U.S. earnings: do Geographic exposure and company size affect earnings growth?

02 February 2023 _ News

Given the easing of COVID restrictions in China and the weakening of the U.S. dollar, the question that arises is whether U.S. companies with greater exposure to international revenues have reported higher earnings and revenues for the fourth quarter of 2022 than S&P 500 companies with greater exposure to domestic revenues. The answer is no.

FactSet Geographic Revenue Exposure data (based on the most recently reported fiscal year data for each company in the index) were used to answer this question.

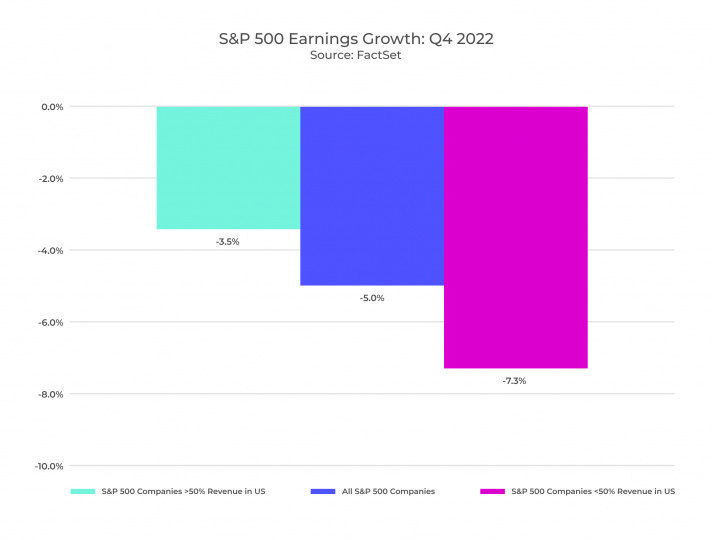

The S&P 500 earnings decline for the fourth quarter of 2022 is -5.0%. For companies generating more than 50% of sales in the United States, the combined earnings decline is -3.5%. For companies generating more than 50% of sales outside the United States, the decline in combined earnings is -7.3%.

The second question that arises is what is driving the underperformance of S&P 500 companies with greater international revenue exposure.

Here it emerges how the largest companies in some sectors are struggling. In terms of earnings at the sector level, the Information Technology and Communication Services sectors are the main contributors to the largest decline in earnings for S&P 500 companies with greater international revenue exposure. Within these two sectors, Intel, Alphabet, Meta Platforms, and Apple are four of the largest contributors to the decline in earnings.

If these four companies were excluded, S&P 500 companies generating more than 50% of revenues outside the United States would have a blended earnings growth rate of 1.1% for the fourth quarter instead of a -7.3% earnings decline.

In conclusion, the effect of geographic exposure combined with company size is weighing on the performance of U.S. equities. In particular, the largest U.S. companies, which are also the most foreign-oriented, have not yet been positively affected by a weaker dollar; on the contrary, they have shown worse performance.

We expect that a weaker dollar combined with a better-than-expected reporting season may support large U.S. companies that continue to show excellent returns on capital and are also at a valuation discount.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.