Non-discretionary consumption: from delusion to opportunity

22 February 2024 _ News

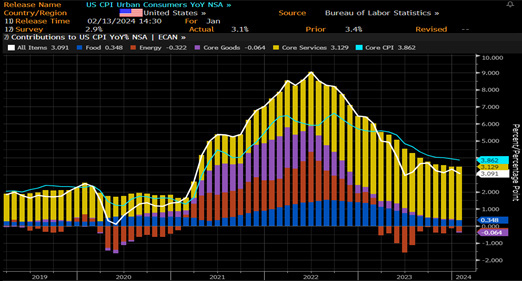

Equity markets are close to all-time highs, driven by an excellent reporting season in the technology sector and the growing prospects for the development of artificial intelligence. This trend persists despite US inflation data released this week showing a more resilient inflation rate than expected. In particular, Tuesday's CPI reported an inflation rate of 3.1 per cent, lower than the 3.4 per cent expected, but showing a less pronounced decline than expected. Furthermore, the core indicator, which excludes food and energy, remained in line with the previous month's rate. Nvidia data are awaited to further assess market developments.

One of the determining components affecting the calculation of 3.1% were rents, which were calculated using the equivalent rent method, a very distorting calculation methodology that does not take into account the real rental prices on the market. Replacing the equivalent rent with a more realistic market figure would lead to a CPI figure closer to or even below 2% and not 3.1%. Observations coming from authoritative economists, among the few to point out that in 2021, for precisely the same reason as rents, inflation had to rise and could not be transitory. Running after macro data is never easy, but it is above all very dangerous as they always lag behind markets that move on expectations, as well as being almost impossible to estimate.

In the previous article we took an in-depth look at the utilities sector, and today we will continue with further examples to put the "this time it's different" narrative, the theme of our monthly webinar, into context. The intent of these examples is to help us understand the nature of the market, focusing on its constant movement from one extreme to the other.

Many investors have likened this movement to that of a pendulum, which moves rapidly from one extreme to the other and rarely finds itself at the midpoint of equilibrium.

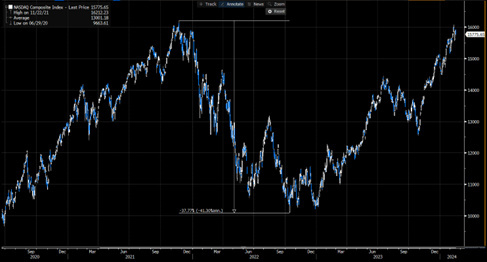

Let us start with a historical example and do so by analysing the technology sector, which is now the talk of the town. In 2022, the technology sector underwent a correction of about 40%, justified by the market with the narrative of rising interest rates.

If, however, we confine ourselves to value analysis, we note that Nasdaq valuations had reached about 30 times earnings by the end of 2021, a level never seen in the history of the index, with the market pendulum thus having swung into an upward excess. This upward excess was reversed in 2022, leading to violent corrections across the technology sector and valuations at an objective discount to history.

The case of technology stocks is a classic example of the value rotation we often observe in financial markets: in 2021, they were coveted by all when technology was seen as the driving sector for the post-Covid recovery, but in 2022, when a narrative emerged of high rates that would penalise long-lived assets such as technology stocks, they were shelved.

Passiamo ora ad un esempio del presente, e lo facciamo analizzando il settore dei consumi non discrezionali, ed in particolare il sotto-settore delle bevande alcoliche e non alcoliche.

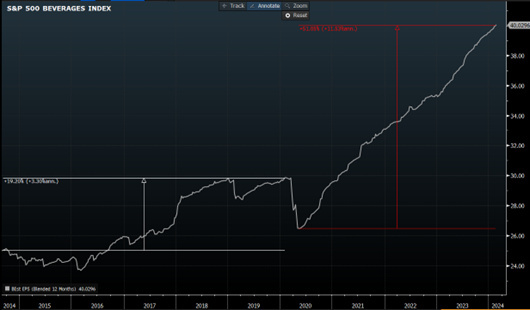

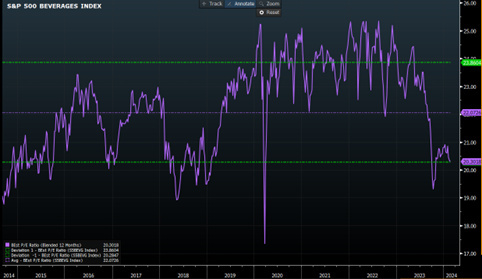

Let us now turn to an example from the present, and we do so by analysing the non-discretionary consumption sector, and in particular the sub-sector of alcoholic and non-alcoholic beverages.

This sector was hit in 2023 by a correction, which, like the case of utilties, caused companies to correct by 30-40%.

The reasons for the correction?

The sector's correction was driven by a return from over-positivity, and over-inflated expectations of the pandemic exit narrative that had led people to consume higher volumes of alcohol both at home and in pubs. This increased consumption had driven a major climb in profits and, more importantly, had led analysts and the market to overinflate expectations, incorporating as normalised what was instead extraordinary growth, with industry profit growth more than three times that of traditional pre-covid growth.

Prices that go up make the investor relax, and psychologically appease him by not making him perceive the higher risk of valuations that rise outside historical averages. Valuations are never considered important when they go up, until the moment when prices start to fall and then one realises that they are essential. Thus 2023 marked a return from excess for the sector, with prices of many stocks falling by up to 40%. Since the pendulum never stops halfway but continues its movement to the opposite extreme, today the sector seems to have arrived at the opposite extreme of negativity, with valuations becoming attractive again. And since this time too will be no different from the others, it will sooner or later be taken over by investors and thus returned to the opposite extreme of positivity.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.