Inflation: temporary or not?

18 May 2021 _ News

The market has been hit in recent months by the rise in inflation and although it was expected and has been defined by the Central Banks as “temporary”, it could increase the pressures on corporate profit margins.

There are two fundamental drivers for the temporary nature of the inflationary movements. Firstly a potential bottleneck effect on goods and raw materials, due to the reopening of economic activities and the return of industrial production to pre-pandemic levels.

Also, a return to full employment levels, with the consequent upward pressure on wages, takes time. In the short term, however, we may see inflationary pressure due to the slowdown in the job market, as reflected by US payroll data for May, which shows that the fiscal stimulus may have reduced the inclination of US citizens to take up jobs.

It is too early to say whether this inflation is temporary or not and probably not even the Central Banks have a clear idea of what will happen, but in the meantime businesses need to be well prepared to deal with a potential upside scenario.

Businesses: raise prices or bear the increase?

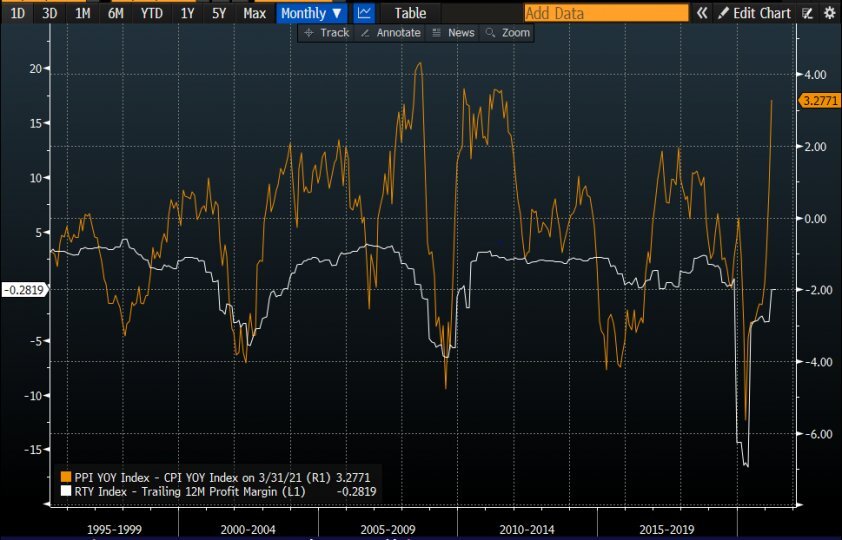

When talking about inflation it should first of all be stressed that the negative effects of an increase in costs on corporate profits depend essentially on the ability of companies to pass this increase on to the final prices. The increase in the production price index (PPI), not followed by a sufficient growth in the consumer price index (CPI) would inevitably make it difficult for companies to pass the rise in inflation on to goods. As the graph below shows, in the last twenty years there have been at least five occasions when companies have been unable to pass the increased costs on to the final prices:

If we compare the PPI-CPI differential and the profit margin of the US small cap market, we can clearly see how increases in the PPI-CPI differential (yellow line) lead to a reduction in corporate profit margins (white line):

Solution: focus on companies with competitive advantage

The mechanism for adjusting the prices of goods needs time, is dependent on the business sector and is often restricted by the globalisation process that has removed the boundaries of corporate competition. However, the most important aspect and one that distinguishes a company capable of passing the price increase on to the final goods is the presence of a competitive advantage. Indeed, a company with competitive advantage is able to bear an increase in production costs without this leading to a reduction in profits.

These companies have several fundamental characteristics:

- They are leaders in the market segment in which they operate;

- They are characterised by high margins and stable growth. Although not always immediately apparent, such characteristics may be indicated by longer-term forecasts;

- They have high profitability indexes, such as for example a consistent and stable ROE;

- They have a strong intangible component, for example they have a brand that is both recognised and unique;

- They have strong innovation skills and the ability to regenerate their own business.

When a company with a clear competitive advantage such as the American utilities company Nextera is compared with IBM, a company that, especially in recent years, has been suffering competition in the technology industry, it can be seen, as the graph below illustrates, that whilst Nextera’s margin (white line) has in the last 20 years been characterised by a steady growth, IBM’s margin (blue line) has suffered competition, especially in recent years.

Given its dominant position in the sector and its improving profit margins, it will be easier for Nextera and for all the companies with similar characteristics to pass on the increase in costs than for IBM.

At this moment in time, therefore, it is a good idea to select those companies that have competitive advantage and would therefore be able to withstand

Information message - The information in this message is produced for information purposes only and therefore does not qualify as offer or recommendation or solicitation to buy or sell securities or financial instruments in general, financial products or services or investment, nor an exhortation to carry out transactions related to a specific financial instrument.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

RELATED CONTENTS