AI and the Fed: the mix that drives the S&P 500

11 September 2025 _ News

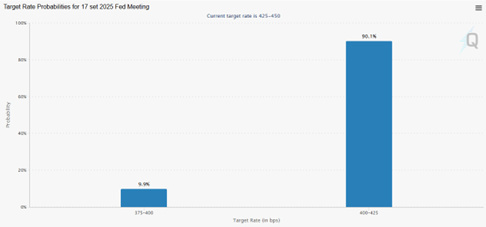

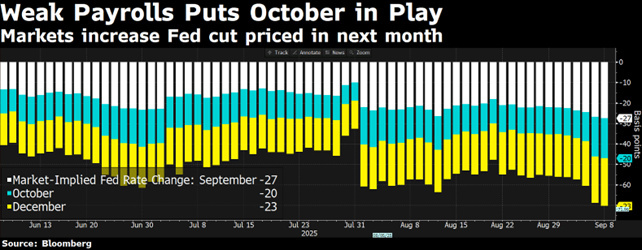

Over the past week, stock markets have continued to rise, buoyed by growing confidence that the Federal Reserve is set to cut interest rates at its September 17 meeting. According to the FedWatch Tool, the probability of a rate cut in the near term is close to 90%, a threshold that reflects unanimous consensus among market participants.

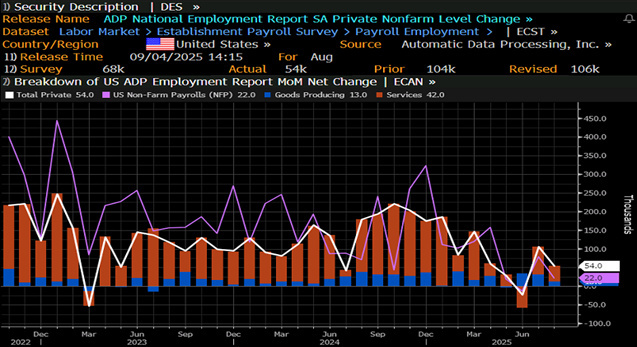

This expectation is fueled by a series of macroeconomic data which, while still showing signs of resilience, suggest a gradual slowdown in the US economy, particularly in the labor market. The ADP report showed an increase of only 54,000 jobs in the private sector in August, well below expectations of 68,000.

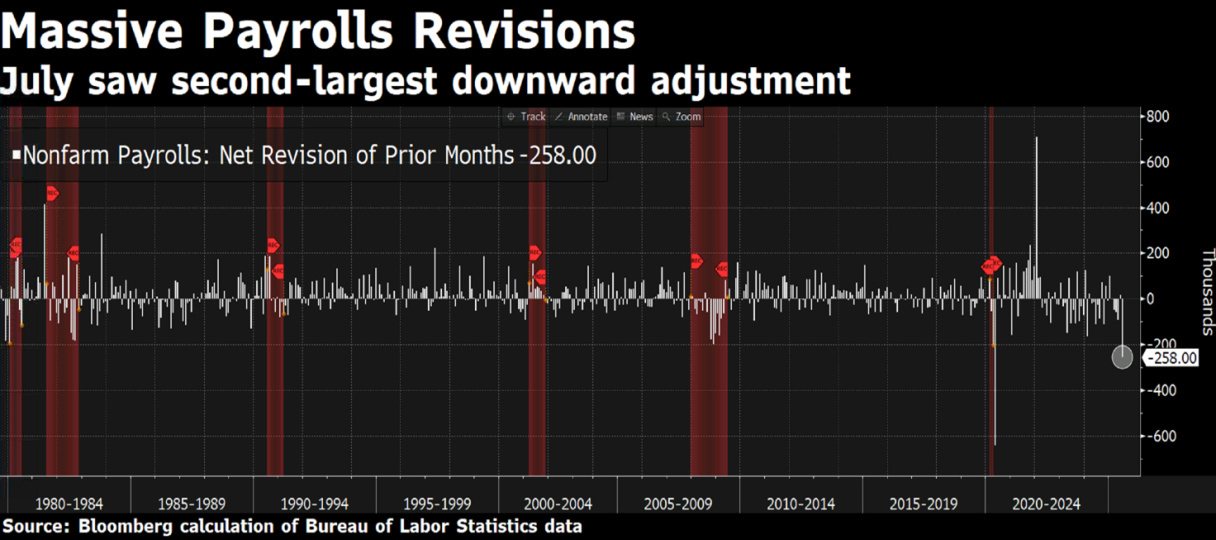

The JOLTS index also recorded a decline in job openings, while weekly unemployment claims rose to 237,000, the highest level since June. On the revision front, the latest employment survey saw a retroactive cut of more than 250,000 in the data for the previous two months, fueling political debate about the credibility of the data provided by the Bureau of Labor Statistics after the removal of its director.

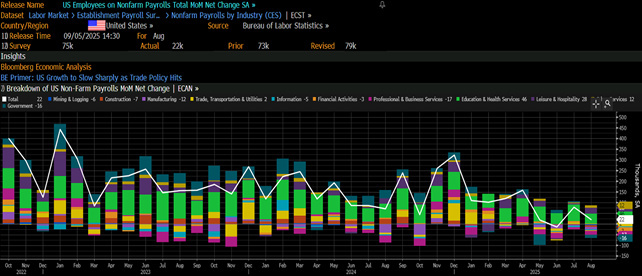

The most eagerly awaited figure, non-farm payrolls, was also weak, coming in at 22,000, while analysts had expected an increase of 75,000 jobs. The unemployment rate rose from 4.2% to 4.3%, in line with expectations, but at its highest since the end of 2021.

Meanwhile, the Fed's Beige Book also painted a weaker economic picture than previous surveys. Several districts reported stagnant consumption, wage growth that is not keeping pace with inflation, and increased uncertainty about hiring by businesses, partly linked to concerns about the impact of tariffs.

Yet despite these signs, the stock market continues to show strength. The S&P 500 index has reached new highs, driven by expectations of a “Fed Put,” i.e., expansionary intervention by the central bank to support financial asset prices. It is clear that the market is interpreting weak macroeconomic data as good news, as it fuels the possibility of monetary easing. However, this interpretation could prove short-sighted if the slowdown turns into a more pronounced recessionary cycle.

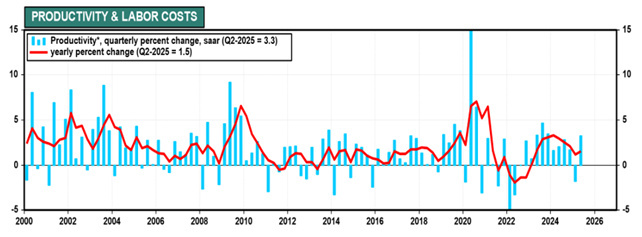

Meanwhile, second-quarter productivity figures have been revised upward: +3.3% compared to the previous +2.4%. This growth in productivity was driven by the adoption of new technologies, particularly in the field of artificial intelligence, which also helped to contain unit labor costs. In this sense, the narrative of the “roaring 2020s,” supported by some influential economists, remains valid: an expansionary cycle fueled by technology, capable of sustaining real growth even in the presence of restrictive interest rates.

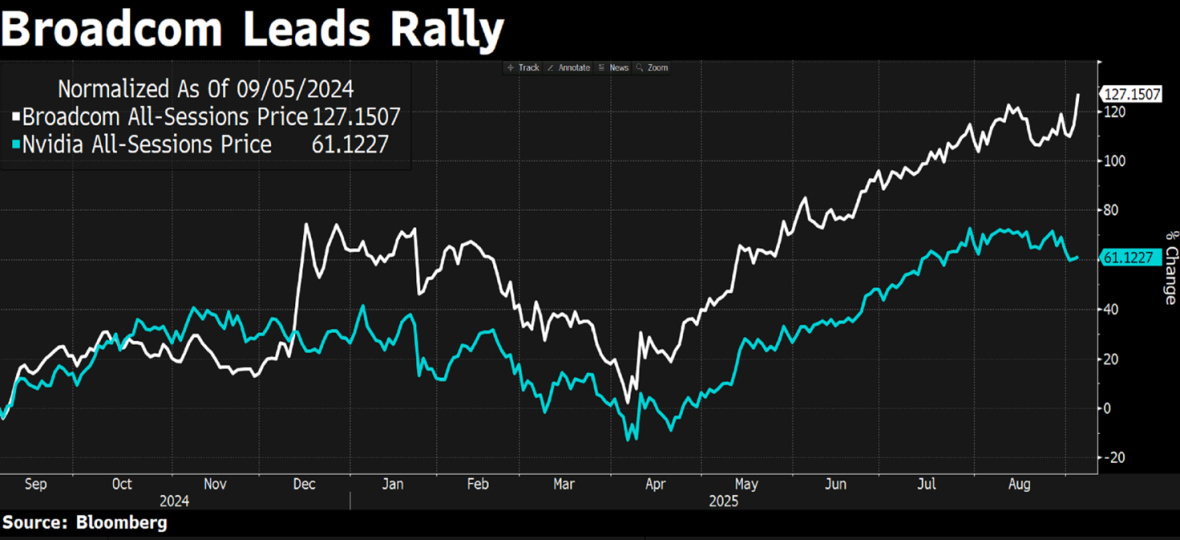

The earnings season confirmed the strength of the corporate sector, delivering mixed but generally positive results. In particular, Broadcom's upward revisions this week, driven by 63% growth in AI-related revenues, demonstrate that demand for semiconductors and digital infrastructure remains high.

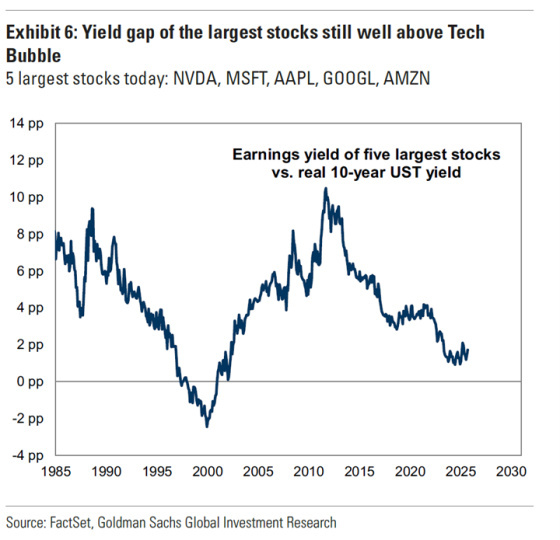

Artificial intelligence continues to be a key driver for the markets. After a 32% rally in 2024, stocks exposed to artificial intelligence (AI) have risen a further 17% since the beginning of 2025. This strong performance raises doubts among investors about the sustainability of current US equity valuations. In reality, both the implied earnings growth expectations for the S&P 500 and the valuations of TMT (Tech, Media, Telecom) stocks are only moderately above the historical average and far from the peaks reached during the tech bubble or in 2021.

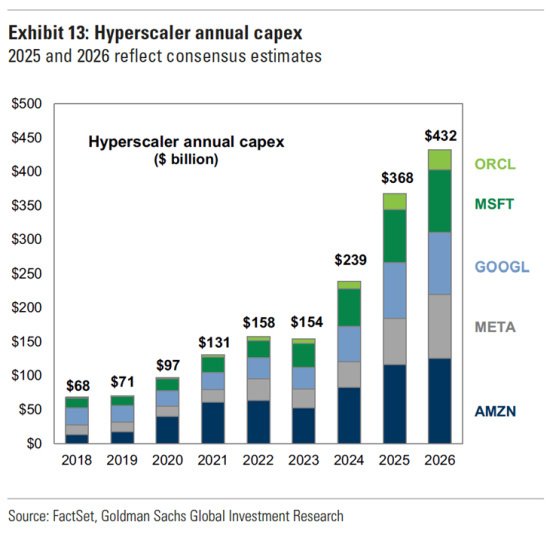

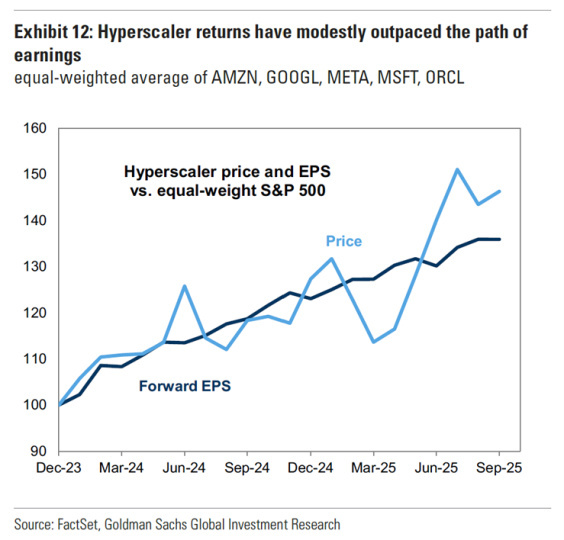

The current rally is still being driven by investments in digital infrastructure, particularly those made by hyperscalers, whose capex for 2025 has been revised upward by 0 billion to 8 billion.

However, the rise in prices of securities linked to these capital expenditures has outpaced that of expected short-term earnings, beginning to reflect very optimistic expectations. The real unknown for the markets will be when the pace of investment growth begins to slow, and the upcoming earnings seasons (Q3 and Q4) will be crucial tests in this regard.

On the geopolitical and institutional front, we note that Washington is currently the focus of a congressional hearing on some of Trump's new appointments. In particular, attention has been focused on Stephan Miran, chosen for an interim position at the Fed for the rest of the year, who has repeatedly stated that he would not leave his position on the White House Council of Economic Advisers, thus dangerously calling into question the Fed's independence. With at least four new Fed Board members potentially appointed by Trump by May 2026, US monetary policy could shift structurally towards a greater focus on growth. This paradigm shift could reinforce the trend towards lower rates in the medium term, but risks fuelling instability if not supported by solid fundamentals.

In this context, it is always worth monitoring the Atlanta Fed's GDPNow, which currently estimates annualized GDP growth at 3% in the third quarter, following +3.3% in the second quarter. This figure is consistent with an economy that is still expanding, but it could clash with weaker readings of GDI, Gross Domestic Income, which is often more volatile but historically more closely correlated with cyclical turning points. The divergence between GDP and GDI, as observed at various times in the past, may be a sign of vulnerability in the economic cycle.

In conclusion, we find ourselves at a precarious equilibrium between weak macro data, expectations of monetary stimulus, and very high equity valuations. The forward P/E multiple of the S&P 500 is now well above historical averages, with the equity risk premium at its lowest level in a decade.

In a context where the Fed may soon cut rates not because of excessive inflation but to curb a cyclical downturn, valuation dynamics are likely to become more fragile. We continue to recommend a cautious and selective approach, favoring sectors and geographical areas where valuations still offer a margin of safety.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.