Market buzz: stocks up, Bitcoin at highs, favourable earnings cycle but risk is growing

07 March 2024 _ News

February ended with the fourth consecutive month of positive performance in global equity markets, with many markets registering average gains of 4-5% and many markets recording all-time highs. The situation is different, however, in the bond world, which continues to suffer from an upward stabilisation of rates, with only the credit component recording positive performances since the beginning of the year. At sector level, the great divide continues between the high beta component, which continues to lead the markets, and the low beta component, which continues to underperform. A measure of the market's risk appetite is undoubtedly bitcoin, which has risen steeply and is back near all-time highs.

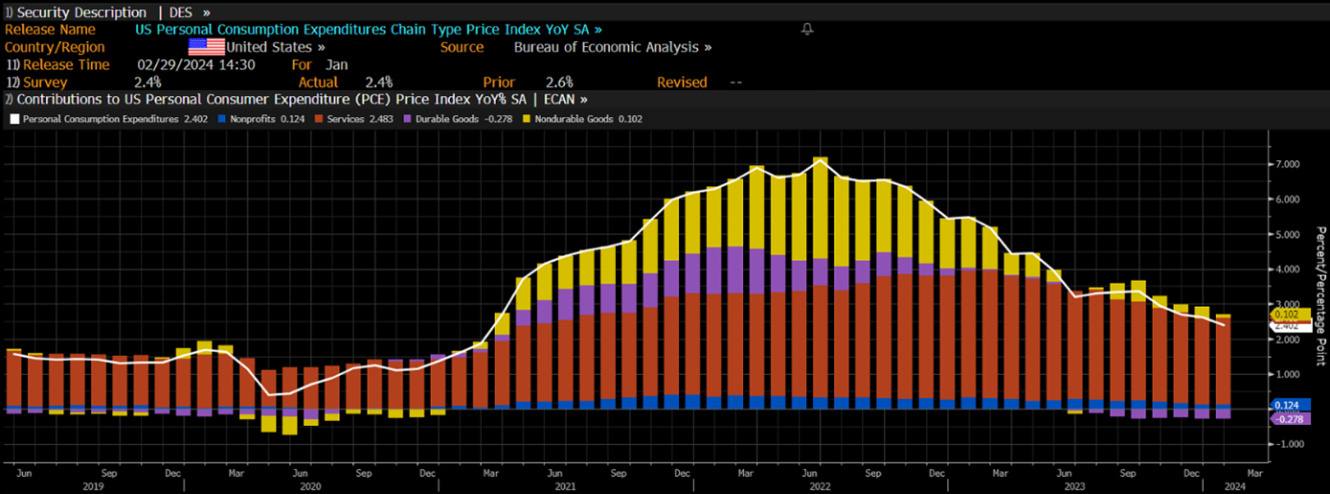

In terms of macro data, investors' attention was polarised last week by inflation data for February, with the release on Thursday afternoon of PCE, the Fed's preferred inflation figure, followed on Friday by European inflation. The PCE came out in line with expectations, confirming a sequential decline, with a slight downward revision of the previous month's data.

A figure that did not tip the scales on the FED's or the market's inflation outlook, but was enough to send equity markets to all-time highs, comforted by less strong-than-expected labour market data and, above all, lower-than-expected ISM data. Even European inflation, although slightly higher than expected, and despite fears of new increases, remained down on the previous month, highlighting how the downward path is continuing in Europe as well, as predicted by the central banks.

With the reporting season coming to an end, we can take stock together of what matters most to the markets: the performance of the earnings cycle.

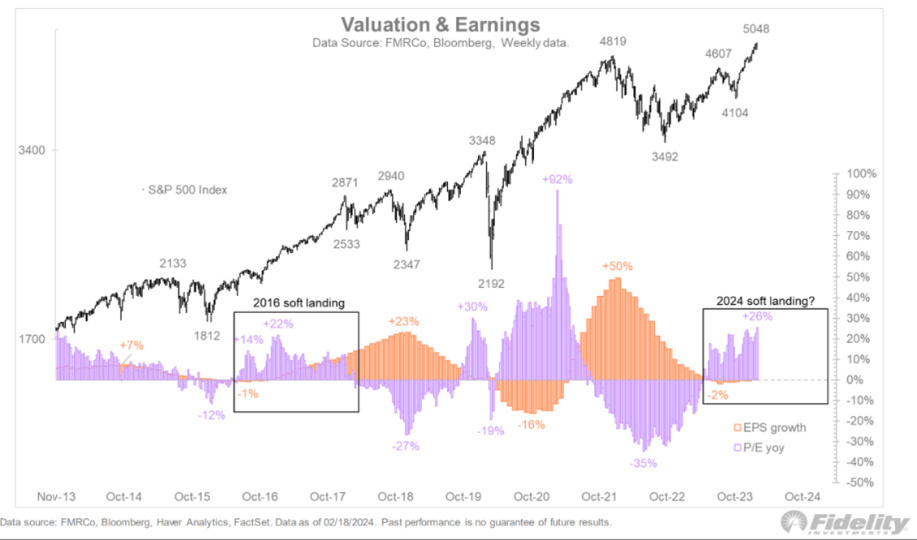

During most bull markets, the baton is passed from multiples expansion to earnings growth. Up to now, multiples have been expanding, but the data from the last reporting season are confirming that we are now exactly at the stage of the cycle where earnings are growing again.

This bull market is not behaving differently from the others, if we look at it in terms of earnings cycle dynamics. In October 2022, markets bottomed out and earnings were being heavily cut by analysts. Prices going up and earnings going down again represent each start of a new cycle, but the confirmation that we can really talk about a new bull market comes when earnings estimates finish being cut and start being revised upwards. This inflection point on we recorded in March 2023 and since then these estimates, together with stock market prices, have continued to rise.

Against rising valuations, reported earnings continued to be negative, but are now returning to growth.

This recovery in earnings is necessary because last year the stock market was driven solely by valuations, which expanded from a P/E multiple of 15 times to 21 times today. If earnings continue to rise, as they are doing, valuations should stop rising or even fall, as typically happens during this phase of the market cycle, which is usually in the middle of the cycle.

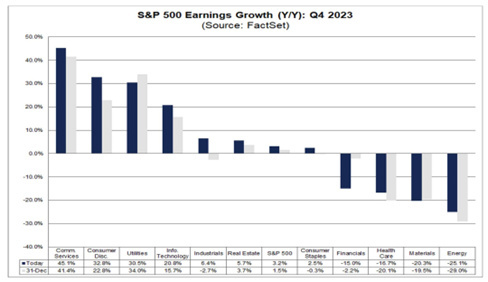

The current US reporting season for 4Q23 is confirming the above, with 75% of companies beating earnings estimates by about 7.5%, posting 3.2% year-on-year growth, in what would be the second quarter in a row with sequentially rising earnings.

The macro narrative is unfolding more or less as expected in terms of earnings cycle trends, and it is very likely that we are really only halfway through the overall cycle, but we believe that the market is currently incorporating earnings growth expectations that are a little too optimistic. Earnings growth of 11% for 24 does indeed seem generous to us for two reasons:

- First of all, we are talking about a growth of almost double the historical average of the S&P500 since 1950, which is more like 6.5% and not 11-12%.

- Also, historically speaking, earnings growth in the 12 months following major rate hike cycles is usually weak and averages around 3% negative and not 11-12% growth.

To sum up, we see a market well into a new cycle of earnings growth, but with valuations at the upper end of historical averages, thus discounting very generous earnings growth expectations and incorporating an increasing risk of being disappointed.

The solution is not to sell the market, but as always to look for value, which in the face of sectors with valuations that are difficult to sustain, priced for more than perfection, is also rich in opportunities in many sectors and particularly in defensive sectors.

In the European market, expected earnings growth is lower (+8.5% for 2024), and valuations still on the low end of the valuation range of the last 10 years, making it a more discounted market than the US.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.