Not all that glitters is gold at NVIDIA

02 October 2025 _ News

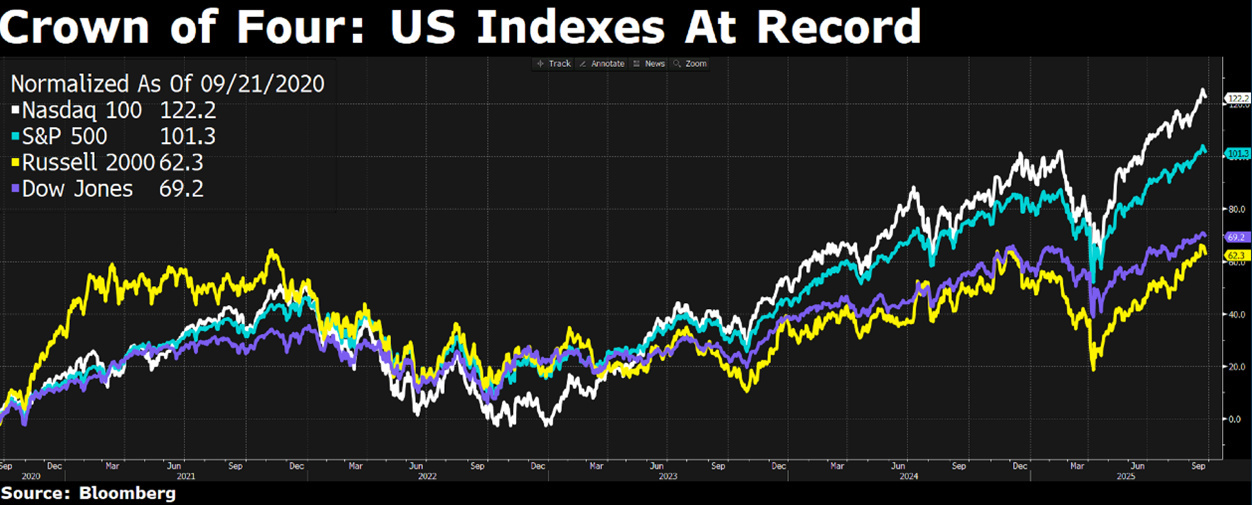

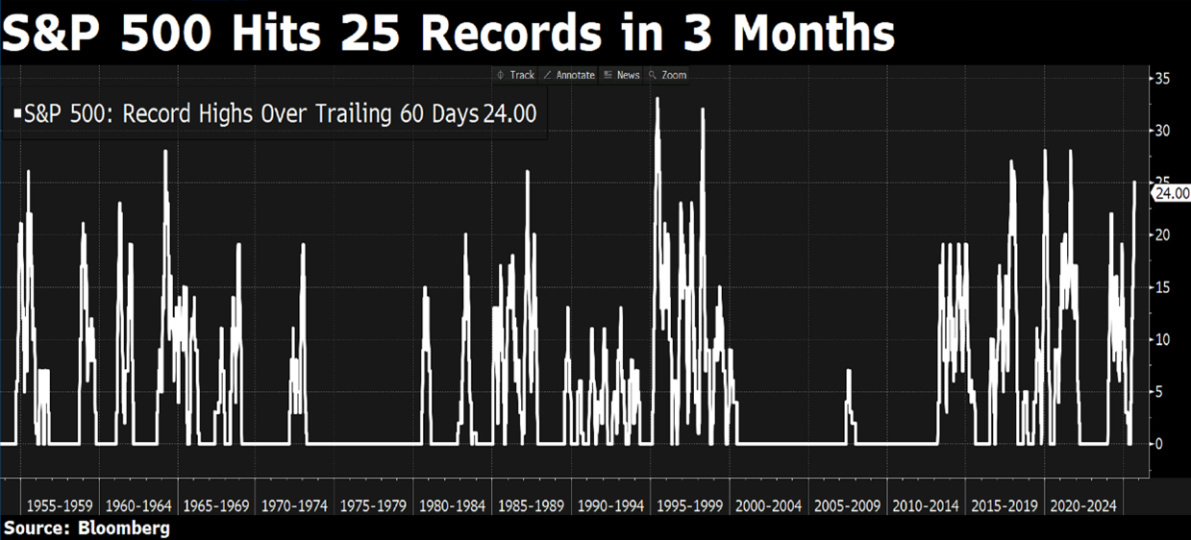

The week opened with new record highs for the S&P 500 and Nasdaq, driven by renewed strength in technology stocks.

The catalyst was NVIDIA's announcement of a 0 billion investment in OpenAI, aimed at developing at least 10 gigawatts of data centers. The news reignited enthusiasm for artificial intelligence, but in the days that followed, the markets slowed down, taking a consolidation break after reaching new highs.

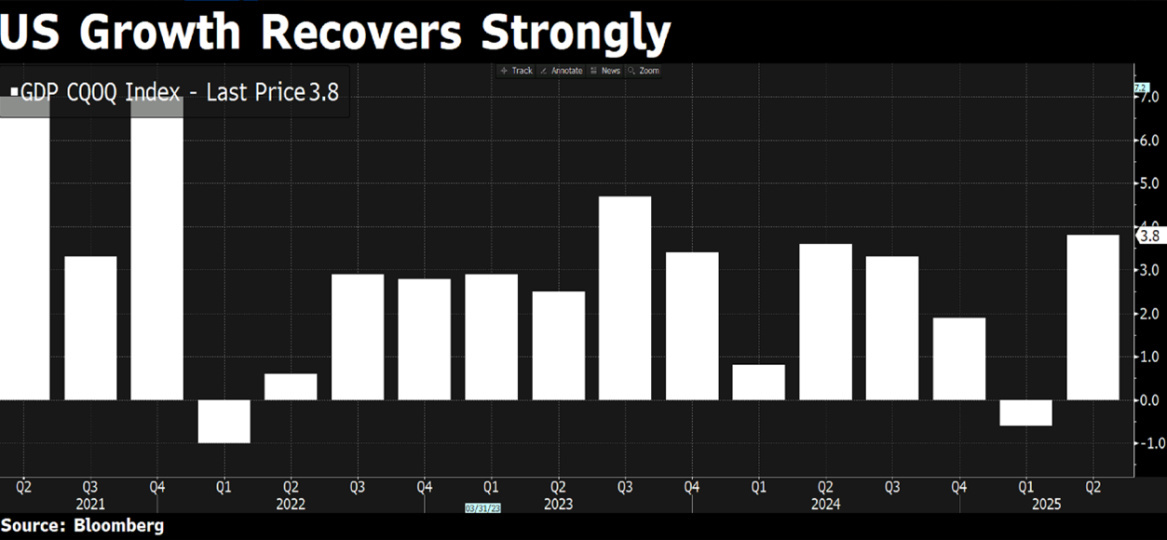

On the macroeconomic front, the final US GDP figure for the second quarter was revised upward to an annualized 3.8%, exceeding expectations.

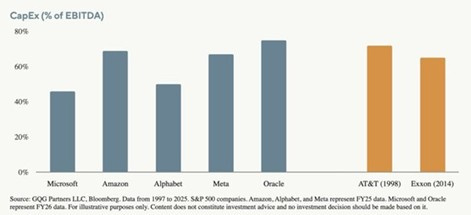

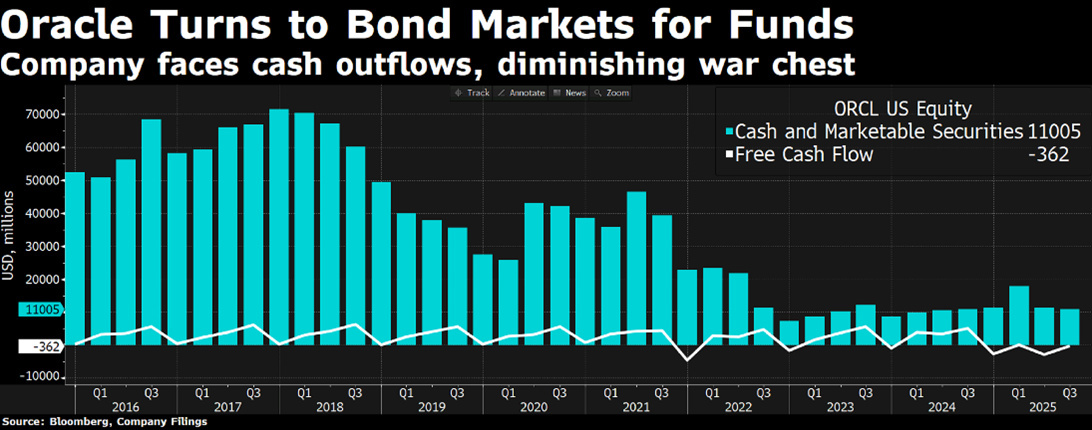

Sustained nominal growth, fueled in part by increased AI-related investment, which is contributing significantly to GDP in 2025. However, a critical point is approaching: according to the latest estimates, Big Tech's capex on AI projects reached 72% of operating cash flow in the second quarter, an unprecedented level.

The transition from a phase of cash-financed investments to a phase of debt-financed capex is expected in 2026 (in fact, Oracle has already begun). It is possible that this will be the moment when the market begins to question the sustainability and actual economic return of these investments.

The monetary policy environment remains in transition. The Fed cut rates by a quarter of a point last week, bringing the Fed Funds rate closer to a more neutral level. According to the Fed's approach, neutrality would be around a real rate of +100 basis points above inflation, or around 3.75%. However, the prospect of a “post-Powell Fed” that could favor forms of financial repression, with the aim of reducing the cost of public debt and keeping interest rates under control, as already happened in the 1940s, is an increasingly discussed hypothesis among observers.

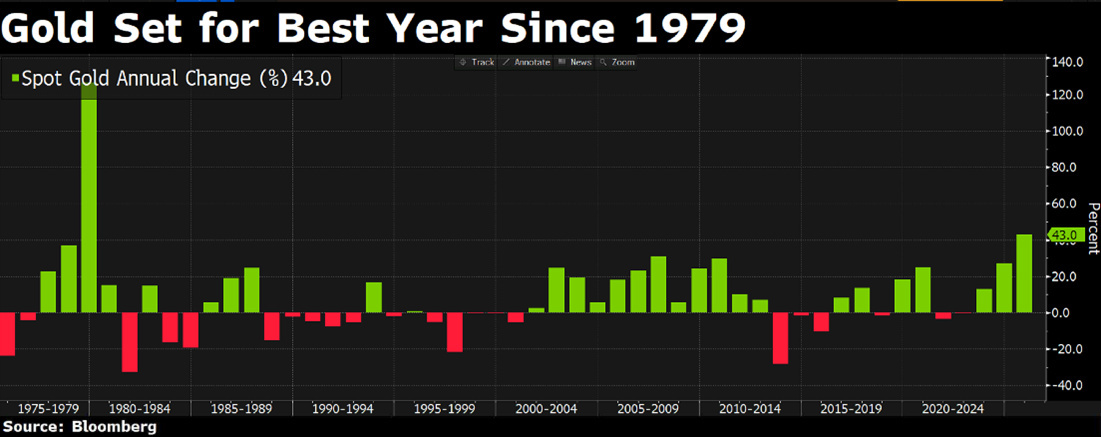

The gold market continues to reach new historic highs, with a YTD performance of +40%, the best since 1979.

The combination of persistent inflation and slowing economic growth is prompting more and more institutional investors and central banks to hedge against systemic risk. The price of silver has also risen to its highest level in 14 years, confirming the return of interest in safe-haven assets.

On the labor front, US jobless claims fell back to 218,000, better than expected. However, this positive data should be viewed in context: any signs of deterioration in the labor market could erode confidence in the cycle, especially if accompanied by a return of core inflation.

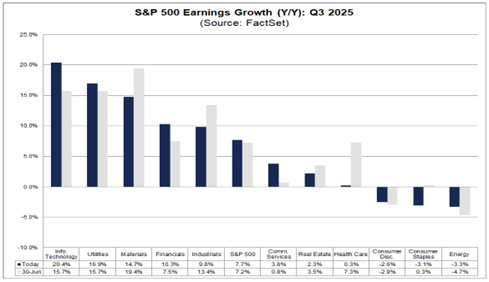

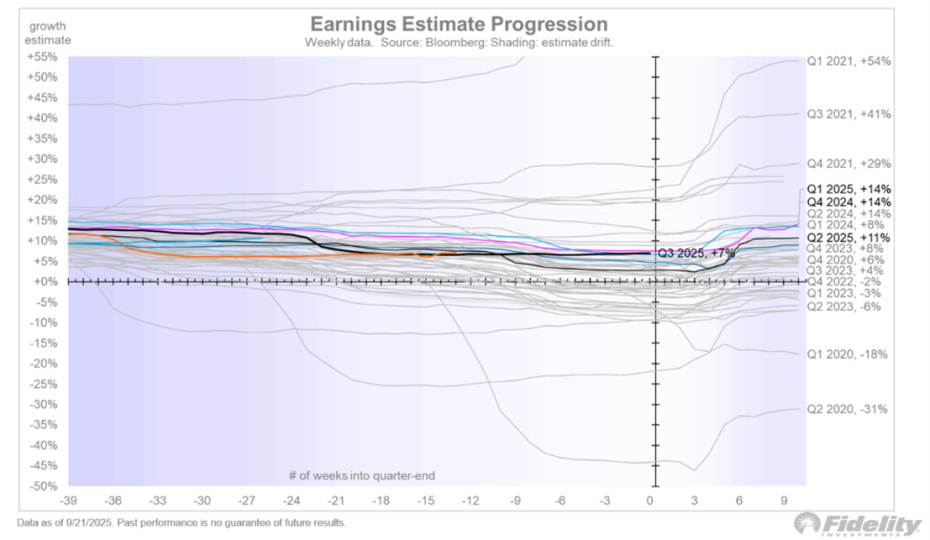

The new third-quarter earnings season is approaching. After a surprisingly positive first half of the year, with Q1 and Q2 exceeding expectations thanks to widespread margin improvement, investors are now looking to Q3 as a test case to confirm earnings momentum. Consensus estimates remain steady at around +7% growth in S&P 500 earnings per share, but a possible improvement is expected with the start of the reporting season.

This is certainly not a new pattern for the revision of estimates, which are usually lowered by analysts in the weeks leading up to the earnings season, only to be beaten and then revised upwards in the reporting weeks.

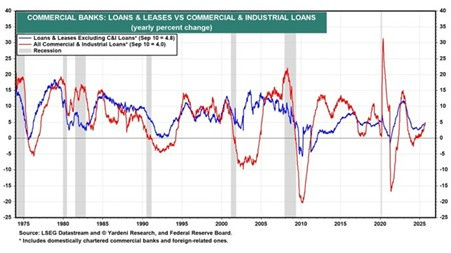

The financial sector should make a particularly significant contribution in the third quarter, which could surprise on the upside thanks to growth in lending volumes, the steepening of the yield curve, and improved investment banking activity. In this context, it is no coincidence that bank stocks have returned to outperforming: the S&P 500 Financials index has reached new highs, supported by growing credit volume data.

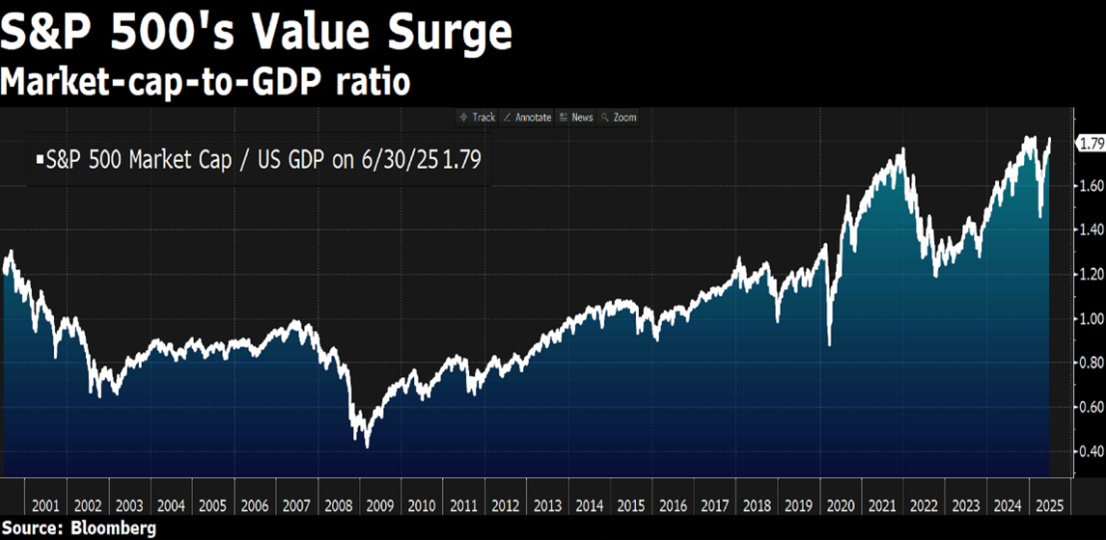

However, there remains a risk factor that should not be underestimated: US stock market valuations, particularly for growth stocks, have returned to very high levels compared to historical averages. The forward P/E ratio of the S&P 500 is comparable to the peaks seen before the dot-com bubble, while the absence of a significant risk premium means that any disappointments in guidance or inflation could trigger rapid corrections.

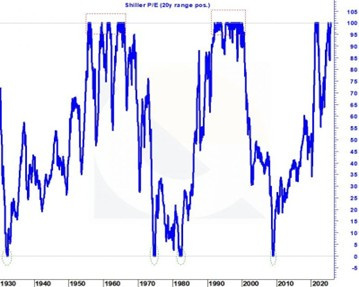

However, it is important to remember that fundamental valuation parameters do not lend themselves to a symmetrical interpretation. When multiples reach extremely low levels, these phases tend to be short-lived and often represent historic entry opportunities, because the market reacts quickly, bringing valuations back to the mean. Conversely, when multiples are high, the situation is very different: such conditions can persist for a long time. A clear example emerges when analyzing price/earnings in a 20-year rolling window: moments of extreme undervaluation appear rare and concentrated, while phases of overvaluation tend to last longer, becoming the norm rather than the exception. In short, multiples can remain high for a long time before returning, as they certainly will, to the mean.

In his speech in Providence, Fed Chairman Jerome Powell noted—something he does not often do in his speeches—that according to various metrics, stock prices appear to be quite high. However, he pointed out that the current environment shows no signs of significant risks to financial stability. The comment raised some concerns: although agreeable in substance, that final reassurance triggered a contrarian instinct. Financial crises, in fact, often present themselves as “Black Swans”: unexpected events that emerge precisely at moments of irrational euphoria. In this regard, the text recalls Alan Greenspan's famous words in 1996 on “irrational exuberance” and the dangers of asset overvaluation.

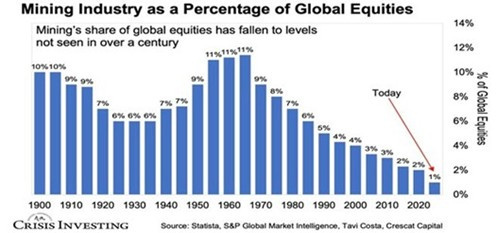

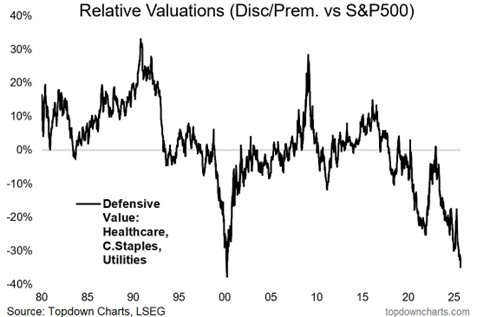

The good news is that the market is also full of abandoned and forgotten stories, characterized by very attractive valuations. The weight of the mining sector in the global stock market, for example, has fallen to 1%, the lowest level in over a century. Yet, with the energy transition underway and structural demand for copper, lithium, and rare earths, the conditions for a reversal seem increasingly ripe. Historically, the best entry points have occurred when sentiment was at its lowest and market share was at current levels.

A similar argument could be made for the pharmaceutical sector and certain areas of non-discretionary consumption, such as the beverage sector. These are all market areas where momentum is certainly lacking, but which offer potential value reserves in portfolios.

In conclusion, we remain constructive but selective. The AI narrative, the earnings cycle, and the Fed's new stance continue to support the market, but US equities are trading at valuation levels that require solid results to be justified. The next quarter, and in particular the ability of companies to beat estimates, will be the real test of the sustainability of this rally.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.