Banking turmoil or return to normalcy?

29 March 2023 _ News

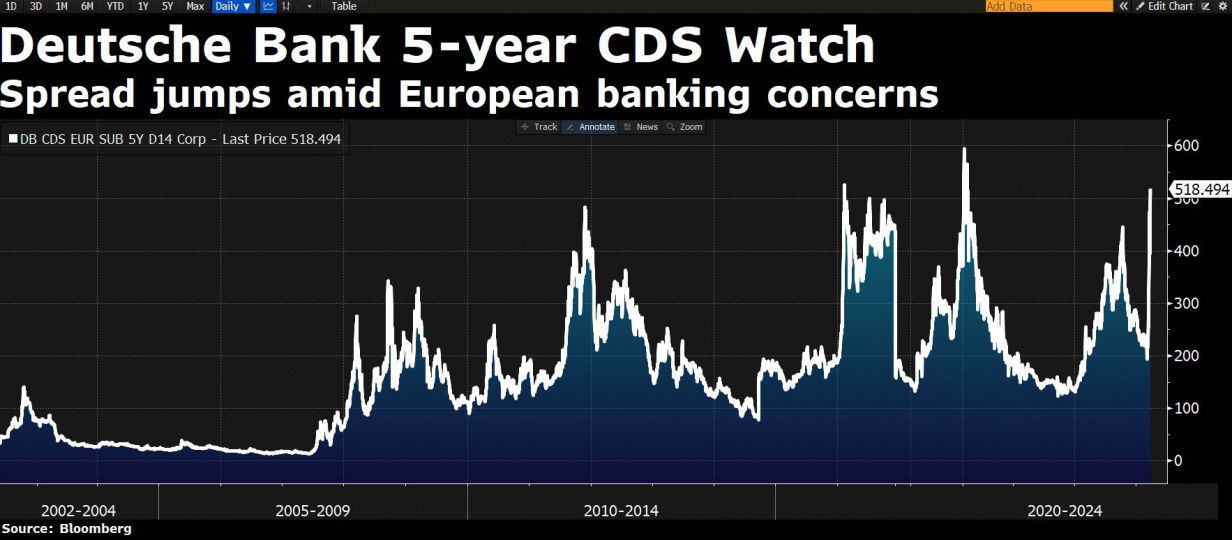

On Friday, a week after the Credit Suisse case, the European market was hit again by high volatility. Especially suffering was Deutsche Bank, whose CDS, a measure of the risk protection required by investors on subordinated bonds, spiked to all-time highs.

Triggering the volatility on Deutsche Bank were market concerns about the German banking sector after two small banks (Aareal Bank and Deutsche Pfandbriefbank) failed to redeem their AT1 bonds at the call, accepting a coupon hike. This decision highlights the strong capital needs of the banks, which, if they had redeemed and reissued the bonds, would likely have paid a higher coupon due to the turbulence affecting the sector.

However, the market reaction seems to be excessive. First, Deutsche Bank has stated that it will buy back an AT1 of about 1.5 bn, indicating that capital and liquidity are solid. Second, Deutsche Bank is no longer the bank of three years ago. In fact, the institution has been restored after a particularly difficult 2016-2019 three-year period marked by losses of about 7.5 bn. As of today, capital situation, liquidity, and NPLs appear to be good.

Finally came an early response from the institutions. Indeed, the ECB considers the banking system to be healthy, and said it was ready to step in with aid; in addition, German Chancellor Scholz intervened, pointing out that Deutsche Bank's capitalization and liquidity situation are sound.

In fact, the European banking sector after 2008 appears to be particularly supervised and solid, as the numbers demonstrate:

- First, bank deposits of retail customers weigh about 60 percent on average of total deposits. Retail deposits tend to be more stable, as shown by the U.S. banks hit hardest by the crisis, which had a predominance of corporate deposits;

- The bank liquidity ratio is around 245%, definitely above the regulatory limit of 100%;

- Banks' capitalization is found to be solid and above regulatory requirements.

There are two main factors that are increasing banking turmoil. First is the reduction in deposits. In fact, post-pandemic fiscal aid had contributed to an increase in bank deposits, which to date, in an context of high inflation and rising interest rates, are shrinking. This reduction in deposits is causing banks to have to reduce assets, and with rising interest rates, this can lead to losses, especially in those banks that had anticipated a greater expansion of deposits and did not manage their balance sheets as efficiently as they could.

Finally, the European sector pulled back from the imbalance at the beginning of the year, with YTD performance falling from +25% to zero.

In conclusion, the European banking system is strongly supervised and sound. Indeed, we believe that the increase in volatility has brought a sector that had been running a bit too fast since the beginning of the year back to normal.

Information message - The information in this message is produced for information purposes only and therefore does not qualify as offer or recommendation or solicitation to buy or sell securities or financial instruments in general, financial products or services or investment, nor an exhortation to carry out transactions related to a specific financial instrument.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

RELATED CONTENTS