“Factors” tested

23 November 2022 _ News

The difficult market conditions investors are currently facing are not the first, and this certainly will not be the last crisis period that financial history will present.

At this exceptional time, the hectic turnover of product sectors clearly does not allow for stable trends (with the exception of commodities and energy), as was the case during the two-month period from February to March 2020 (in which tech, communications and health care had helped generate extra returns).

Therefore, we have conducted an in-depth analysis to observe whether the factor strategy could be useful for this purpose.

Factor investing is a way of defining asset allocation through the use of factors, that is, common characteristics that can determine their own effects on long-term outcomes and thus become critical drivers for the return/risk of a portfolio.

There are factors that are useful for reducing risk, increasing returns, or improving portfolio quality, thus characterising it through a distinctive element that the manager believes will be most beneficial.

The ultimate goal is obviously to favour the element that will be capable of making the best contribution in terms of alpha to the operating result.

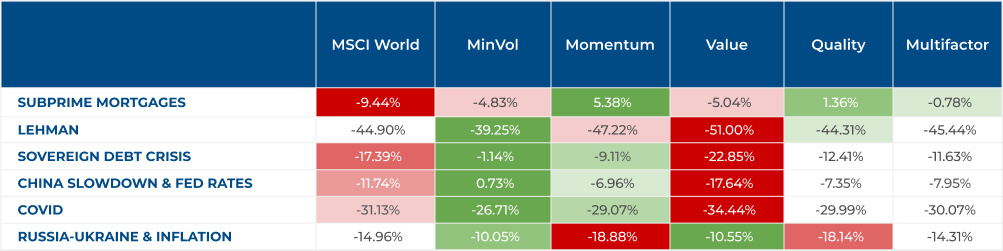

Considering, therefore, four investment factors, namely VALUE, MOMENTUM, MIN VOL, and QUALITY, and a fifth one that is equivalent to the equal weighting of the previous four, we assessed how these strategies behaved in previous periods of high market stress (the subprime mortgage crisis, the Lehman Brothers crisis, the sovereign debt crisis, the China slowdown and FED rate rise fears, COVID, and the Russia/Ukraine war).

It is clear from the table that the MIN VOL strategy was able to offer (though it would have been surprising otherwise) attractive extra returns compared to what was recorded by the parent index, MSCI WORLD Local, as opposed to what was recorded by the VALUE factor, which only in the current market environment and the subprime crisis generated alpha.

In four cases out of the six analysed, the MOMENTUM and QUALITY strategies rewarded the manager's choice, while the MULTIFACTOR approach (equally weighting the factors) provided not always the best absolute results, but more consistent results over different time horizons. It follows, then, that even in the multifactor approach, diversification wins.

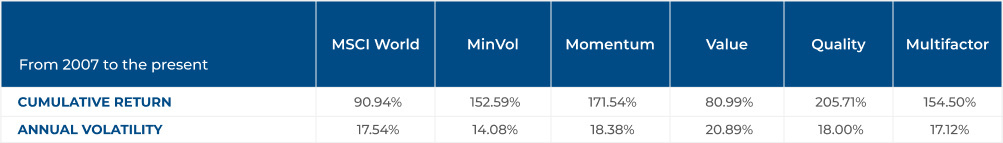

After broadening the time horizon and starting from the subprime crisis up to the present day, which strategy generated the most extra returns?

In this case, the QUALITY strategy proved to be the best performing strategy considering even the respective post-crisis periods, as markets once again considered quality companies whose stocks had been hastily sold (as is always the case due to emotional responses), against volatility levels that were absolutely comparable with the parent index, MSCI WORLD Local.

Therefore, summarising the considerations that have emerged, this analysis highlights several key aspects:

- The factor approach is an additional element for generating alpha in portfolios;

- Diversification is always beneficial;

- The lower-performing Value approach is affected by the downward rate environment over the period under consideration, while in the current environment, the results seem to give opposing signals.

- The quality of the stocks in the portfolio, which may be hard to see during periods of high emotion, is bound to emerge as soon as market turbulence subsides.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.