China: is this time different?

26 January 2024 _ News

Nowadays it is increasingly difficult to hear positive comments about the investment industry on Chinese equities. We often hear that China is not investable, that there is too much politics in the market and that therefore the investor should not consider this market.

At this point, the question that arises is: if until two years ago the investment industry itself was telling us that China was the future, are we so sure that everything has changed in this short period of time? Or are we repeating the now famous statement: 'This time it is different'?

Let's take a look together at why we don't think it is different this time and how China is in fact a stock market with certain intrinsic characteristics where there is now a margin of safety for the investor that was not there two years ago.

This time it's different, part 1: price correction to historical average

First of all, the -45% correction we are experiencing is a normal correction that China has experienced every 4 years since 2002, average corrections of -45%. At the end of 2021, when the investment industry was very positive on China, we were on the all-time highs of the Chinese index, in particular on the triple high touched in 2007-2015 and which had always brought major corrections thereafter.

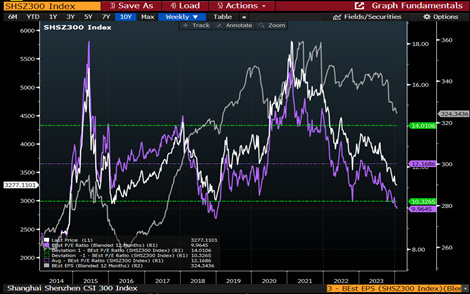

This time it's different, part 2: evaluations

Today we find ourselves with price-to-earnings valuations at 9.95x, a level seen only four times in the last 10 years. Again, in 2021 when the investment industry was positive on China, the price-to-earnings value hit an all-time high of 18x, twice the current level:

This time it's different, part 3: Chinese companies and their valuations

However, discussing the index complicates investors' understanding of the companies that make up the Chinese index. Let us look, by way of example, at the Chinese company that weighs the most: Kweichow Moutai.

Kweichow Moutai is a company specialising in the production, sale and distribution of a particular distillate. This company belongs to the non-discretionary consumption segment and, like the major European and American companies, has been adversely affected by the return to normal consumer spending after the pandemic. Both European and American companies are in fact correcting 30 to 40 per cent.

If we go back to Kweichow Moutai, we see from the chart below how the profit (grey line) has not fallen at all, but the PE valuation (volatility line) was too high in 2021 (around 60x) and has now returned to an average of 22.9x.

Conclusion

We do not believe that this time will be any different for China. In 2021 the market had run so much because of the positive expectations that the savings industry had brought to China. After 3 years the situation has reversed; China is still the same but investors' expectations are very negative.

We don't like bad news but it is also the news that creates the opportunities for the patient investor. At this time and at these valuations, we believe that China can be an investment with a large margin of safety.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.