2026: the year that tests expectations

22 December 2025 _ News

The week ended with a rebound that, at least on the surface, restored some confidence to the markets after several difficult days.

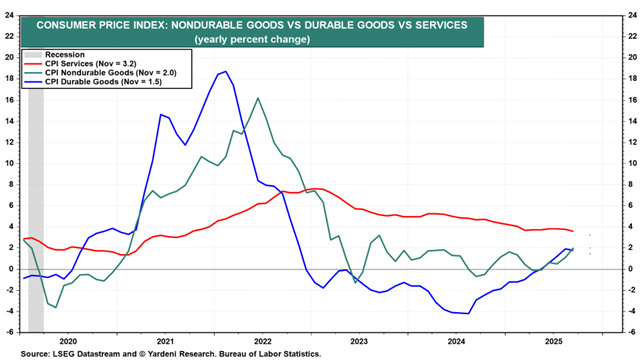

Weaker-than-expected US inflation data has reignited expectations of further rate cuts by the Federal Reserve, fueling a strong recovery, particularly in the technology sector. The message that the market has chosen to read is clear: disinflation appears to be more solid than expected, even with the labor market slowly losing momentum.

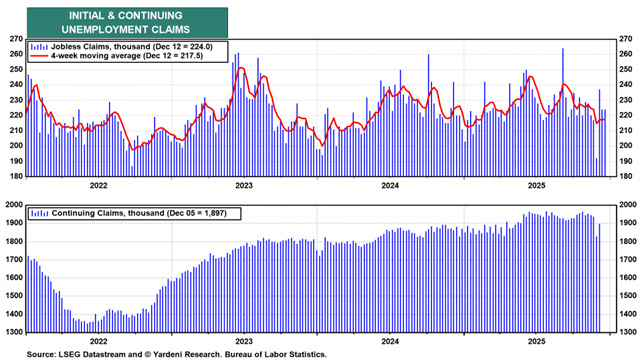

It is precisely this combination—slowing inflation and cooling employment without collapse—that makes the picture particularly delicate. Initial claims for unemployment benefits remain at historically low levels, a sign that we are not facing a wave of layoffs. At the same time, continuing claims are on the rise, suggesting that it is becoming more difficult for those who leave the labor market to return quickly. This dynamic is consistent with a gradually slowing economy, which explains why the Fed now seems more concerned about employment risk than inflation risk.

However, caution is also needed when interpreting macroeconomic data. After the federal government shutdown, the quality of statistics has come under scrutiny again, and the Bureau of Labor Statistics itself has reported possible distortions in the collection of inflation data. Part of the slowdown in prices may have been amplified by technical and seasonal factors, such as end-of-year discounts. This does not invalidate the underlying trend, but it reminds us how important it is not to draw absolute conclusions from individual monthly readings of macro data.

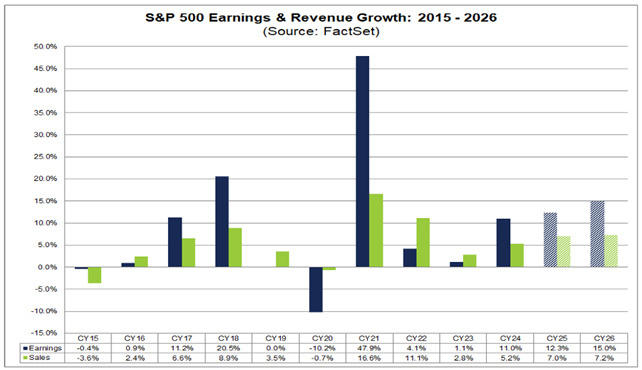

In this macroeconomic context, which is less linear than it appears, the topic of artificial intelligence remains central, but with increasingly complex nuances. The rebound in technology stocks shows that AI continues to be the main driver of growth expectations. At the same time, signs of fatigue are emerging in the most extreme narrative. The Oracle case is emblematic: results were not negative, but a sharp increase in investment in artificial intelligence infrastructure, financed in part by debt, was enough to reignite fears of a possible AI spending bubble.

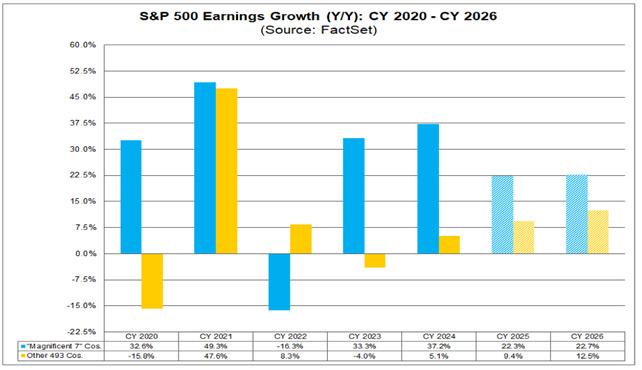

Even Nvidia, the absolute symbol of this cycle, is increasingly the focus of more mature reflection. Over the past two years, the market capitalization of the Magnificent 7 has doubled, coming to represent over 30% of the entire S&P 500. Multiples remain high and are only sustainable if expectations for growth and margins remain exceptional for a long time to come. But it is precisely those extraordinary margins that are attracting competition, accelerating an almost “war of thrones” dynamic in technology, in which the big players compete directly with each other and historical competitive advantages begin to thin out.

This helps explain a phenomenon that often goes unnoticed: beneath the surface of the market, leadership is slowly broadening. The equal-weighted S&P 500 index has begun to outperform the traditional one, signaling that some capital is shifting from crowded stocks to companies with more reasonable valuations, more stable earnings, and less dependence on a single narrative. This is a typical movement in the more mature phases of market cycles, when selection matters more than enthusiasm.

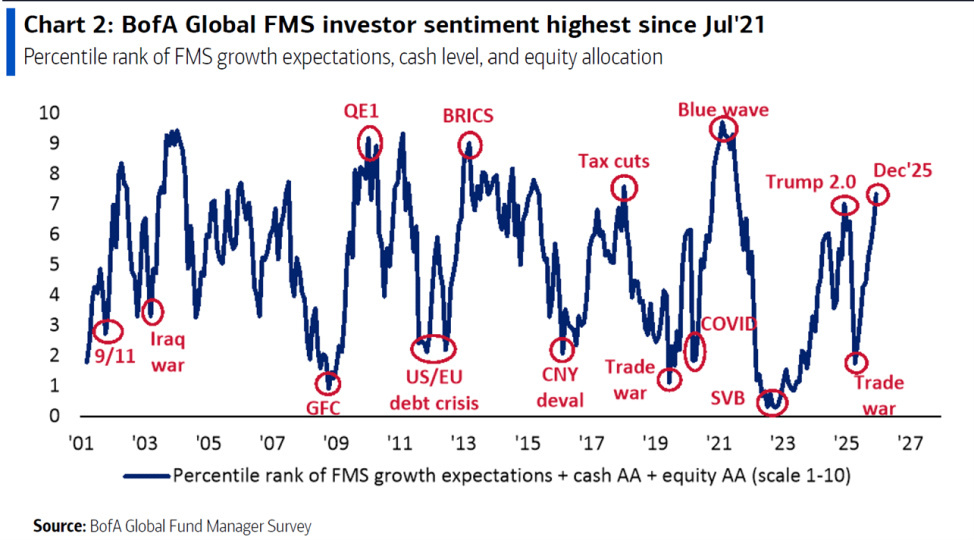

All this is linked to a deeper issue that goes beyond macroeconomic data or quarterly reports: investor psychology. After more than a decade of markets being systematically rescued by monetary and fiscal interventions, the idea has taken root that every downturn is an opportunity and that there is always a safety net ready to intervene. It is the classic problem of moral hazard. The Fed, with the best of intentions, has ended up influencing investor behavior, turning caution into an opportunity cost and leverage into a seemingly harmless shortcut. In long bull markets, what some have called the “bull market genius” emerges: the belief that one is good because the environment rewards risk, not because decisions are actually sound.

History teaches us that it is precisely at times like these that risk is ignored. Valuations cease to matter, at least until they suddenly start to matter again.

You don't buy securities, you buy future cash flows, and paying too much today means reducing tomorrow's return. It's simple math, but it's often overlooked when euphoria takes over. In this scenario, risk management is not an optional extra but a condition for survival. You don't always have to be right; you just have to avoid making irreversible mistakes.

This is where an often underestimated but fundamental aspect comes into play: investor behavior. One of the most difficult aspects of investing is not choosing the right stocks, but maintaining the right perspective over time. Markets move in cycles, alternating between periods of euphoria and periods of uncertainty, volatility, and fear. In both cases, awareness of what you have invested in is crucial.

When markets are rising and optimism is widespread, the main risk is getting carried away by the euphoria and forgetting that past performance is no guarantee of future results. It is precisely at times like these that discipline becomes more difficult, but also more valuable. Conversely, when markets fall and the news turns negative, the role of guidance becomes even more crucial: helping investors not to react emotionally, not to do exactly the opposite of what would be rational.

History clearly shows that many investors sell in moments of panic and buy when prices are already high. This behavior, repeated over time, significantly compromises long-term results. Corrections are not anomalies to be feared, but an integral part of the value creation process. Volatility, which we may see at least in the first part of 2026, is not a risk to be eliminated, but a condition to be lived with.

Only by accepting this reality can you truly benefit from compound capitalization, one of the most powerful drivers of wealth growth. But compound capitalization only works for those who manage to stay invested over time, navigating cycles with discipline and rationality. In this sense, the true value of investing lies not in perfect market timing or a single brilliant choice, but in the ability to build informed investments that are consistent with one's objectives, remaining invested in those securities and market areas that offer the best margin of safety.

Today, the market seems suspended between confidence and doubt. Inflation is slowing, the Fed appears more accommodating, but growth is less uniform and competition in AI is putting valuations and expectations to the test. We are not necessarily at the end of a cycle, but we are in a phase where clarity matters more than enthusiasm.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.