The momentum factor

09 September 2022 _ News

We shall now analyse the MOMENTUM factor.

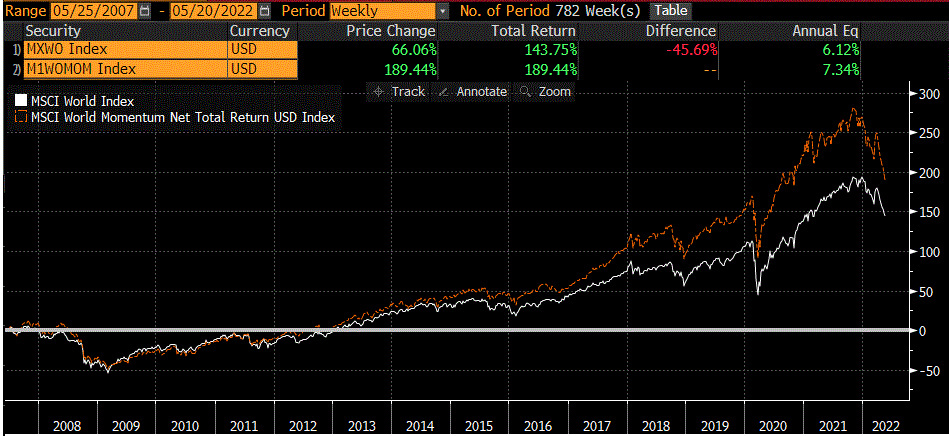

Stocks defined as "high momentum" are characterised by high performance recorded over a circumscribed and relatively short period of time (typically the last 6 to 12 months). The managers will focus their attention on these stocks, as empirical evidence and academic studies confirm that their outperformance relative to the market tends to continue in the subsequent short term.

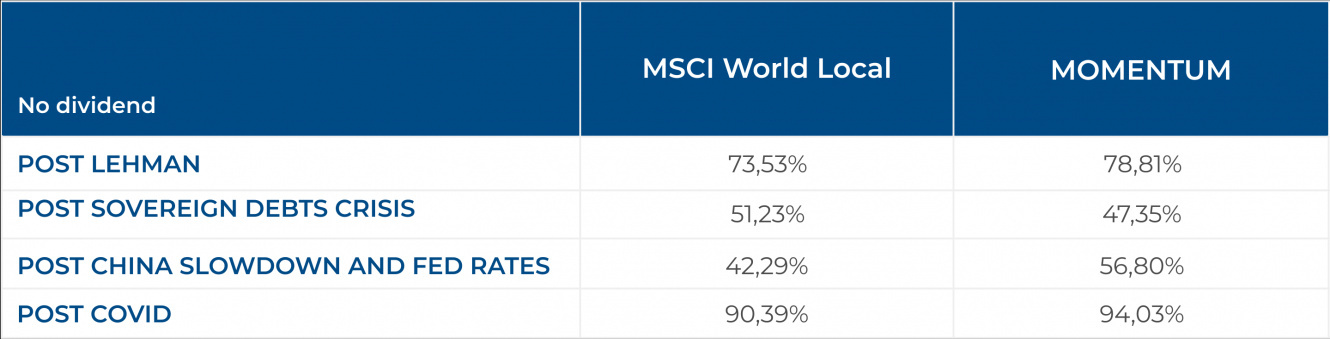

The table demonstrates a clear example where MOMENTUM has almost always clearly outperformed the parent index, MSCI WORLD LOCAL.

As with all strategies, this process must be methodological and disciplined, that is, applied and monitored periodically so that the best-performing portfolio is obtained at all times. It is commonplace to point this out, but it is clear that the persistence of a trend is not perpetual; otherwise, we would just have shares that go up and others that go down. Furthermore, it is always necessary to consider whether or not to continuously fine-tune, which could increase the cost of rebalancing the portfolio.

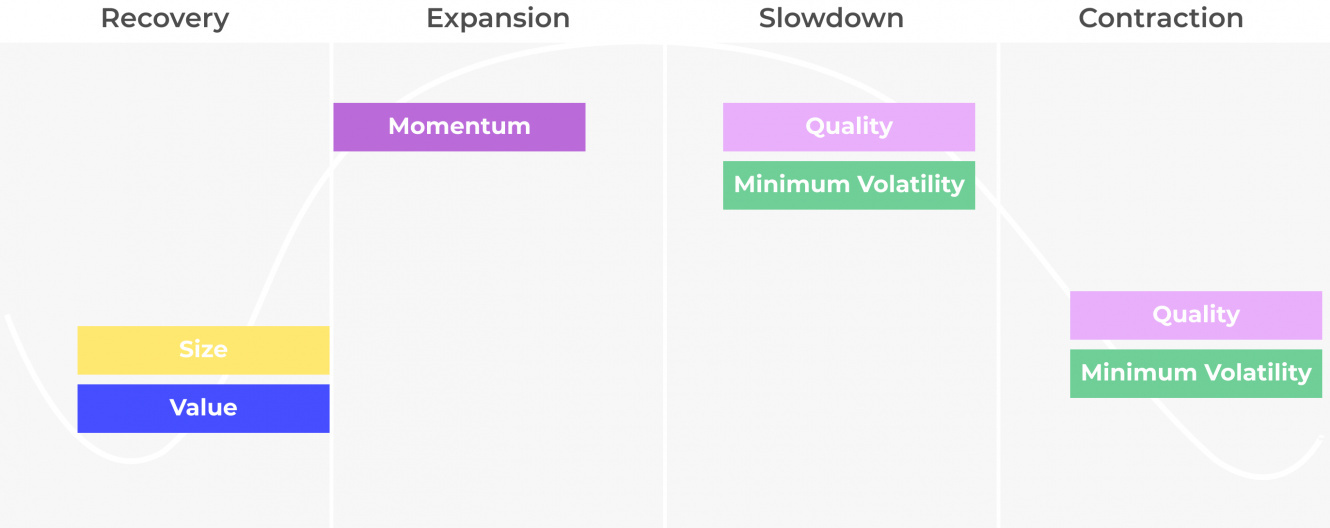

If we wanted to identify the most opportune time to apply this strategy within an economic environment, then the phase of overt expansion of the cycle undoubtedly turns out to be the best phase for implementation, as it is precisely in the second phase of the economic situation when recovery stocks have performed better and, for that reason, will be considered on trend, while value stocks will begin to record overpriced parameters.

During the last two-year COVID period, through momentum strategies, managers have identified certain sectoral and geographic trends that have achieved explosive performance, but here it is also worth mentioning the specificity of the context we were experiencing, namely of low or falling rates (through QE), through which growth stocks (TECH, HEALTH CARE, BIOTECH) played a leading role during the stay-at-home economy.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.