Yields up, tariffs down: this is the new narrative that is moving markets

19 May 2025 _ News

The dominant theme in the markets concerns the surprising de-escalation in the U.S.-China trade war; a change of course that caught markets almost by surprise, and prompted analysts and investors to recalibrate their expectations. After weeks of tension, the narrative has suddenly softened, and the odds of a U.S. recession have been revised downward by many major investment houses: Goldman Sachs has reduced them from 45 percent to 35 percent, JP Morgan now estimates them “below 50 percent,” and Polymarket has dropped from 51 percent last Friday to 37 percent.

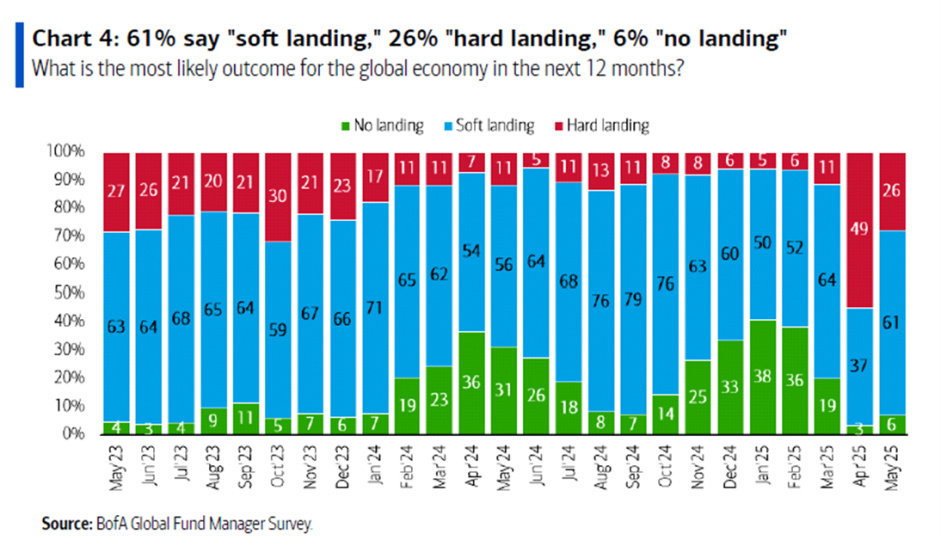

The same indications of easing come from Bank of America's Fund Management Survey for May, where a soft landing returned for 61 percent of interviewees to be expected as the main scenario, in contrast to expectations of a recession expected last month by 41 percent of respondents.

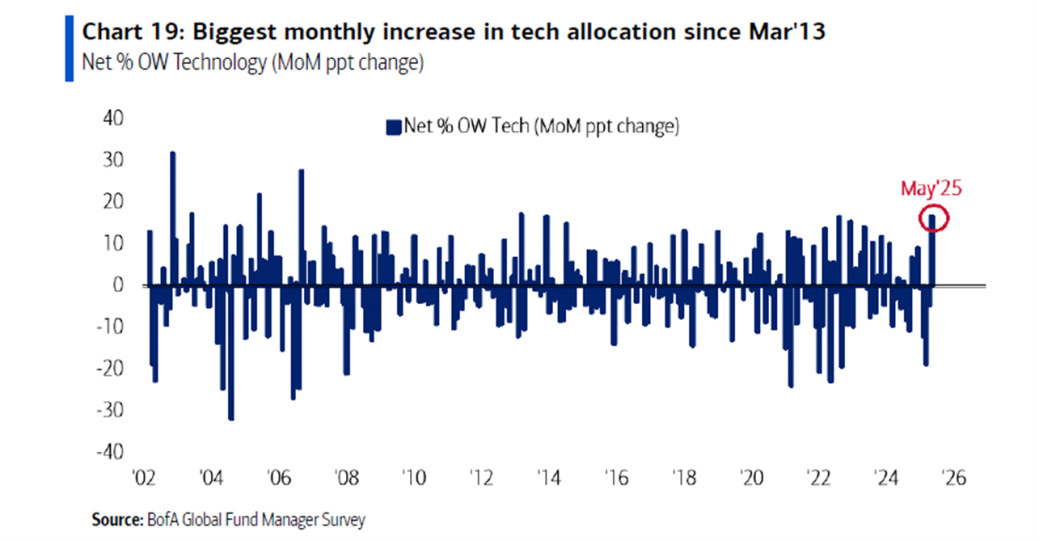

Investor allocation also reflects this risk-on sentiment, with purchases in technology registering the highest monthly change since March 2013.

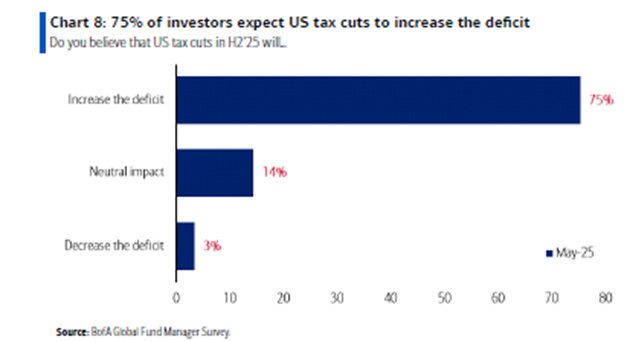

In Bank of America's survey, they also start talking about the more than .5 trillion tax cut program expected in the second half of 2025 in the U.S., seen by 75 percent of respondents as a source of increased government deficits.

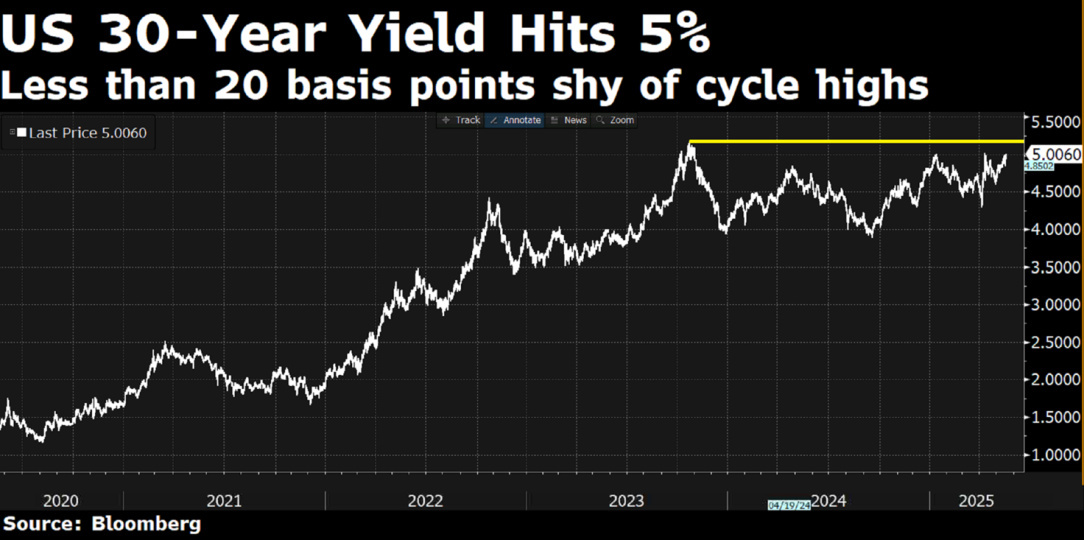

A narrative that could not please the bond world with the treasury rising in fact 4. 5 percent yield, a level of caution for the treasury and the Trump administration, which could again see the 10-year the main special watcher in the coming days also following Friday`s news about the downgrade of American debt by Moody`s, which had now remained the last agency among the so-called Big Three to have not yet stripped U.S. sovereign debt of its triple-A rating, with Bessent defending Trump`s policies and calling Moody`s and the other rating agencies as “lagging indicators.”

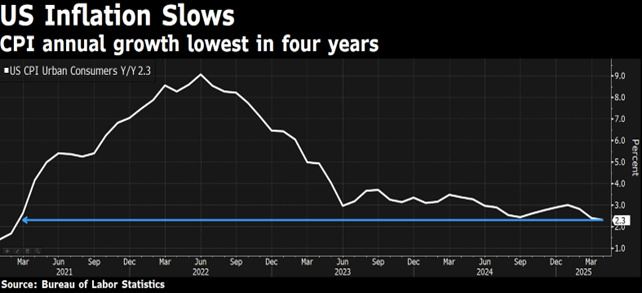

Further boosting the markets was also the April inflation figure with The core CPI coming in at 2.3 percent year-on-year, But what was most striking was inflation adjusted for housing costs: only +1.8 percent. This was a strong signal that positively surprised investors, especially considering the environment of tariff tensions.

Meanwhile, the U.S. administration has been moving decisively on the international trade front, but with a more constructive approach: during a trip to the Middle East, President Trump announced a huge order from Qatar Airways for 160 Boeing jets, calling it “the largest in the company's history.” Also on that occasion, Nvidia made official a major AI chip supply agreement with the Saudi company Humain, in partnership with AMD and Amazon. Overall, we are talking about economic commitments of about trillion over the next few years from the Arab Gulf states to U.S. companies.

This marks a definite change of pace: from the punitive announcements of recent weeks, there has been a shift to a trade agenda geared toward expanding strategic U.S. exports. A clear pro-growth signal Trump is giving to markets.

Instead, the Fed continues to remain cautious, Chairman Powell spoke last Friday in Washington, and his words were anything but conciliatory: he warned that real yields could remain higher than in the past, due to a possible increased frequency of supply shocks, such as precisely the tariffs. In other words: even if inflation seems under control today, the risk of cyclical stagflation -- linked to exogenous factors and not domestic demand -- is by no means dismissed.

On the real economy front, the picture remains mixed. Some surveys of small business owners show sentiment is still fragile, and uncertainty remains high, but not dramatic. Even inflationary pressures, while present, do not seem explosive. In short, no red alarms of impending recession, but no signs of full momentum either.

Speaking of recession, an often misunderstood concept is that recession does not necessarily mean a 2008-style deep crisis resulting in falling stock indexes. If we want to understand markets, we have to get used to looking at corporate profits, because it is precisely profits that determine prices. So the key determinant is whether or not the recession will translate into a profit recession or not. There are mild recessions, almost invisible in everyday life, that minimally impact companies and their profits. The technical definition of a recession is simple, but the severity can vary enormously, and we often realize that we have been in a recession only because it is certified by the National Bureau, but this is always several months later than it began.

The desire to “get out before the crisis and get back in when it is over” is understandable, but almost always proves ineffective. Historical simulations show that even the theoretically perfect investor (which, of course, does not exist), capable of getting in and out at exactly the right times in every recession, does not beat the simple buy & hold strategy over the long run. The reason is simple: the highest gaining days in the markets tend to be concentrated in short windows of time, often when uncertainty is still highest. Skipping even a few of these days can jeopardize the entire long-term performance. We`ve seen the example again this time with thes&p500 recovering from the April lows more than 20 percent in just over a month.

We must therefore get used to avoiding market timing, which turns out to be a trap for investors, but instead look for the margin of safety, that is, staying invested especially by focusing on those market areas where expectations and therefore valuations already in fact discount a slowdown scenario or earnings recessions.

In summary, markets welcomed Trump's turn on tariffs. But, as always, investors are looking ahead. And they do so with a selective approach. Economic activity is slowing, but not slowing; the Fed is not cutting, but neither will it raise; and tariffs, at least for now, are being managed. It is an unstable but manageable environment in which diversification, careful reading of fundamentals, and a good dose of discipline matter more than ever.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.