Recession? No, maybe Soft Landing

17 February 2023 _ News

The FED has a huge challenge ahead: being able to slow down the economy to allow inflation to recede, thus allowing companies to work under a normal inflationary regime. But at the same time, it must work to avoid a severe recession that could have, among other consequences such as excessive unemployment.

The Central Bank of the United States of America is succeeding in slowing down the economy without interrupting its growth, the so-called soft landing, an event about which we at Pharus have always been confident.

Let’s first look at the reasons supporting the economic slowdown.

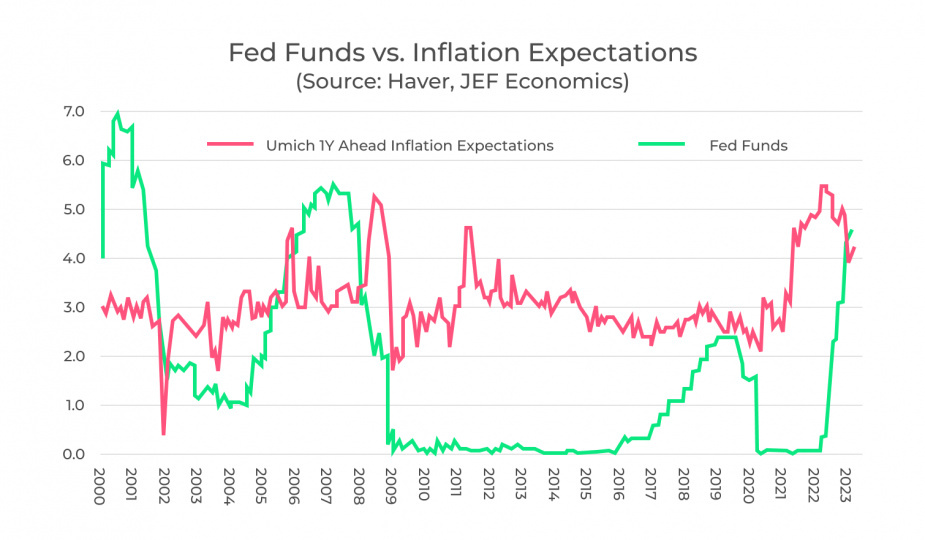

First, the rise in interest rates has tightened financial conditions, and this can be clearly seen from the fact that FED has raised short-term rates above 1-year consumer-expected inflation:

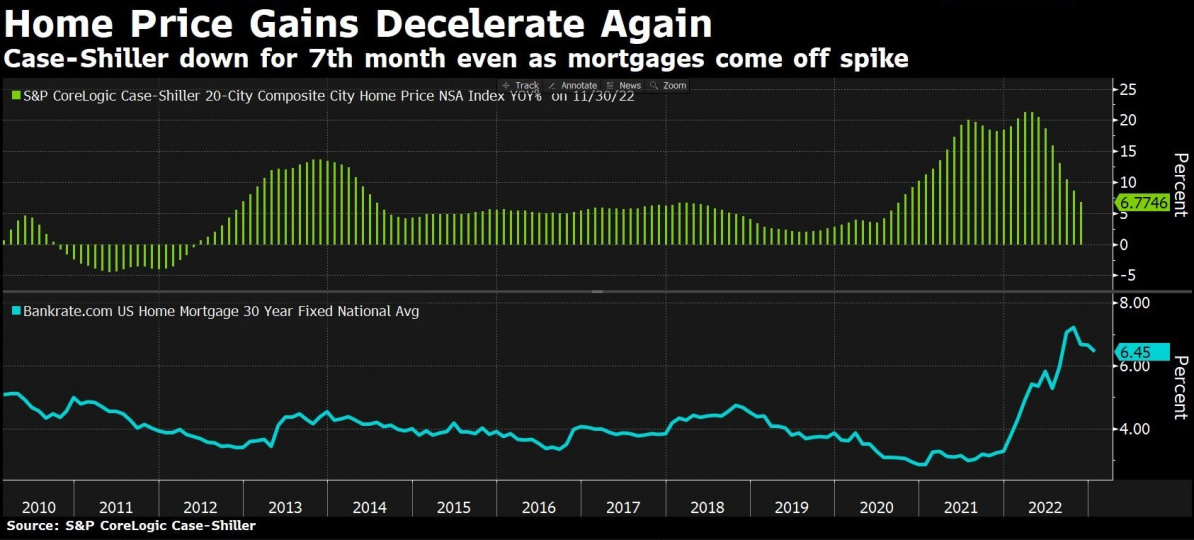

This tightening of financial conditions can also be seen in the decline in house prices as measured by Shiller, which shows that from the peaks at the beginning of the year, the price of American homes is falling. This trend is aided by mortgage interest rates of around 6.5 percent, the highest level in 15 years:

Analyzing the state of credit supply and demand in the United States, we see that loan demand is at the lows of 2020 and 2009, while on the supply side, the conditions set by banks are particularly restrictive as in 2020 and 2008.

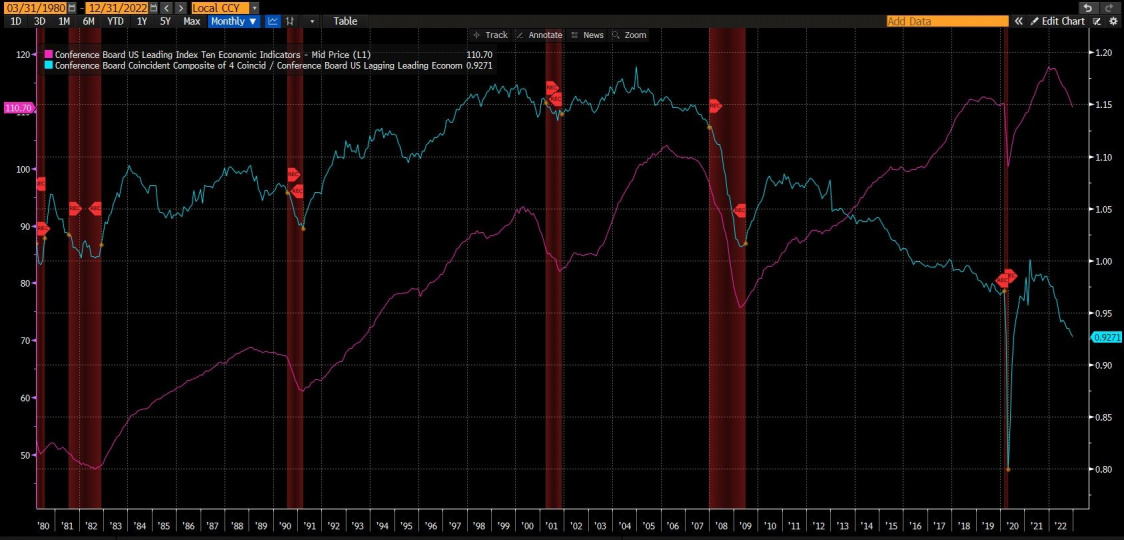

The third indicator, expected on Friday, which is supposed to confirm the easing of economic conditions, is the Leading Index, which is intended to forecast future economic conditions, which are currently falling sharply:

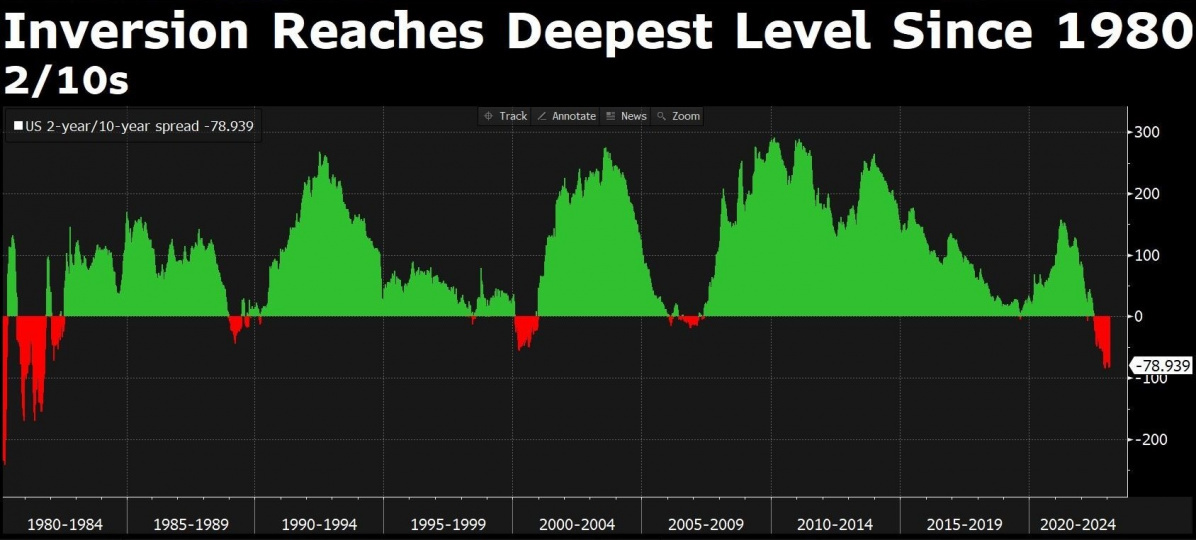

The fourth indicator emerges from the bond market, where the two-ten-year spread continues to show a strong inversion around -80 basis points, values seen only in the 1980s. This inversion implies that the market believes that the Fed's high-rate conditions are too restrictive and could cause an economic slowdown.

But why should this slowdown not turn into a severe recession?

First, the U.S. labor market continues to remain very strong. In January new employment was about 517k, with the monthly average of new employment over the past 6 months at 413k and the past year at 504k. Comparing these numbers to averages of recessions since 1945 shows that the 6-month average is about 90k newly employed, 110k at 6 months, and 128k at 1 year, highlighting how it is not possible to talk about a recession with such a strong labor market.

Second, the U.S. reporting season confirms a slowdown but better than expected. Overall, 69% of S&P 500 companies reported results for the fourth quarter of 2022. Of these companies, about 70% reported earnings per share above estimates by about 1.1%. Evidence of how low investors' expectations were is the market's reaction to a below-expectations reporting, where companies were punished by only -0.4 percent over the next few days compared to the historical average of -2.2 percent. The mixed earnings decline for the fourth quarter is -4.9 percent today, compared to a -3.3 percent decline at the end of the fourth quarter. For 2023, expectations are for +2.4% earnings growth, compared to 4.8% at the end of December.

In conclusion, we continue to see in the numbers the possibility of a Fed-led economic slowdown, the so-called soft landing that could even turn into a no-landing. This would imply an earnings revision that is already widely priced by the markets.

Information message - The information in this message is produced for information purposes only and therefore does not qualify as offer or recommendation or solicitation to buy or sell securities or financial instruments in general, financial products or services or investment, nor an exhortation to carry out transactions related to a specific financial instrument.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

RELATED CONTENTS