Accommodative Fed, AI creaking: the market enters a delicate phase

18 December 2025 _ News

This week, the markets celebrated the Fed, turned up their noses at Oracle and its AI debts, and meanwhile TIME magazine crowned, as is tradition, the Person of the Year, naming the “Architects of Artificial Intelligence,” i.e., all the main CEOs of companies involved in the AI race, as winners. Three seemingly unrelated news stories that actually tell the same story: we are in the midst of a bullish cycle dominated by AI, central bank liquidity, and increasingly stretched valuations, at least if we look at those of the S&P 500.

I'll start with what is known as “the TIME curse.” Historically, when a person or topic ends up on the cover as “Person of the Year” at the height of euphoria, it often marks a turning point. This happened with Jeff Bezos in 1999, just before the dot-com bubble burst, when Amazon lost over 90% of its value in the following 18 months before rising from the ashes. It happened again with Elon Musk at the end of 2021, before a disastrous year involving Twitter, a collapse in share prices, and the destruction of his personal wealth. Today's cover is dedicated to the architects of AI: it is not a mandatory sell signal, but it is a wake-up call on an issue that has now become the dominant narrative, both politically and financially.

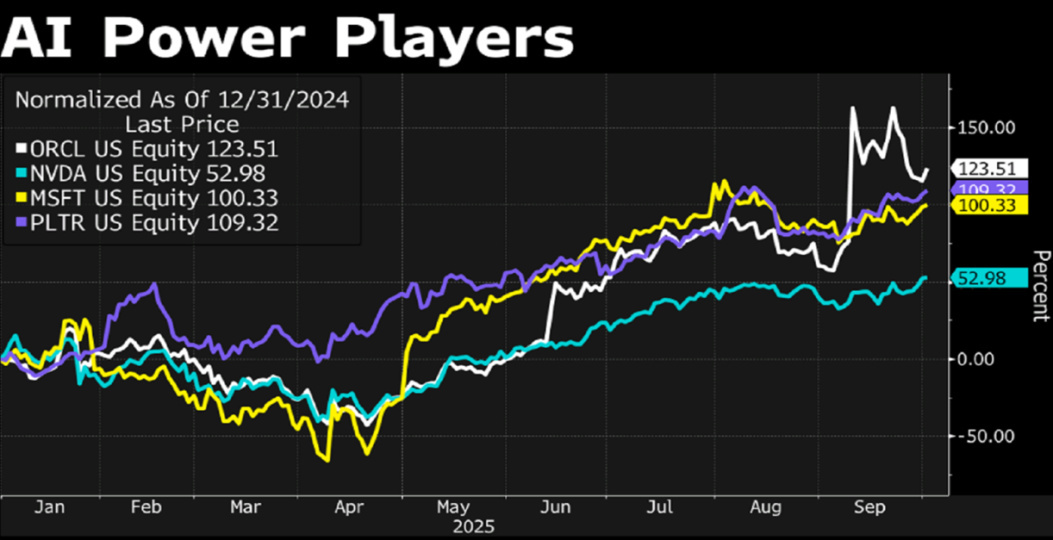

Within this narrative, the competitive landscape surrounding AI is becoming increasingly complex.

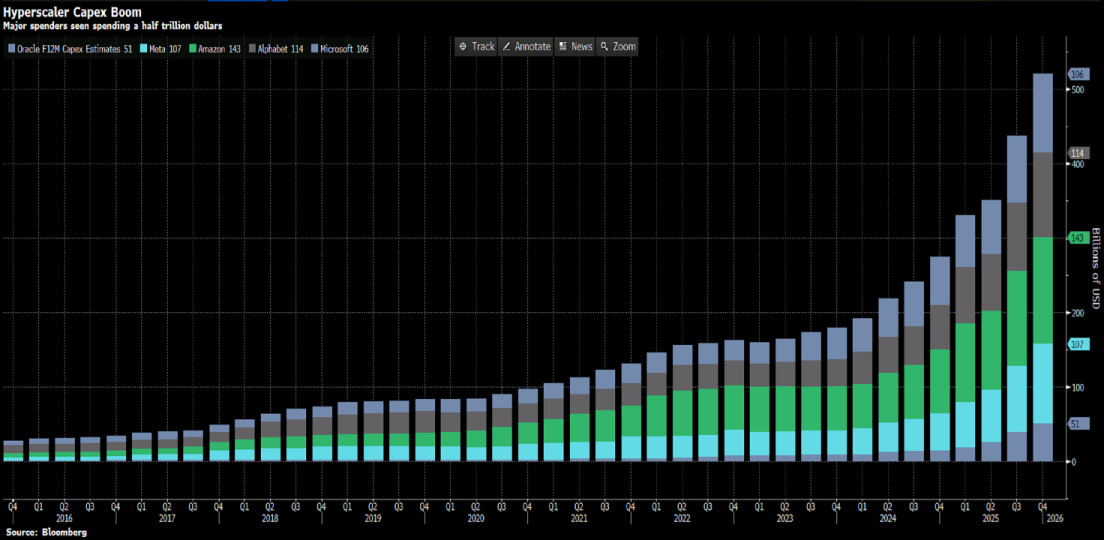

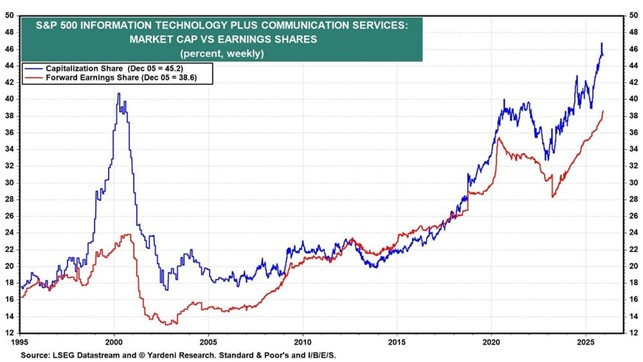

For years, the Magnificent Seven ruled their own kingdoms, protected by deep moats, search engines, social media, cloud computing, and e-commerce. Now, however, they are invading each other's territory: competing on algorithms, chips, data centers, cloud platforms, and AI services for businesses. We no longer have seven separate monopolists, but seven contenders for the same throne, spending monstrous sums to avoid falling behind. In such a context, the S&P 500's concentration on technology and communications has reached levels that, for a prudent manager, are beginning to be objectively excessive: these two sectors alone now account for over 45% of the index's capitalization and almost 40% of its profits. There is too much risk of concentration in a single theme, namely AI.

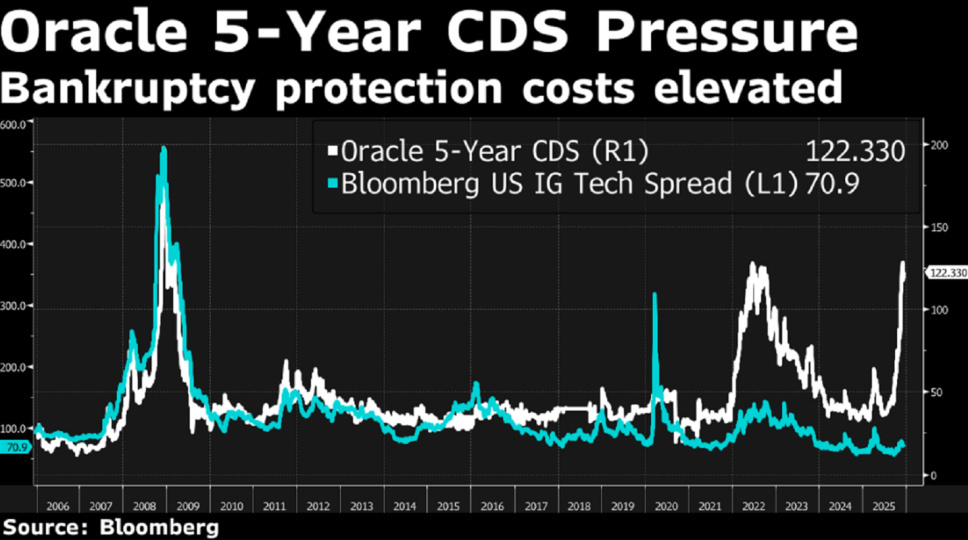

It is no coincidence that the first cracks are beginning to appear. The market reacted badly to Oracle's announcement, which presented mixed results and, above all, a capex plan for AI financed largely by debt.

We are not talking about a hyper-liquid hyperscaler like Microsoft or Alphabet: we are talking about an investment-grade company, yes, but one with a significant leverage profile and tighter cash flows. The idea of building AI data centers with tens of billions in loans to “stay in the game” fuels the suspicion that capital expenditure is running faster than visibility on returns.

This is exactly how bubbles are created: not by technology itself, which is real, but by the dangerous combination of high expectations, growing debt, and internal competition within the sector. For now, the market is aware that we cannot talk about a bubble, but it is concerned when it begins to see the first signs.

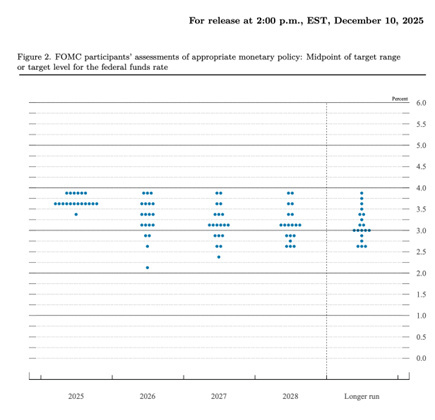

To complicate matters, this week the Fed made a move that could be described as “hybrid”: on the one hand, it cut rates by 25 basis points, bringing the Fed Funds rate to a range of 3.50–3.75%. On the other hand, it announced that it would resume buying short-term Treasuries at a rate of billion per month, well above what had been previously suggested. Officially, they are not calling it “QE,” but that is essentially what it is: quantitative tightening is being halted, bank reserves are being replenished, and liquidity is being injected into the system. This is not just a technical choice, it is a reflection of what is now a structural balance: the government is pushing ahead with expansionary fiscal policies and the Fed is ensuring that there are no hitches in debt refinancing. It is a snapshot of what many call “fiscal dominance”: the central bank as a permanent guarantor of liquidity, rather than a guardian of inflation.

Powell's official message is that monetary policy is now “well positioned”: after 175 basis points of cuts since the start of the easing cycle, rates have returned to a range compatible with an estimated “neutral” level of around 3%. Translated: from here on, the Fed can afford to wait, observe the data, and decide on a case-by-case basis whether to take further action.

But if we look under the hood, the picture is much less straightforward. The dot plot tells us that the median of the members sees only one 25 basis point cut in 2026, with PCE inflation gradually falling towards 2% and unemployment around 4.4–4.5%. At the same time, internal dissent is growing: one member would have liked to see a 50 basis point cut now, while two would have preferred not to cut at all. And at least three participants even see the risk of having to raise rates next year.

The real point, however, is not the comma in the dot plot, but the Fed's change of focus. At the press conference, Powell appeared more concerned about the weakening labor market than about inflation, which continues to hover around 3%. He repeatedly emphasized that much of the pressure on prices stems from tariffs and that, net of the tariff component, inflation would already be much closer to the target. At the same time, the “soft” labor data tell a consistent story. We are not in a phase of mass layoffs, but the strength of labor demand is declining.

It is in this context that stock markets continue to trade at levels very close to their all-time highs.

The S&P 500 is just over 1% off its late October highs, with a year-to-date performance of around 16–18% including dividends. Expected 12-month earnings have risen significantly, driven by margins that have reached new all-time highs of around 14%. For 2026 and 2027, the market is discounting earnings growth of more than 14% per annum: significant figures that leave very little room for error.

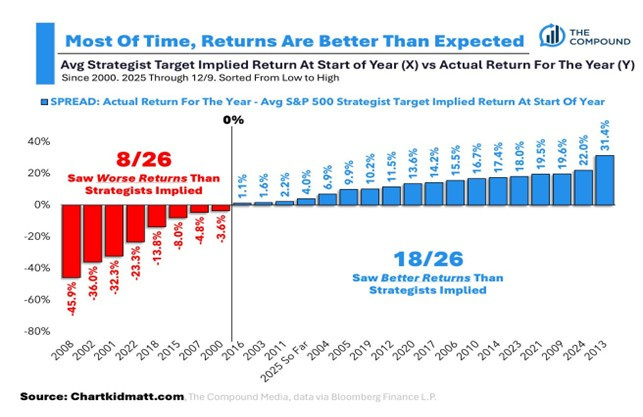

We also know from experience how fallible year-end forecasts and market estimates in general can be: over the last 26 years, the market has beaten analysts' estimates in 18 out of 26 cases, often by more than 10% above or below.

So what can a rational investor do in such a context? First, recognize that the narrative surrounding AI is powerful, but it is not a law of nature. We do not know whether we are in a bubble or not, and we will only find out later. However, we do know that the extreme concentration of the portfolio on the usual mega-cap technology and communication stocks increases vulnerability to any shock, be it regulatory, competitive, or simply one of sentiment.

At these levels, it makes sense to stop structurally overweighting these two sectors and bring them back to at least a “market” weight. Second, it makes sense to look more closely at those more traditional sectors—financial, industrial, non-discretionary consumer goods, healthcare—which combine more reasonable valuations, more direct links to the real economy, and, in some cases, benefits from the normalization of the yield curve and the rotation toward value.

Third, it is worth remembering that behind the short-term noise—the TIME headline, Powell's comments, Oracle's pre-market collapse—process discipline remains essential: true diversification, concentration risk management, attention to fundamentals, and a time horizon consistent with objectives. The Fed is now “well positioned to do nothing for a while,” as Powell said. Disciplined investors should be well positioned to survive both a further upturn and a more serious correction, and we can only do this by shifting the weight of our portfolios towards those areas of the market that currently offer the best margin of safety.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.