High Yield keeps bonds afloat

23 March 2021 _ News

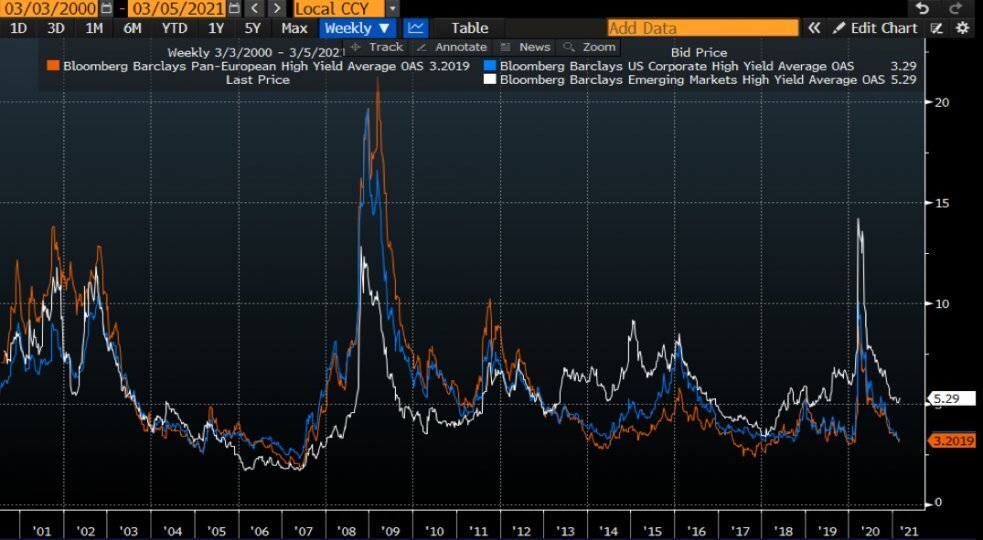

The corporate bond market, in particular the High Yield one, so far has only been marginally affected by the turbulence that hit the stock market. As can be seen from the image below, High Yield spreads are in sharp decline both in the American market (blue line), in the European market (orange line), and also in the emerging one (white line).

The narrowing of spreads was driven by five main factors:

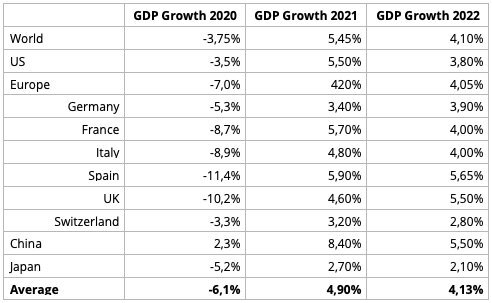

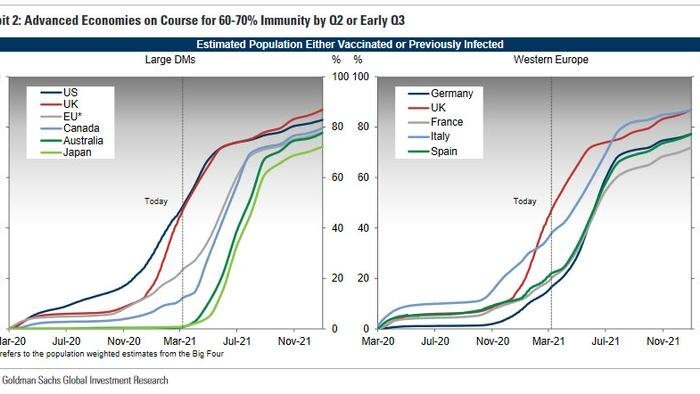

1) The cyclical recovery. The global GDP is expected to grow by about 5% this year, driven by the progress of the vaccination campaign. It is expected that by November 2021 80% of the population will be vaccinated.

2) The rise in interest rates. The rise, driven by the cyclical recovery, has the effect of reducing spreads, as evidenced by the figure below. When the American 10-year rises (blue line), the US High Yield spread falls (white line).

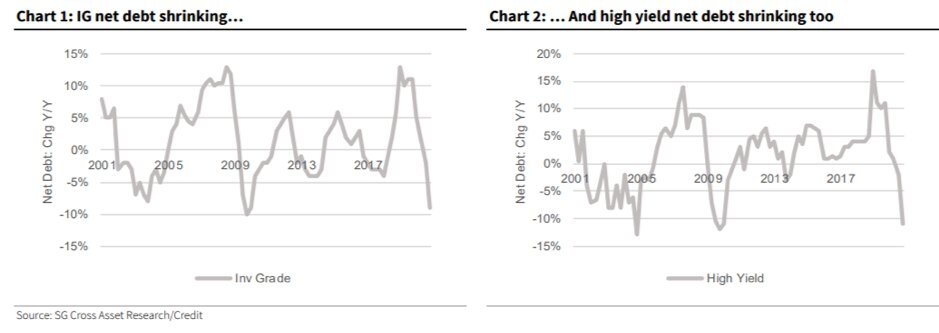

3) Improvement of corporate fundamentals. In particular:

a) Debt reduction in both the Investment Grade and High Yield markets.

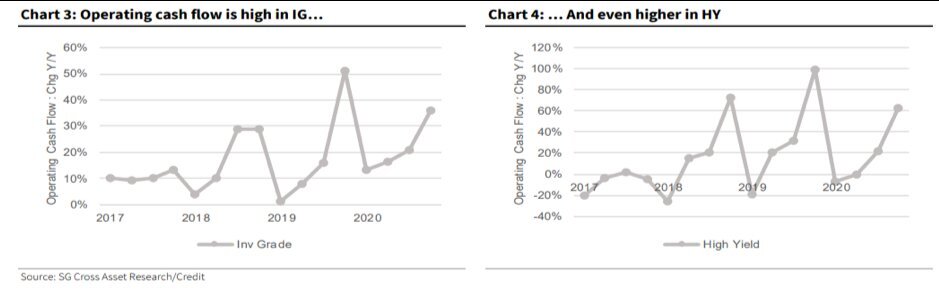

b) Rising of cash flows

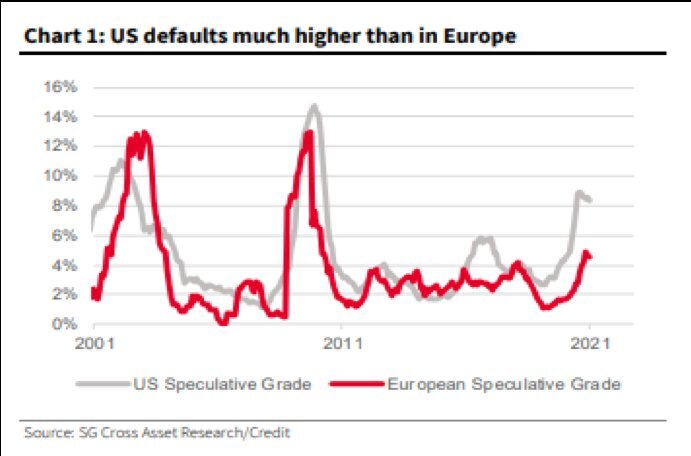

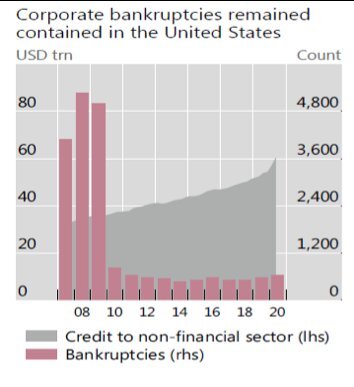

4) Probability of bankruptcy decreasing and under control, especially in Europe:

5) Last, and probably the most important aspect, is the support of Central Banks. Both Fed and BCE have as their objective, in addition to controlling inflation and unemployment, financial stability, in which the bond market, in particular the High Yield market, plays a fundamental role. Lagarde's recent words, with the increase in the PEPP, and the strong support highlighted by the Fed which has kept interest rates on hold and will continue to buy bonds on the market, send a clear signal of how much the financial stability of the bond market is today of great importance.

In conclusion, we remain positive and constructive regarding the bond market. On the Pharus Sicav Target, we will continue to select individual issues and use diversification, as these are the mantras of the Fund management. We believe that the High Yield market, in particular BB-rated issues, has an excellent risk/return ratio, especially in the current phase of cyclical recovery and with financial stability maintained by central banks.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.