That's how to really read Buffett's caution of the last few months...

04 May 2020 _ News

Age, Berkshire Hathaway's portfolio composition and unlimited Fed help are the real reasons for Buffett's investment freeze during the coronavirus crisis.

On Saturday night, Italian time, Warren Buffett spoke for 4 hours at the annual shareholders' meeting of his Berkshire Hathaway. It was a surreal event, which says a lot about the situation the world is experiencing. The meeting was in fact broadcast from an arena with over 17,000 empty seats, a symbol of the health uncertainty generated by the spread of the coronavirus.

Immediately the Italian press focused on the news most likely to attract the attention of investors: in the first quarter the Buffett conglomerate had recorded a massive net loss of almost billion due to the sell-off following the spread of the virus and further losses were recorded on the shares of US Airlines, Delta Airlines, Southwest Airlines and United Airlines (the major US airlines). On this occasion, the star investor had to admit he had got it wrong.

But at Pharus we don't just read the news. On the contrary, we prefer to set emotions aside and examine and objectively analyse all the facets, through the lenses of over twenty years of experience.

And what emerged from the Oracle of Omaha's speech goes far beyond news.

First of all, it should be noted that the loss also reflects recent changes in accounting rules, which require that unrealised losses on equity (i.e. when the market value falls but the security is not sold) are entered on the profit and loss account, i.e. changes in fair value are recognised in net income.

It should also be remembered that Buffett will turn 90 in August, while his partner Charlie Munger will turn 96. It is not surprising, therefore, that he is cautious in the face of the health emergency, as confirmed by Buffett himself in recognizing that the virus and its consequences are still too uncertain to assess: "the future is much less clear to me, we are learning as we go along", although he says he is consoled by the fact that "it is not as lethal as it could have been". At this point it is natural to wonder whether the US guru has not already thought about the generational changeover of his colossus and has not already chosen his heir. All the latest signs indicate that the current vice-Chairman of Berkshire Hathaway, Greg Abel, will be the next CEO, but Buffett has not yet finalised the succession plan.

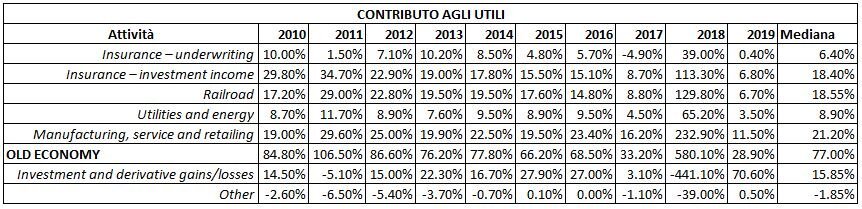

We must not forget the nature of Buffett's favourite investments, which is how the Berkshire Hathaway portfolio is composed: it focuses mainly on the Old Economy (insurance and banking and financial giants purchased at discounted prices during the 2008 crisis, railways and infrastructure, utilities and energy, industry and commerce), which is why it is without exceptions suffering during this pandemic crisis that has penalised the real economy to the benefit of the more defensive sectors, including the entire online world, for both work and consumption.

When you own so many consumer-oriented companies, you need a cautious approach, especially in the face of an unprecedented state of blockage. To ensure sufficient liquidity for his companies, Buffett needs to keep large sums of money at hand. Hence his investment freeze in recent months, even in the face of attractive buying opportunities. And his consistency in avoiding leverage.

With the large amount of liquidity it has available, Berkshire Hathaway appears to be in a perfect position to act as a lender of last resort for financially strained companies and to acquire companies affected by the crisis, and one might expect Buffett to be active in this regard. But, so far, this has not happened and, to the contrary, Buffett has remained on the sidelines.

The reason is simple: in the face of the unlimited monetary aid immediately promised by the Fed, in which Powell emulated Draghi's "Whatever it takes", explicitly quoting him, companies can obtain better loan conditions from the federal government than from Buffett's Berkshire Hathaway. The US Central Bank, during this crisis, has in fact burned the Oracle of Omaha over time, minimising his purchase opportunities. And, in the mind of some analysts, the idea has crept in that Buffett was just waiting for the right moment to invest, as if the bottom purchase opportunities were still coming.

But it should not be forgotten that this asset allocation has always allowed him to achieve a double-digit performance, at least 20% per year, which the great man distributes for the buyback of Berkshire Hathaway shares and uses to invest in the stock market a small part of the portfolio on the most promising stocks, including Apple and Amazon. This time it will be no different.

Despite the debacle with the airlines, the financial guru is not losing faith in the US market: "nothing can stop America. The American miracle, American magic has always prevailed and will continue to do so. I was convinced of it during the Second World War, I was convinced of it during the missile crisis with Cuba, on September 11 and in the financial crisis of 2008". It's true, the current period is very complex and he himself admits that "the future is much less clear", but his confidence in his country is granite: "If you could choose a day and a place to be born, you would choose today and you would choose America. Ever since America was founded, everyone has always wanted to come here. And as the last word: "In the end, the answer is: never bet against America."

What does an investor have to do today?

The answer for Buffett was unchanged: "Buy US stock, through a cross action in the S&P500. If you can keep your emotions under control and have a time horizon of 10 years ahead of you, buy US stock".

It seems that the pessimists and advocates of the bear market will have to wait yet again.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.