Wall Street accelerates, the economy slows down

09 October 2025 _ News

It has been a week full of macro, technical, and fundamental developments, with stock markets continuing to show resilience but with divergent signals calling for caution.

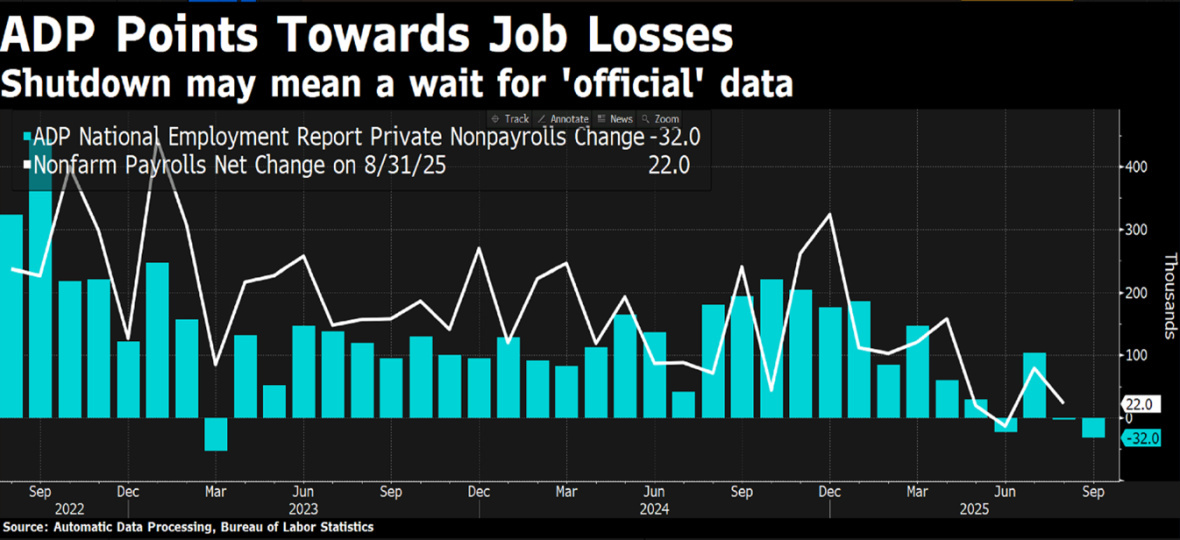

Let's start with the macro picture, where labor market data offered weak indications: the ADP report showed a loss of 32,000 jobs in the private sector in September, the worst figure since March 2023 and well below expectations.

The revised August data was also adjusted downward. Despite this, the markets interpreted the data as “bad news is good news,” reinforcing expectations of two rate cuts by the Fed by the end of the year.

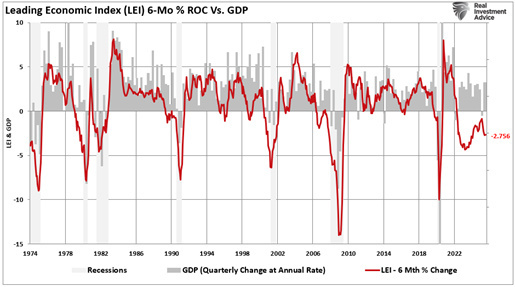

At the same time, the Conference Board's Leading Economic Index, a composite indicator used to predict future trends in the US economy, recorded its seventeenth consecutive monthly decline, the longest negative streak since 2008. Personal consumption expenditure appears to be slowing down amid declining consumer confidence.

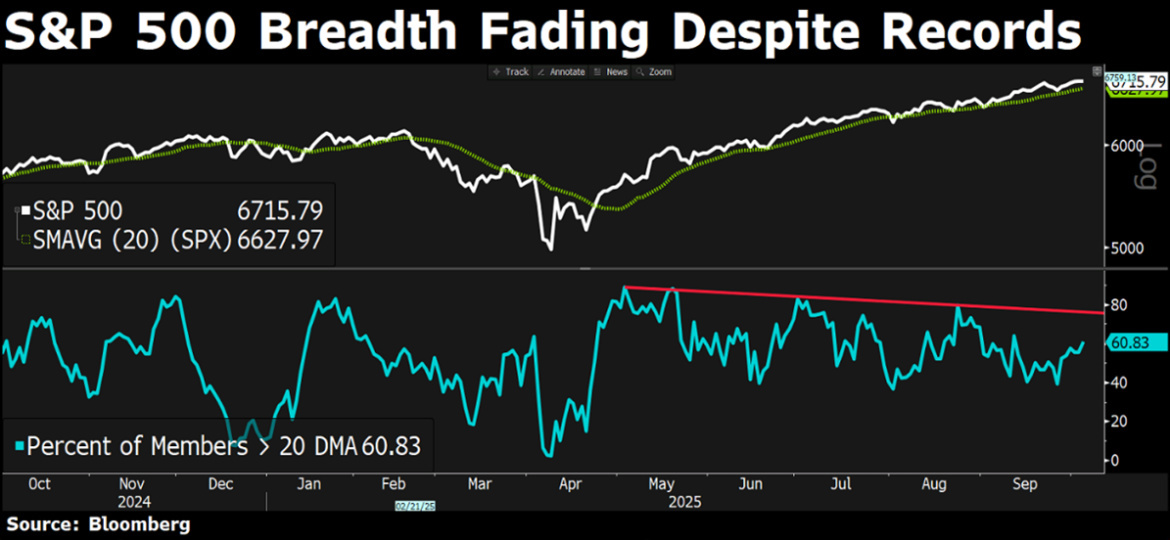

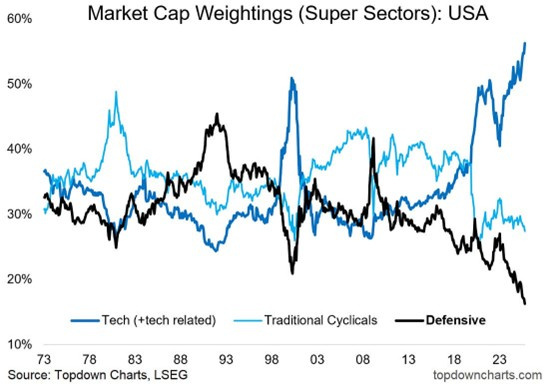

Although the S&P 500 continues to hit new highs, macro signs of weakness persist beneath the surface. Upward momentum in stocks remains fragile, with only 56% of stocks above their 50-day moving average. This suggests a narrowly led market, driven by a few names, and a widening dispersion in performance, signaling a slowdown in the upward momentum.

In recent months, equities have been driven by a particularly favorable earnings environment and growing confidence that the US economy has avoided recession. Despite one of the Fed's most aggressive rate hike cycles, two years of persistent inflation, and global trade tensions, the dominant narrative on Wall Street oscillates between “soft landing,” “no landing,” and even “reacceleration.”

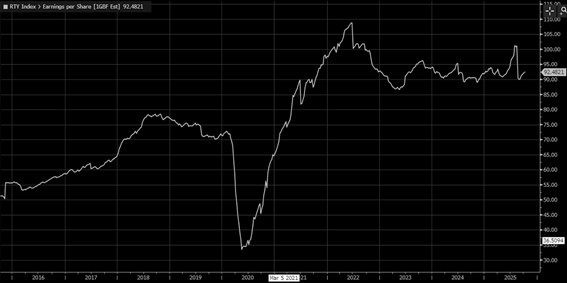

A prime example comes from estimates of future earnings for companies most sensitive to growth, such as small and mid caps. Over the past two years, despite fiscal and monetary stimulus measures, earnings growth in this market segment has remained modest.

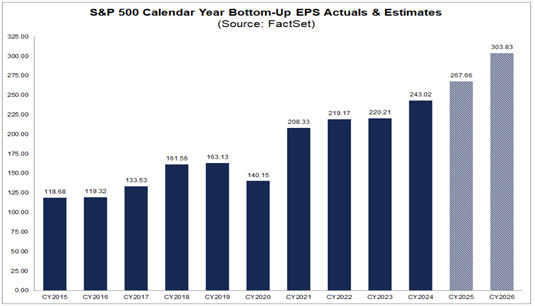

Yet now, looking ahead to 2026, analysts expect a sharp leap forward, not only for the usual tech sector, but also for the rest of the market, a hypothesis that can only hold true in the presence of a real economic acceleration.

The point is that, while the market is betting on a recovery capable of sustaining both earnings growth and high valuations, the real economy is sending opposite signals: key indicators, designed precisely to anticipate changes in the cycle, are already showing a slowdown underway.

Against this backdrop, stock market valuations continue to reflect high confidence in economic resilience and earnings growth. Forward multiples have returned to very high levels:

The forward P/E ratio of the S&P 500 rose to 22.8x, well above the 10-year average of 18x. Only 7% of listed companies have a multiple below 10x, and the forward P/E ratio of the Magnificent 7 returned to 30x, after a low of 22x in April.

Earnings growth expectations are above historical averages, and market direction in the coming months will be dictated by whether these expectations are confirmed or disappointed. With the start of the new reporting season, attention is focused on two crucial aspects: the stability of operating margins and adherence to guidance. Analysts' estimates for 2026 imply a sharp acceleration in earnings growth, but this optimistic scenario contrasts with the aforementioned leading indicators. The risk is that a negative surprise on margins or cautious guidance from companies could trigger a correction, especially given the already stretched multiples.

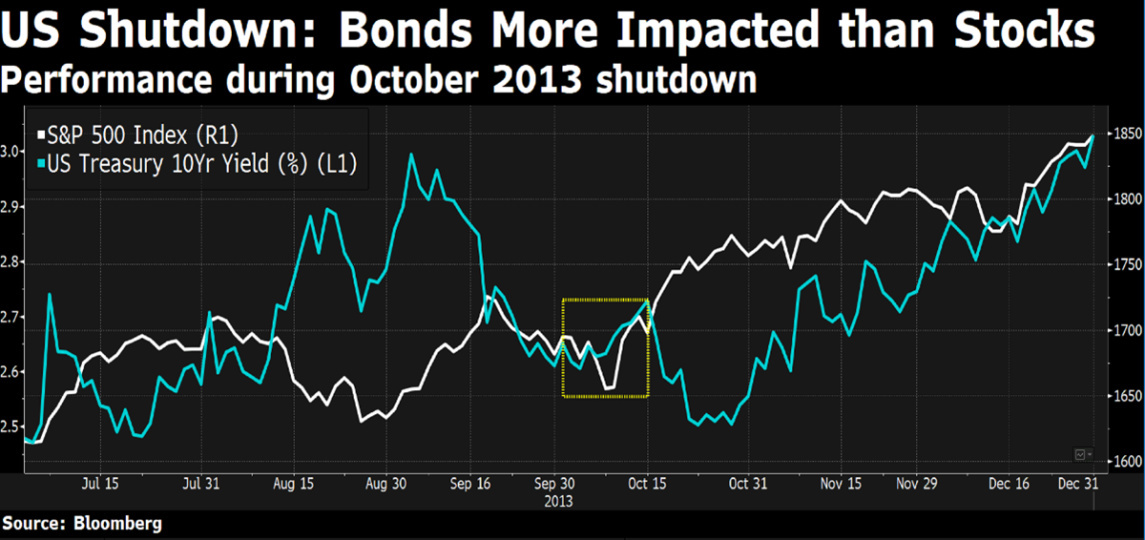

On September 30, 2025, Congress failed to reach an agreement on the spending bill, and on October 1, the federal government shut down, suspending many public activities except for essential services. This is not an unusual event in the United States: there have been 21 shutdowns in the last 47 years, almost always resolved with temporary funding. On average, they last from one to three weeks, although there are exceptions, such as during Trump's first term, when the dispute over the wall with Mexico led to the longest shutdown in history, lasting 35 days.

Despite media hype, the economic impact of a shutdown is generally limited. Historically, it has not had a lasting impact on corporate earnings or industrial production and, consequently, on stock markets. When a correction has occurred, it has usually been linked to a temporary contraction in multiples prior to the event. Subsequently, as the economy and earnings continued to show resilience, multiples often tended to widen.

In summary, shutdowns almost always prove to be more of a political and media risk than a real market risk: during shutdowns, the S&P 500 has recorded an average increase of 0.5%, with 71% of cases closing in positive territory. Even the longest shutdown, in 2018, was accompanied by a gain of 6.9%, while the maximum loss, in 1976, was only 3.4%.

In summary, investors appear to have no reason to fear significant consequences on this occasion either. However, if the shutdown continues, official data (including the employment report) will be delayed, increasing uncertainty for the Fed and investors.

Conclusion: The overall picture suggests a growing divergence between market narrative and economic fundamentals. Leading indicators are signaling a slowdown, while stock valuations reflect a scenario of full acceleration.

At this stage, we believe it is prudent to focus on high-quality companies with defensible margins, good cash generation, and solid balance sheets. Defensive sectors such as healthcare, utilities, and consumer staples offer greater resilience in mature cycles. The goal is not to anticipate the end of the rally, but to prepare with discipline and selectivity for a phase of greater volatility and possible recalibration of expectations.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.