All true, but not enough at this stage of the cycle.

05 February 2026 _ News

The past week has reinforced a trend that we had already begun to outline in previous episodes: markets continue to move in an apparently favorable environment, but with an increasingly low tolerance for any deviation from the expected scenario.

It is in this delicate balance that the week unfolded on the markets: between generally solid macro data, a reporting season that is getting into full swing, and a market that is beginning to discriminate more and more selectively between those who confirm expectations and those who disappoint them even marginally, in a context of rising volatility.

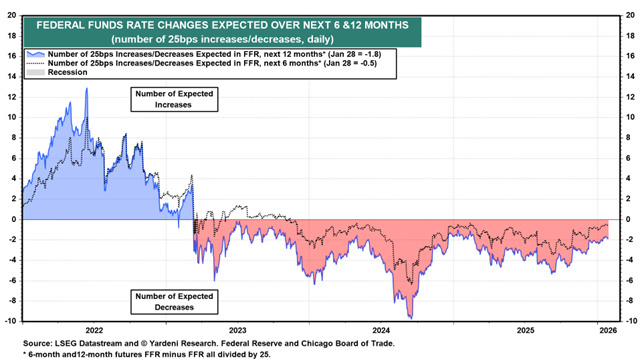

The Fed did exactly what was expected. Rates remained unchanged in the 3.50–3.75% range, which everyone now considers close to neutral. No explicit forward guidance, no promise of imminent cuts. Powell reiterated a key concept: that the economy is solid, the labor market is stable, inflation remains above target but is showing signs of cooling, especially in services. Translation: there is no urgency to do anything.

At a stage in the cycle when growth and employment are holding steady, the Fed can afford to wait. If anything, the perceived risk is the opposite: cutting too soon and reigniting financial tensions, further weakening the dollar, and fueling new inflationary pressures. Not surprisingly, the bond market does not seem to believe in a rapid decline in yields, with the US 10-year yield remaining stable above 4.25%, a level that looks much more like a new normal than a temporary anomaly.

On the macro front, data continues to point to a resilient economy. Jobless claims remain low, productivity is surprising on the upside, and even the slowdown in the Atlanta Fed's GDPNow—from 5.4% to 4.2%—should be interpreted for what it is: a cooling off from exceptionally high levels, certainly not a sign of a reversal.

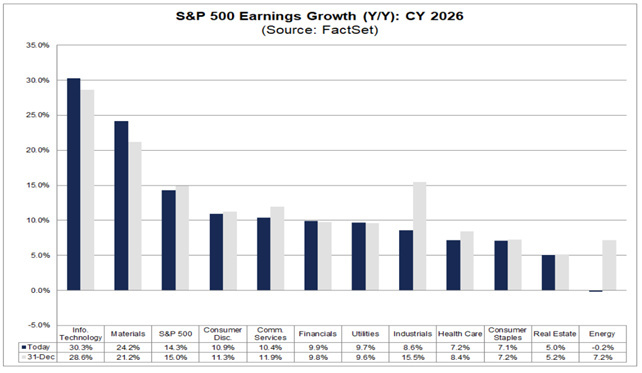

In this context, the market's attention inevitably shifts to earnings. And here a very clear theme emerges.

Large technology companies continue to produce solid numbers. Microsoft met expectations, Meta surprised on the upside, and Tesla beat earnings estimates despite a year-over-year decline. Apple delivered an exceptional quarter, driven by the iPhone 17 cycle and an installed base exceeding 2.5 billion devices. Visa also continues to benefit from resilient consumers and the growth of digital payments.

Yet market reactions are becoming less and less linear. Microsoft closed down about 10%, recording one of its worst days on the stock market since Covid. The movement is not linked to quarterly results, but rather to long-term strategic implications: growing exposure to OpenAI – in which Microsoft already holds about 27% – the explosion of costs related to AI infrastructure and, above all, the still-open debate on who will actually be able to monetize this massive rush to invest in artificial intelligence.

Speaking of the race to invest in AI: In recent days, there have been significant rumors circulating about OpenAI, which is reportedly in talks for a potentially historic round of financing of up to 0 billion. The operation, supported by major infrastructure partners such as Nvidia, Amazon, and Microsoft, would aim to finance the enormous data center, cloud, and computing capacity requirements of artificial intelligence. There is also talk of possible involvement by SoftBank, confirming how the race for AI is becoming capital intensive and increasingly linked to hardware. Beyond the figures, the message to the markets is clear: competition with players such as Google is now being played out on an industrial scale, with investments that would have seemed simply unthinkable a few years ago.

ServiceNow beats estimates, but its stock falls, dragging down the entire software sector, as the market questions how much AI could erode the value of the software services model in the long term. Tesla is also hit by sales, despite a futuristic narrative of robots, autonomous driving, and Cybercab that would have been enthusiastically welcomed by the market in the past. But, as we said, we are talking about a completely different context: today's market is much more selective, less willing to reward long-term promises and much more attentive to earnings visibility, returns on capital and investment sustainability, in short, all issues far removed from the investment story of Tesla.

In Europe, the reporting season is behind that of the US, but the dynamics will be the same, as we have already seen with the reporting season of SAP (one of the most capitalized stocks in Europe) which, much like Microsoft, was solid overall, but the stock fell by about 15% because it disappointed extremely high expectations. The company reported overall growth in earnings and revenues, but failed to meet analysts' higher expectations on certain key indicators such as cloud growth forecasts and backlog dynamics.

This is an important signal: we are no longer in a phase where “good earnings” are enough. The market is looking beyond the quarter, and it is doing so with an increasingly selective yardstick, measuring expectations.

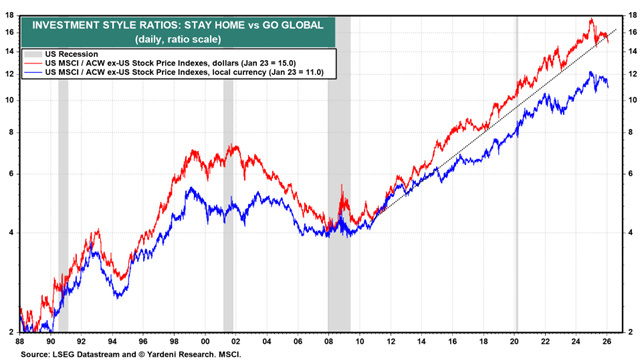

Finally, let's return to the broader theme we touched on in the previous episode: the supposed “Sell America” versus “Buy international markets” dichotomy.

There is no flight from the US, nor do we expect there to be one. The point is more subtle: a need for rebalancing is emerging. After years of American exceptionalism widely incorporated into valuations, the rest of the world now has more compressed multiples and, in several cases, accelerating earnings cycles. This is not a call to sell America, but to recognize that its relative advantage is no longer as overwhelming as it once was.

And that brings us back to where we started.

The market today is not fragile because the economy is doing badly. It is fragile because many things are going exactly as expected. In a context of high earnings, stretched valuations, and monetary policy on hold, the margin for error is reduced. No major shocks are needed: all it takes is a marginal disappointment, slightly less convincing guidance, or a slowdown in the flows that are currently keeping prices afloat.

Being an investor at this stage means accepting this complexity. Don't look for disaster, but don't assume that everything will continue to work the same way either.

This is where the market becomes really interesting.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.