Will there be a Christmas rally again this year?

09 November 2023 _ News

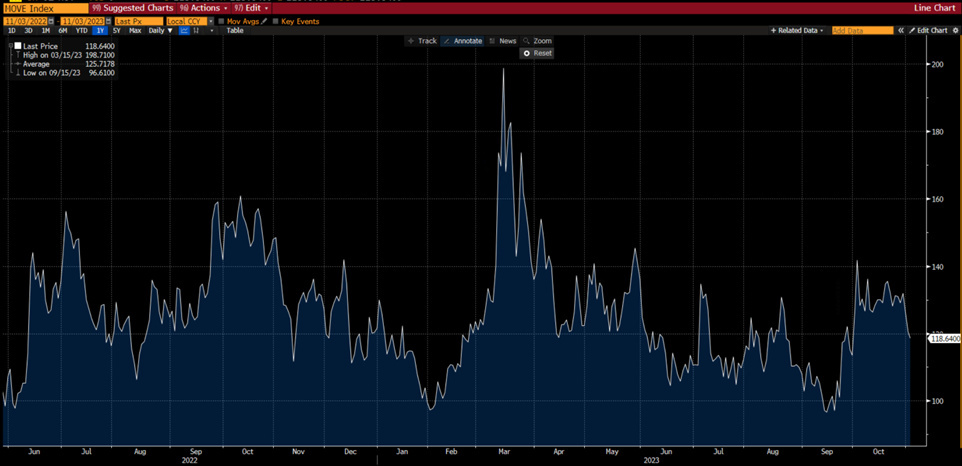

For a few weeks now there has been a feeling that change is afoot in the markets, particularly the possibility that interests rates — having risen inexorably for three years and causing unprecedented suffering for bond investors — might have finally peaked. The month of November started off confirming this prospect, with the US ten-year falling back about 50 hundredths from its highs and the bond volatility index falling significantly in reaction to the central banks, macroeconomic data and the reporting season — factors that have emerged as the markets' main catalysts.

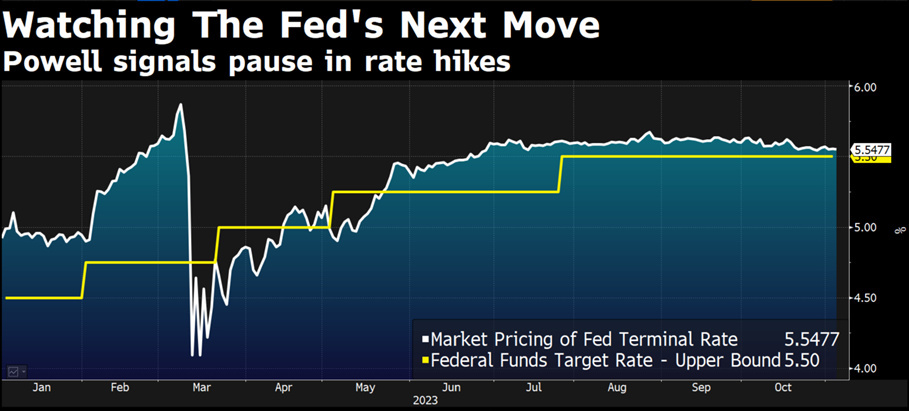

As widely expected, the Fed unanimously voted in its meeting last week to keep interest rates and quantitative tightening unchanged. Chairman Powell made it clear that there may even be further tightening, and rate cuts are not currently on the agenda. There were very few changes compared to the report after the previous meeting, but one notable difference was the more cautious assessment of economic conditions. They are now considered weaker than before and are now described as “strong” as opposed to “solid” like last time. Powell then reiterated that the Fed would maintain its cautious approach, keeping a close eye on data, with the market holding the terminal rate at around 5.5%.

The part of Powell's speech that perhaps most appealed to the markets and convinced them that this rate hike cycle could perhaps be over was his remark that the risks of doing too much for #inflation and the risks of doing too little are becoming more balanced. So now there are risks on both sides, compared to previous meetings, where he indicated that the risk of doing too little was greater. Powell's speech also echoes the ECB's statement of the week before and reflects the tone of the Bank of England's remarks on postponing a rate hike. Finally, Chairman Powell alluded to the fact that the focus now is not so much on further rate hikes but on how long central banks will need to keep rates high to slow down the economy.

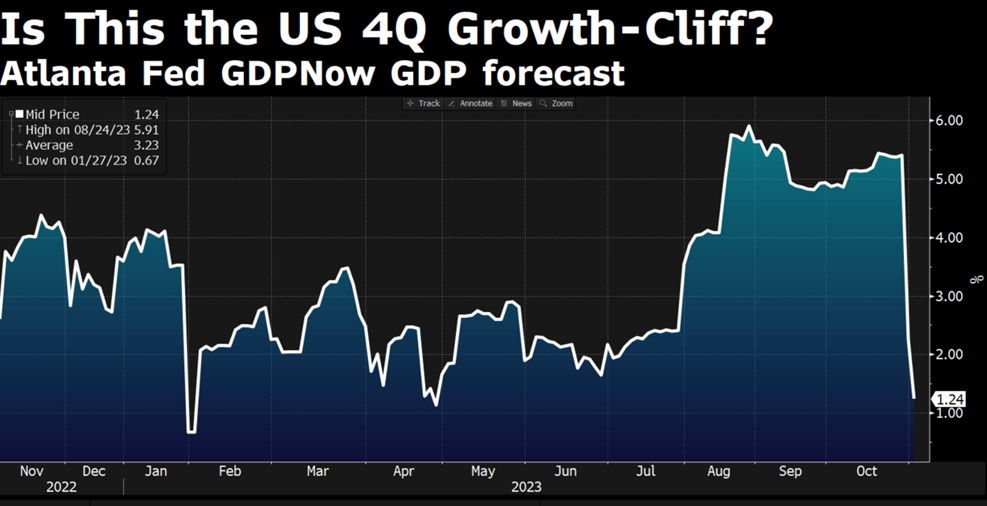

High rates are already slowing down the economy, as evidenced by the macro data, which came in below expectations for possibly the first week in several months. The ADP employment report and ISM manufacturing data showed disappointing numbers, while the Atlanta Fed revised its US GDP Q4 estimates from +2.3% to +1.2%, and jobless claims also proved higher than expected. Then we get to Friday`s non-farm payrolls figure. which came out below expectations at 150K against the predicted 180K and with yet another downward revision of about 40K from the previous month's figure. A downward revision of around 40K jobs is now a well-established trend, last seen back in 2008.

Meanwhile, the US reporting season continues with 80% of companies reporting third quarter results, beating forecasts in 82% of cases and showing surprise profits at around 7.5%. In contrast, the European reporting season was not so rosy, with companies falling short of estimates by 7% and several stocks dropping between -20% and -40% on the day of the results. This, however, did not have a significant impact on indices, which were driven up by rises in many stocks and sectors that are still very undervalued.

The valuations of multiple stocks and sectors make us optimistic on equities, even with the threat of a future economic slowdown, as many prices already account for a slowdown scenario. From this angle, we maintain that the greatest opportunities lie in the defensive and financial sectors.

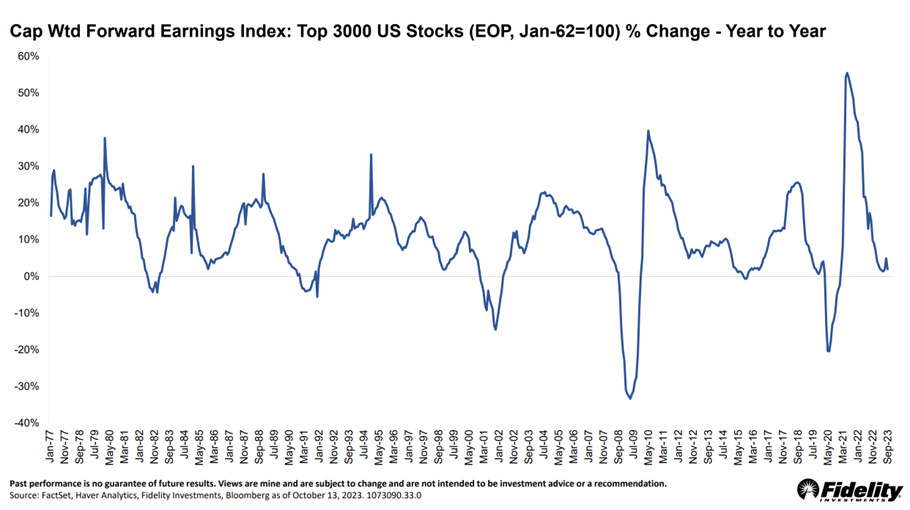

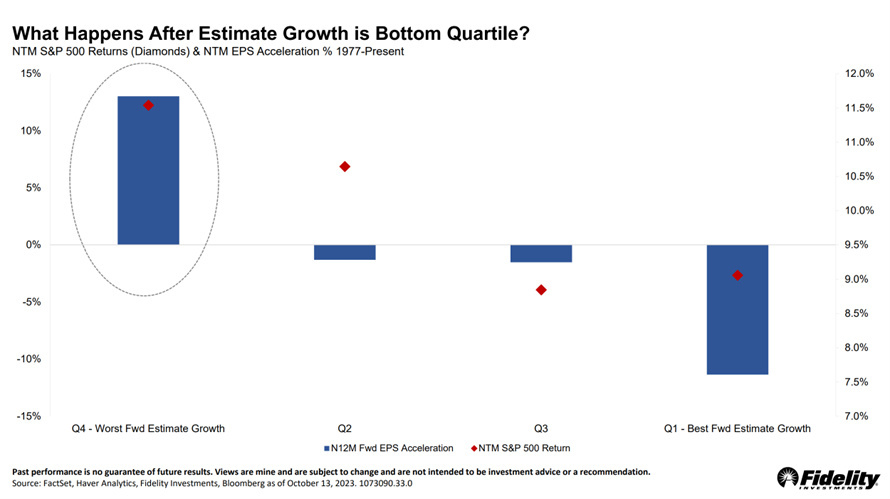

Markets are earnings driven, and earnings estimates for the next 12 months have been on the rise since March, but reported earnings growth is now at its lowest since 2021, with this first quarter the first to show earnings back to year-on-year growth. We are now at the lowest ebb of reported earnings growth, and this has always been a good time to invest.

The revision of estimates from March onwards convinced us to call the end of the bear market, but foreseeable continued earnings growth will help estimates rise further, with the markets following suit. At any rate, this is what we learn from the Fidelity Investments analysis of previous earnings cycles, where it emerges that the worse the previous year was in terms of earnings growth, the better the returns on stocks were the following year, because estimates tend to accelerate rather quickly. Growth trajectory variations (from deceleration to acceleration) are rare and occur little more than 5% of the time. However, each time that it has happened, markets have risen the following year, showing returns above historical averages.

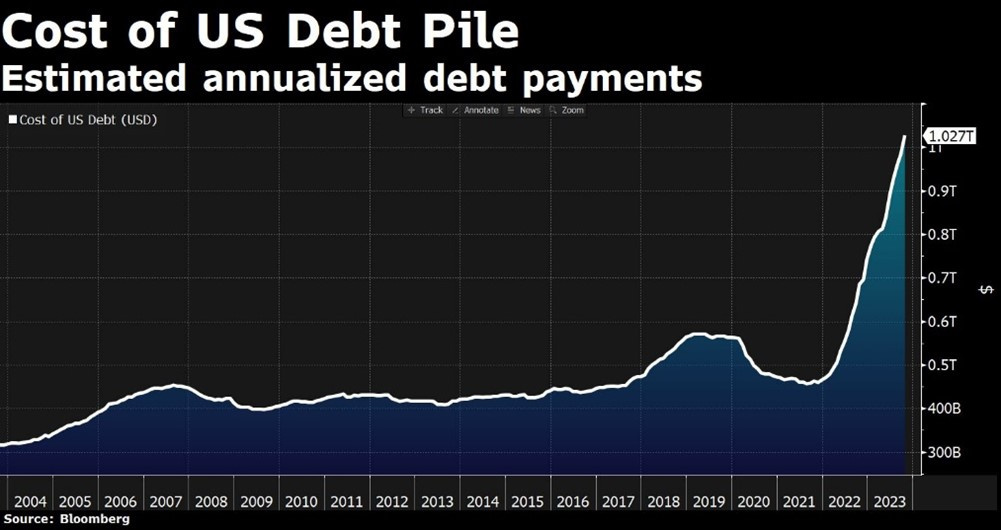

Finally, there is another somewhat hidden factor that we believe has substantially boosted risk-on and helped bring rates back below 5%. We refer to the accommodative stance taken by the US Treasury in its Refunding quarterly announcement. It signalled a willingness to reduce sales of long-term securities and announced debt issues leaning much more towards the short-term end of the curve, with the intention of concluding debt auctions by February, thereby defying expectations of an increase in issues in the next redemptions. The excessive US budget deficit has, in recent weeks, pushed yields on the long-term end of the curve to the psychological threshold of 5%, so bond investors have been eagerly awaiting the Treasury's quarterly financing plan. This explains how the larger-than-expected 6 billion gap in the first quarter would be funded, with the estimated annual cost surpassing the trillion mark.

In more detail, the Treasury stated that it will reduce long-side issues to 8 billion, down from the previously planned 0-460 billion, with the remaining 58% to be issued on the short side. Bull investors see this move as positive for two reasons. On one hand, it could indicate a desire not to further burden the long end with already too-high rates. On the other hand, it could also indicate a desire not to commit to paying so much and for so long in a scenario where interest rates are more likely to fall than to rise.

In the absence of any particularly significant macros and with the reporting season apparently moving to a close, investor attention is likely to be focused on the stabilisation and continuation of the downward rate trend, with many equities showing very attractive valuations and a positive earnings growth environment that should support equity markets.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.