January 2024: is this time different?

25 January 2024 _ News

'This time is different: the four most dangerous words in investing'

2024 started in line with how 2023 ended, with some large companies continuing to record new highs, bringing evaluations close to the high levels seen in late 2021. This expansion of multiples leads the investor to raise the expectations bar and wonder if this time will be different.

In this case, the 'this time it will be different' would be driven by the expansion of artificial intelligence, which is now on everyone's lips and is once again leading the investor to convince himself that there is no need to pay too much attention to valuations, because 'with the developments in AI, this time it will be different'.

We, too, share the view that artificial intelligence will be a productivity engine that will enable all companies in the economy to grow, but precisely because it will help all companies, regardless of sector, we prefer to focus on the large part of the market that continues to be at a valuation discount and avoid running after a few companies for which the investor has very high expectations that turn out to be difficult to fulfil.

Equity

Earnings

As we have been pointing out for several months, we continue to be in a favourable earnings cycle environment, but market expectations for 2024 are a bit too high.

Even when analysing earnings growth expectations, we wonder if this time is different. History, in fact, teaches us that on average after a rate hike earnings tend to grow less than their historical average. This is why we feel that the +12% expected by analysts for 2024 is a little too positive. So far, about 10% of companies have reported results with decreases of -1.7% for Q4 2023 (graph below), growth that was expected to be +1.6% at the end of December 2023.

This earnings growth was driven by negative surprises of about -18%, which led by financials showed -36.1%. We should not be surprised if there is worse than expected earnings growth, precisely because history teaches us that it is normal for companies to slow down with such high rates.

Ratings

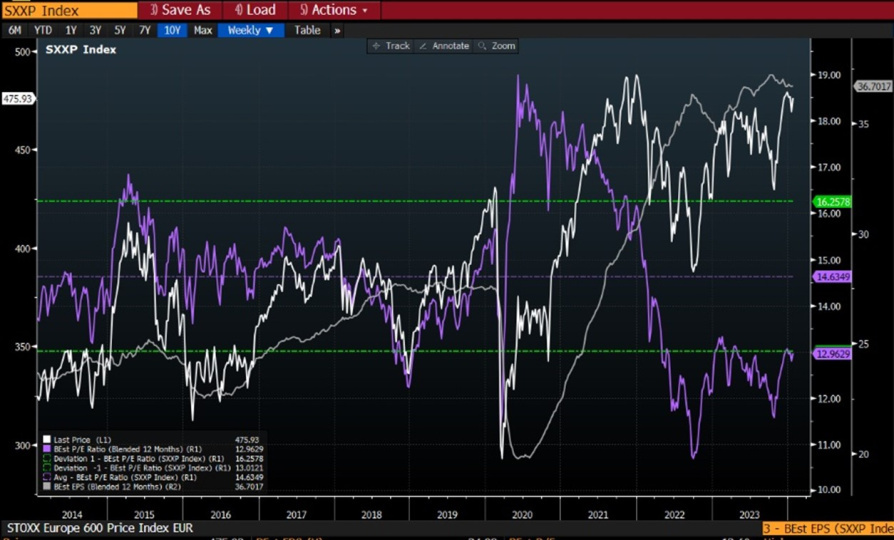

After analysing earnings, the value philosophy asks how much the market is charging us for these earnings, i.e. valuations. The markets where we believe there is a greater margin of safety for the investor and therefore valuations are at a greater discount are: the US equities market equated, Europe (chart below) and China. On the other hand, we believe that major US companies, particularly those related to the technology sector, are showing more expensive valuations than 12 months ago and therefore have a smaller margin of safety.

Stock sectors

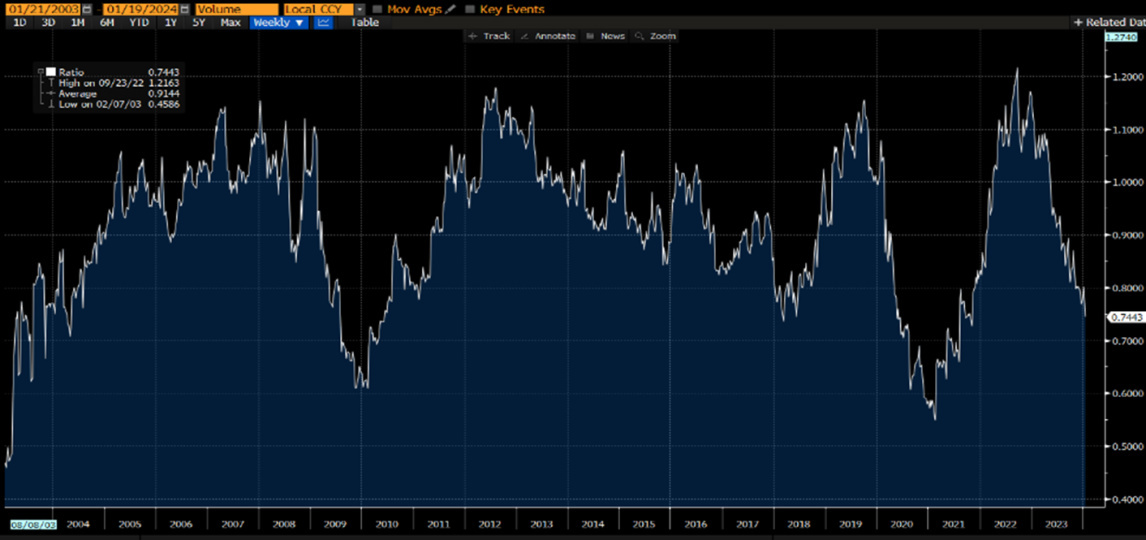

The preferred sectors in the US continue to be: Utilities, Non-Discretionary Consumption, Financials, Health Care and Industrials. From the chart below we see that the Price on Earnings of Utilities is at a 30% discount to the Price on Earnings of the S&P500, a level of discount rarely seen in history.

The preferred sectors in Europe are: Discretionary Consumption, Non-Discretionary Consumption, Health Care, Real Estate and Industrials.

Bond

On bonds, we continue to see opportunities in European and US long duration government bonds.

Government

The main theme that will drive the rate trend will be how many rates cuts the Central Banks will make. Powell's latest words made it clear that it is too late to wait for inflation to return to 2% before cutting interest rates.

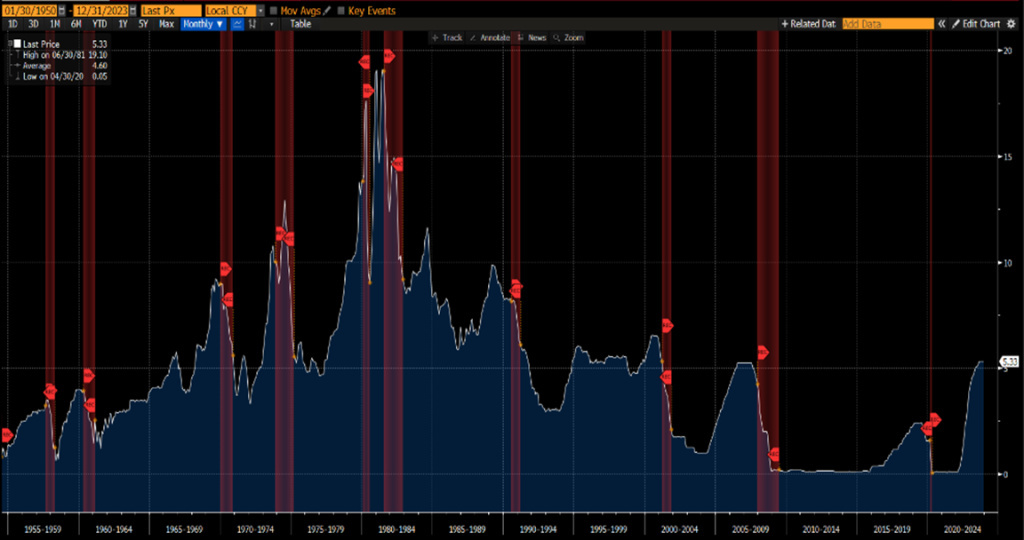

Let's see what history tells us about the rate cut and why we believe this time too will be no different:

- On average FED rates rise 5.6%, today we are at 5.25%

- On average rates stay 5.5 months on the highs before being cut, today we are at 6 months

- On average, rates are cut by about 6%, returning to pre-hike levels

- On average the duration of the cuts is about 18 months

- The rates have always fallen back below the values before the rise, with the exception of 1994 (1 case in 9)

- Recession occurred in 8 out of 9 cases

For all these reasons, we should not be surprised if rates are cut even more than market expectations.

Corporate

On the corporate bond side, we continue to prefer Investment Grade over High Yield. Indeed, if we look at High Yield, we see that the spread level is in the 15th percentile for US HY; for European HY bonds we are in the 35th percentile.

Conclusion

In conclusion, we believe that this time will be no different and that valuations will continue to be the market's compass. This is why we continue to see value in the stock market, especially in certain sectors and markets. As far as bonds are concerned, history teaches us that perception is always different from reality.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.