Financial markets: Record figures and surprising profits

04 September 2025 _ News

This week ends with the market still suspended between robust macroeconomic data, expectations of rate cuts, a reporting season that continues to surprise positively, and September just around the corner, which – as often happens – could bring volatility and new challenges, especially on the geopolitical and monetary policy fronts. It is interesting to note that, despite various important events such as the Fed's accommodative shift in Jackson Hole and NVDA's figures, the markets moved sideways throughout August.

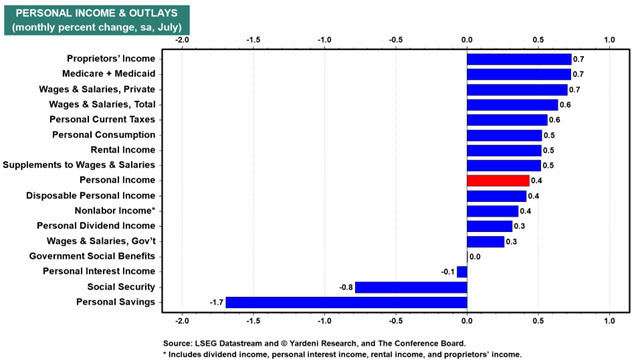

Let's start with the US economy, which continues to show impressive resilience, as evidenced by data released on Friday that painted a picture of a booming economy: personal spending up 0.5% in July, personal income up 0.4%, and, above all, a sharp increase in private wages, up 0.7% for the month.

US GDP for the second quarter was revised upward to 3.3%, but even more interesting is the increase in GDI – Gross Domestic Income (an alternative measure to GDP that calculates economic growth from the income side rather than the expenditure side) – which rose by 4.8%. Both figures reached new all-time highs, confirming an economy that, looking at these figures alone, would not seem to need monetary stimulus, despite market expectations of a rate cut as early as the Fed's meeting on September 17. The Atlanta Fed's GDP Now model currently estimates GDP growth at 3.5% in the third quarter, up sharply from 2% on August 26. GDP Now is an econometric model developed by the Atlanta Fed that provides a real-time estimate of quarterly GDP growth, updated as new macro data is released. It is a useful tool for monitoring economic momentum between official GDP releases, providing highly reliable data on economic growth.

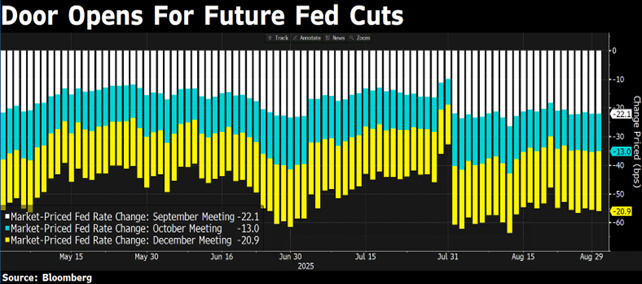

Yet the Fed is under pressure. The central bank's independence could be threatened by strong political pressure from the Trump administration, which has already openly criticized monetary policy on several occasions. Today, 86% of the market is pricing in a rate cut in September and further cuts in the coming months.

In this context, September could prove to be a particularly difficult month for stock markets, as has often been the case in recent years. However, historically, declines in September have been followed by buying opportunities for year-end rallies.

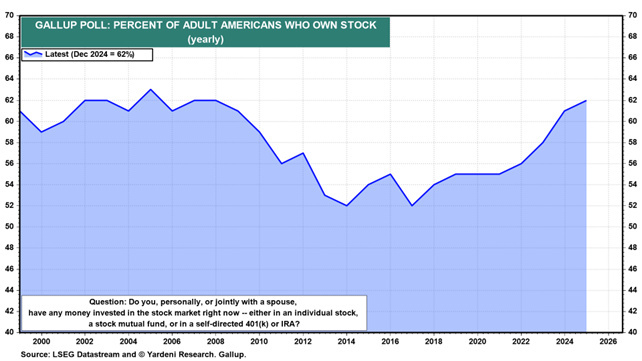

Positive signals are also coming from the consumption side: sales and order data suggest that American households remain healthy, albeit with greater attention to discretionary spending. In terms of sentiment, the University of Michigan confidence index is expected to remain stable at 58.6. Recent surveys report that as many as 62% of Americans have stock investments, the highest level since the 2008 crisis, with clear direct impacts on household wealth.

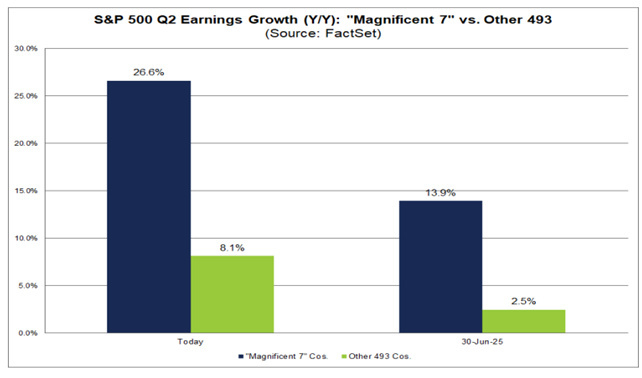

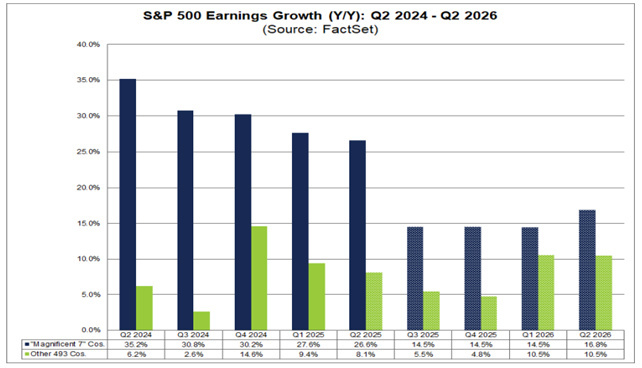

But let's turn to the markets. US equities continue to grind out new highs, with the technology sector once again leading the way, as Nvidia reported better-than-expected earnings and revenues, marking its ninth consecutive quarter of revenue growth above 50%. However, the market reaction was lukewarm, due to slight disappointment with the data center component and the absence of chip sales to China. The stock corrected slightly, as did other artificial intelligence names, suggesting a possible consolidation after the strong rally and despite earnings growth still well above that of the market. In the second quarter of 2025, all of the “Magnificent 7” companies (Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, NVIDIA) reported higher-than-expected earnings, with aggregate growth of 26.6% compared to the previous year.

This figure is well above the estimate of 14%, although slightly lower than the average for the last four quarters (31%).

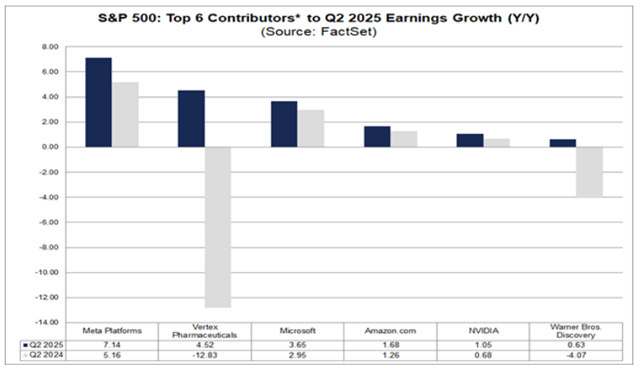

All seven companies exceeded earnings per share (EPS) expectations, averaging +10.5% above estimates, compared to +7.7% for the S&P 500 as a whole. Four companies in the group—NVIDIA, Amazon, Meta, and Microsoft—are among the main contributors to the earnings growth of the entire index.

Looking ahead, analysts predict a slowdown in growth for the Magnificent 7 over the next four quarters, with rates expected to be between 14% and 17%, lower than in recent quarters but well above the rest of the market, where growth of between 5% and 10% is forecast.

On the international front, the debate between “Stay Home” and “Go Global” has reignited. Since the beginning of the year, the US has gained ground on foreign markets and now accounts for 72% of the MSCI All Country World Index capitalization, compared to 50% in 2010. US stocks are certainly more expensive, with a forward P/E ratio of 22.8 compared to 14.7 for the rest of the world. However, the outperformance of US earnings continues to be the argument supporting this premium and justifying this difference.

In summary, the prevailing narrative is that of a healthy economy, with solid profits and robust consumption, but surrounded by a growing set of exogenous and political risks. The Fed may find itself forced to cut rates not out of macroeconomic necessity, but for reasons of political and market balance.

Against a backdrop of solid growth, potentially falling interest rates, and resilient corporate earnings, it is understandable that the stock market continues to show strength. However, as investors, it is precisely at times like these that discipline becomes essential. Equity valuations—particularly in the United States—have returned to very high levels, with the forward P/E ratio of the S&P 500 well above its historical average, approaching highs seen only in rare moments of market euphoria.

This expansion in multiples seems to be driven more by growing optimism about a more favorable macroeconomic environment and the strength of a few mega-cap stocks than by a structural revision of future earnings. It is therefore essential to remember that strong markets and positive trends do not always mean fair prices. History teaches us that when everything seems to be going well, the biggest risk is paying too much for good news that is already priced in.

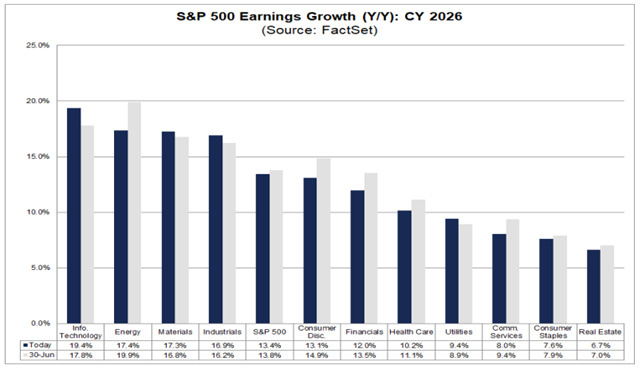

As always in this type of context, the key words remain “discipline” and “selectivity” in portfolios, selection criteria, and above all in the analysis of valuation multiples. This is not to predict an imminent correction; we are well aware that multiples can remain high for a long time before Mr. Market decides to bring them back to values closer to their historical averages. Rather, it is to recognize that the safety margins on the indices are narrowing in the face of generous earnings growth expectations for 2026.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.