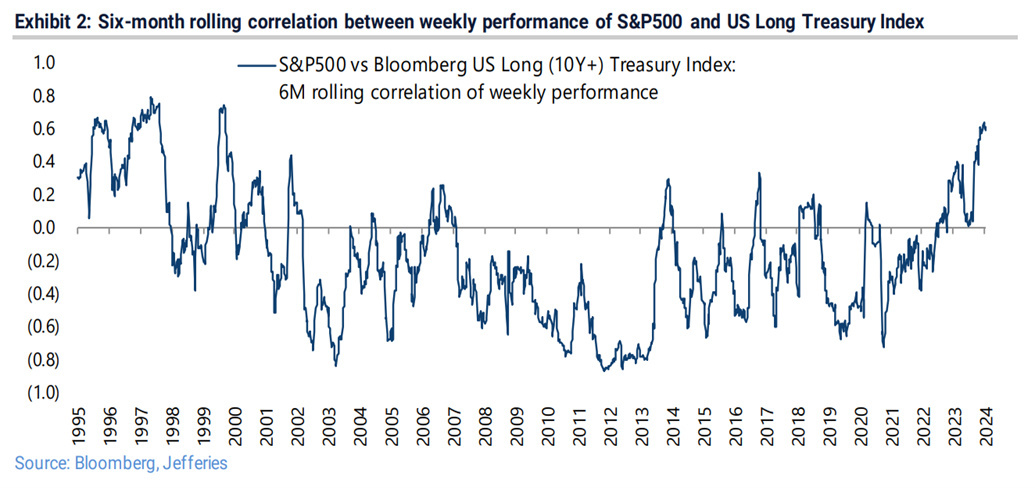

We highlight, finally, how the six-month correlation between the S&P 500 and the U.S. 10-year rate has reached the level of +0.6, a level that historically has never exceeded 0.8, and we need to go back to the 1990s to see it at current levels again.

This also supports our view of value being created on duration in bonds. It is evident from the chart that the correlation between the rate and euity is now near an extreme with the plausible return toward the mean that would cause the rate to return to decorrelate the equity component, with very positive effects for all investors who have been able to stretch duration in their portfolios.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.