AI pushes Wall Street...until Trump tweets

16 October 2025 _ News

The week just ended was supposed to be yet another triumph for the US stock markets, with the S&P 500 and Nasdaq pushed to new highs thanks to a combination of macroeconomic optimism, expectations of Fed rate cuts, and positive narratives about artificial intelligence. But just when complacency seemed to be widespread, Trump's usual tweet was enough to bring investors back to reality with a bump. But let's take it one step at a time.

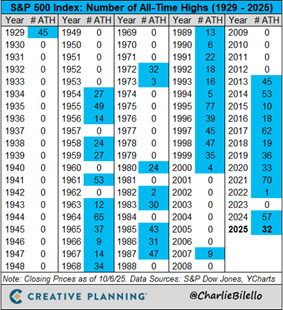

On Thursday, October 9, the S&P 500 posted its 32nd new record of 2025, with global stock markets buoyed in particular by the continuing strength of the tech sector and, more specifically, by the ongoing enthusiasm for investment in artificial intelligence, which remains the main driver of the markets.

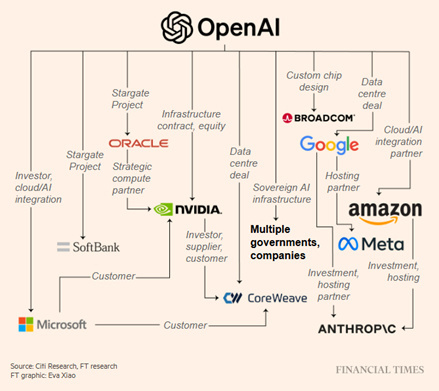

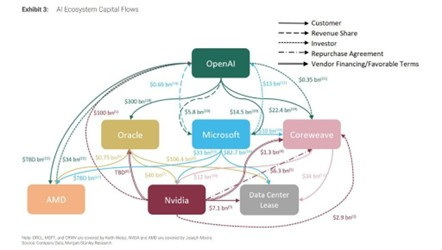

NVIDIA has announced a multi-billion dollar investment in Elon Musk's startup xAI, as part of a billion infrastructure funding round. At the same time, OpenAI continues to attract capital and partnerships: after modifying the terms of its exclusive agreement with Microsoft, it has also entered into partnerships with Google Cloud, Oracle, AMD, and CoreWeave.

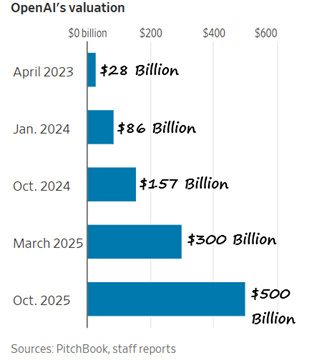

According to the latest data, OpenAI has signed agreements worth over trillion in infrastructure and chips, despite not yet being profitable. Its valuation has reached 0 billion, which, if it were listed, would make it the 16th largest company in the S&P 500.

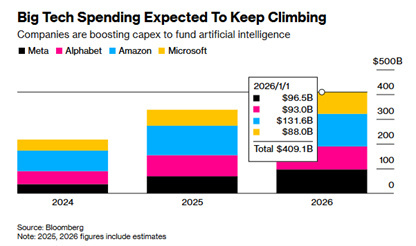

The push for investment in artificial intelligence is impressive, with the combined CAPEX of Microsoft, Amazon, Alphabet, and Meta alone expected to grow from 7 billion in 2024 to over 0 billion by 2026.

According to Goldman Sachs' calculations, OpenAI will need over 5 billion to finance its projects, and 86% of this requirement will depend on external capital. This is a huge circular financial engineering scheme, in which hyperscalers invest in OpenAI while also becoming its customers and suppliers, fueling a spiral of growth that could slow down abruptly if even one of these links were to break.

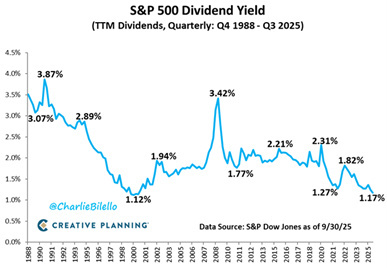

But for now, this machine continues to grind out results, and all this enthusiasm is reflected in a marked expansion of multiples, with the S&P 500 price-to-earnings ratio reaching 23 times expected 12-month earnings, the highest since early 2000, while the dividend yield has fallen to 1.17%, the lowest since the peak of the dotcom bubble.

There is increasing talk of a possible bubble linked to artificial intelligence, and there are plenty of charts showing stock indices at extreme valuation levels. However, history teaches us that bubbles rarely form when everyone is expecting them. Today, in fact, liquidity parked in money market funds is at record levels, representing a mountain of savings ready to be reinvested in equities as soon as a significant correction occurs.

The combination of high valuations, widespread euphoria, and increasingly fragile market psychology certainly calls for caution, but with the awareness that, as Peter Lynch reminded us, “more money has been lost waiting for corrections than during the corrections themselves.”

Speaking of corrections, Friday afternoon brought a surprise liberation day 2.0 with a tweet from Donald Trump that shook the markets. The former president announced his intention to introduce 100% tariffs on China starting November 1, in response to Chinese restrictions on rare earth exports. The reaction was immediate, with widespread selling across the board, the S&P 500 down 3% and the Nasdaq down 3.5%. On a weekly basis, the S&P closed down 2.4%, with only the more defensive sectors such as utilities and consumer staples holding up.

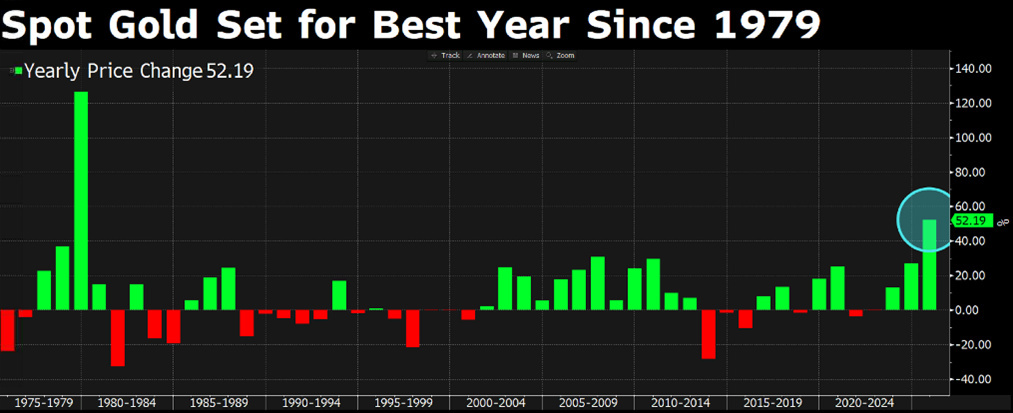

The movement also affected credit, with spreads widening and the yield on 10-year Treasuries falling to 4.06%. At the same time, safe-haven assets such as gold and Treasuries returned to strong performance, signaling a clear return to a risk-off approach.

Uncertainty remains as to the nature of this new chapter in the trade war: whether it is a real escalation or just the usual negotiating tactic. In any case, we can say that the result is a correction that would actually be healthy for the markets and would help the multiple return to less extreme levels.

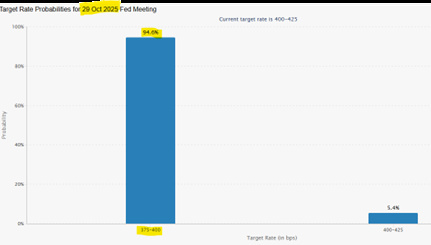

There are certainly risks. The US government shutdown has entered its third week, blocking the publication of key data such as the Nonfarm Payrolls report. However, the absence of new employment statistics has not dampened expectations of a further rate cut by the Fed, which the market is currently pricing in with a 95% probability at the October 29 meeting, and expects two further cuts by the end of the year.

The Trump administration, on the other hand, is preparing to unveil its real economic bazooka, and surprisingly, there is still little talk about it: banking deregulation.

With Bowman's appointment to the Fed, the reform of the leverage ratio (SLR) is back on the table, which could exclude Treasuries from the capital constraints of large US banks. This would free up trillions of dollars in capacity for US banks, transforming them into the main buyers of Treasury securities and strengthening the domestic bond market. This is a substantial change that would make the US bond market even more robust and domestic.

In this scenario, investors' psychological fragility, extreme valuations, and the strong concentration of returns in a few high-growth names make the market vulnerable. The AI flywheel continues to turn, but it depends on high valuations and easy access to capital. As we saw on Friday, all it takes is a crack in this mechanism, a change in sentiment, a reporting season that falls short of expectations, or an unexpected macro event to turn a virtuous cycle into a downward spiral.

Monitoring the sustainability of this cycle will require attention, discipline, and prudent management of risk exposure. As always, we remain focused on fundamentals, maintaining a selective and rational approach, avoiding areas of the market where objective and high valuations persist and where expectations seem increasingly detached from reality.

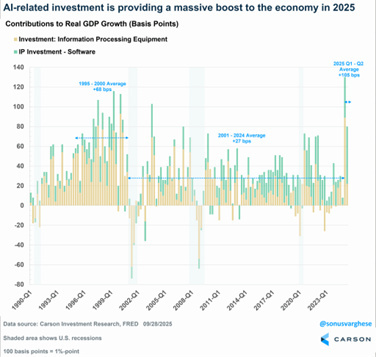

To give us an idea, it is astonishing that the contribution to US GDP growth in the first half of the year from investments in AI infrastructure almost equaled consumer spending (which historically accounts for about 70% of US growth). This figure inevitably raises questions about the sustainability and durability of this growth spurt, which the market seems to be increasingly incorporating into its long-term growth forecasts.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.