Investments: how to structure a portfolio that is weatherproof on all fronts

20 May 2020 _ News

To protect capital and grow it over time, our asset management team offers All Weather investment portfolios, which are able to withstand the changing seasons of the financial markets.

Equilibrium. A keyword not just for life, but also for investment. A good starting point is to build strong, balanced portfolios even during financial storms, which maximise returns and minimise long-term risks: this is the "All Weather" model that Pharus is offering to meet the changing seasons of the markets.

Wealth can be seen as an organism: without proper care it can weaken, injure itself or catch a serious illness.

A lesson also repeated by the recent Covid-19 crisis, which imposed a new paradigm of life.

A key concern for investors is the decline in financial assets. Many think it is better to safeguard their savings than to invest them, making the mistake of not looking at capital from a broader perspective: in the past, purchasing power has halved in twenty years with inflation at only 2%, today it would be no different with the current negative rates.

In most cases, investors are stuck with three unresolved dilemmas: "Why should I invest? Who can I invest for? And what should I invest in?

Enter the Wealth Manager, who, in addition to promoting knowledge of his subject, becomes first and foremost a financial educator:

- he highlights the need to protect people and their assets;

- he provides emotional/behavioural support and espouses the virtues of patience;

- he assesses the loss aversion of the client;

- he shares with him the financial planning choices that reflect his goals and are in line with his risk profile;

- helps to understand that profit and time are closely linked to the investment goals set;

- he reminds him of the crucial importance of diversification - geographical, sectoral and by financial instrument - for portfolio optimisation and tax optimisation of capital gains and losses;

- he periodically supports portfolio monitoring;

- he helps with the management of generational transition.

This means that he adopts a top-down approach: it begins with the identification of the client's core values and vision of life; it continues with the shared decision on investment goals and financial planning; it ends with the implementation of the structural asset allocation that best responds to the client's personal needs, preventing him from falling into the mental traps studied by behavioural finance (for example home bias, information overload, present bias and the disposition effect).

The allocation will be "wider" - formulated to navigate in equilibrium at every stage of the market in the long term, because unlike speculators, wealth managers are always invested and opportunistically calibrate only the weights of the various asset classes in the portfolio, shifting the tactical component (usually 10% of the total portfolio) to generate an additional return.

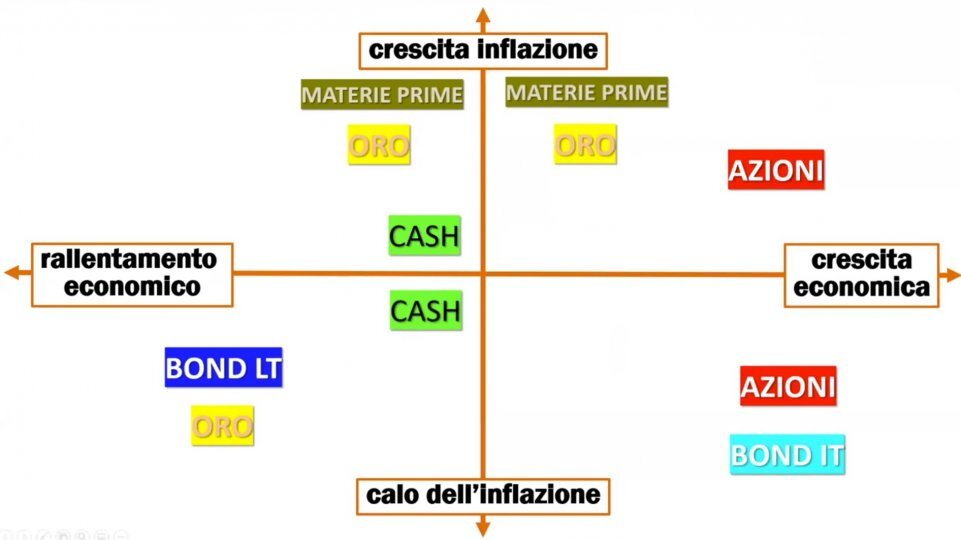

Our Wealth Manager team focuses on growth, inflation and interest rates as fundamental market variables and identifies which instruments can work well in the various phases.

The various building blocks are then combined so that, based on available historical data, the portfolio can survive any scenario and withstand any storm.

Inevitably, in the different market cycles, some sectors of the portfolio will perform well, others less so, but capital will be protected and, indeed, will grow over time, preserving purchasing power.

We provide below a graphic presentation of the "All Weather" model portfolio, which summarises the basic assumption: "While the correlation between asset classes is inherently unstable, the relationship of asset classes to economic environments is consistent over time. History teaches that every investment has an ideal environment in which to prosper. There is a season for everything.

The basic recipe therefore seeks to assign 25% of the risk to each quadrant.

The first requirement is 40% in predominantly US equities, then long-term government bonds: 15% medium-term (7-10 years) and 30% long-term (20-25 years), because they counteract stock volatility.

Finally, up to 5% in gold and up to 5% in commodities, with 10% cash, so that the portfolio continues to perform well even as inflation accelerates.

Source: Revision of Gabriele Turissini, €FA Private Banker in Fideuram, from ideas in the book "Money. Master the Game. 7 Simple Steps to Financial Freedom" by Anthony Robbins

Information message - The information in this message is produced for information purposes only and therefore does not qualify as offer or recommendation or solicitation to buy or sell securities or financial instruments in general, financial products or services or investment, nor an exhortation to carry out transactions related to a specific financial instrument.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

RELATED CONTENTS