Risk Off o Opportunità? Come i Mercati Reagiscono agli Shock

23 June 2025 _ News

The dominant theme of the week is undoubtedly the re-ignition of the conflict between Iran and Israel. Israeli air raids on Iran's nuclear and energy infrastructure and Tehran's subsequent drone and missile responses have brought instability in the Middle East back to the centre of investors' concerns. It seemed that markets were waiting for some sort of resolution to the conflict, but over the weekend, the US bombing of three nuclear sites in Iran made such a resolution even more uncertain, putting market participants back into risk-off mode as they awaited events.

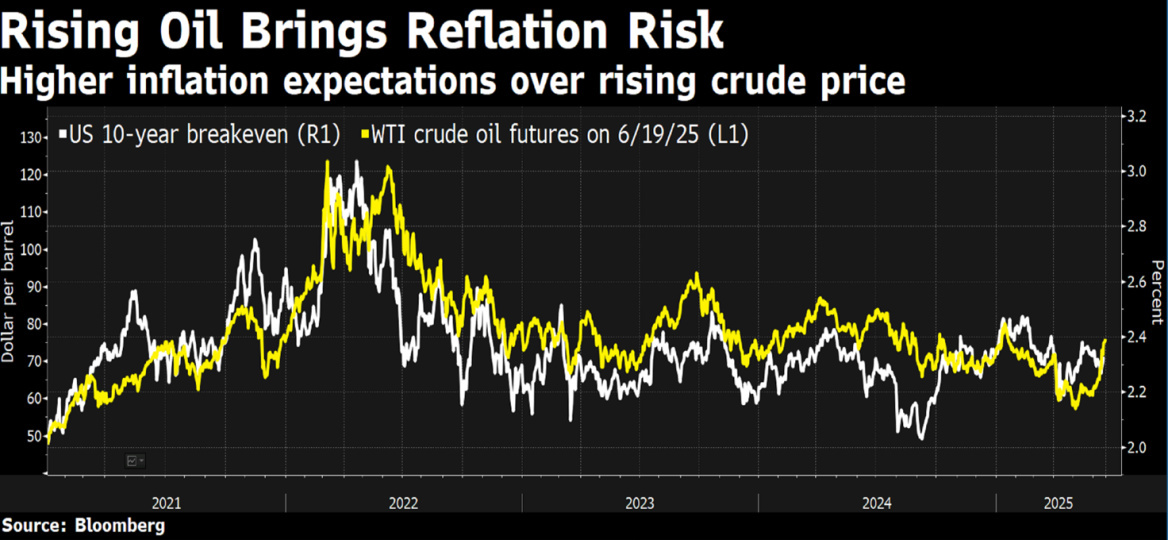

The market's attention will focus on the Strait of Hormuz, through which some 20% of the world's oil passes every day. More escalation is likely to result in a short-term rise in oil, rates, dollars and hints of “stagflation” in the media, which can hardly help stocks. Less escalation or resolution will probably mean the opposite.

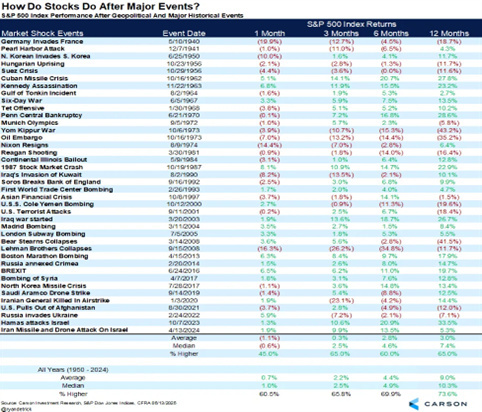

Although not very pronounced, the market reaction to the Iran-Israel conflict is following a familiar pattern in market behaviour during geopolitical shocks, which typically involves three phases. A first phase of rapid revaluation of risk (the so-called risk off where everything is sold off), a second that sees investors reallocate capital by moving into defensive sectors, and finally a final stabilisation as investors' expectations are recalibrated.

Looking at previous geopolitical tensions or historical events that have occurred since 1940, statistics tell us that on average already three months after the start of the event, indices have already realigned themselves to the historical average trend and performance.

What is most important for investors to understand is that markets tend to quickly discount geopolitical risk, especially when energy supply chains or critical infrastructure are targeted. As geopolitical events such as the latest Iran-Israel conflict occur, investors focus on the worst possible outcomes. However, it is crucial to take a step back and observe how markets have reacted throughout history to such events.

And what history teaches us is that geopolitical shocks of this kind tend to trigger short-term movements, followed by a gradual stabilisation. It happened in the past during the Yom Kippur war, the Iranian revolution of '79, the Gulf conflict, and also in more recent crises such as those of 2006 and 2014. Initially, the market discounts the worst, but when the risk perimeter becomes clearer, opportunities return and the market is bought back by investors.

The key element was that today the markets were arriving at this geopolitical appointment with valuations that were certainly not given away. The major stock indices had recorded one of the best two-month rallies in recent history, with the S&P 500 up more than 20%.

In such an environment, any negative event can become a catalyst for a technical correction, and the conflict in the Middle East provided the pretext. It is not surprising, therefore, if we see a consolidation phase in the coming days.

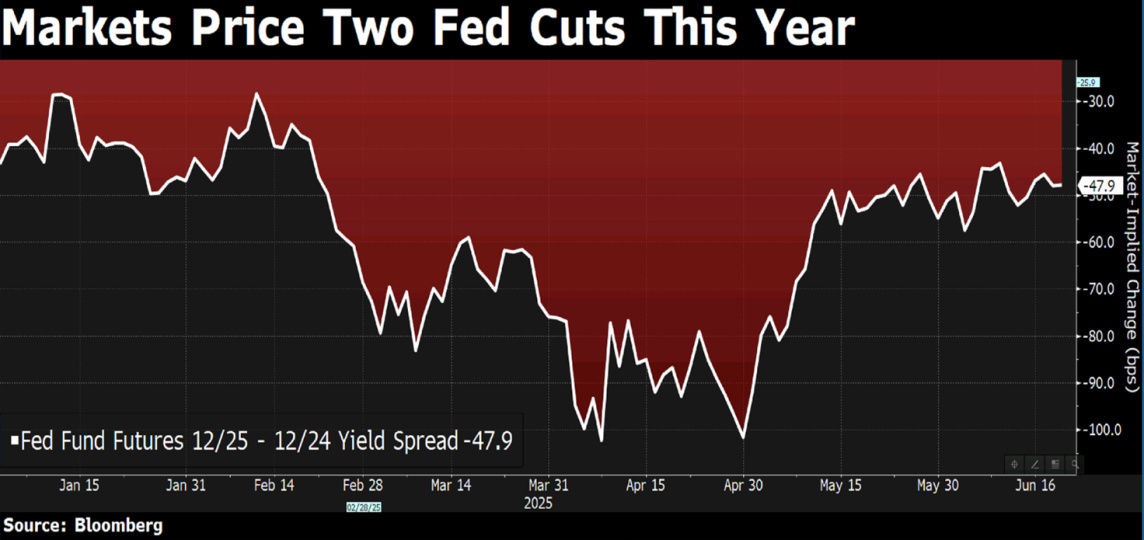

Besides geopolitical tensions, another highly anticipated event that catalysed investors' attention was the Federal Reserve. The US central bank left rates unchanged as expected and confirmed its intention to make two cuts by the end of the year.

But uncertainties also increase within the FOMC: compared to March, the number of members who do not see any cuts in 2025 has risen from four to seven. Chairman Powell, in his usual measured tone, emphasised that monetary policy remains “well positioned to wait”, even in light of the still uncertain effects of tariffs and geopolitical tensions.

The political side is also interesting: during the FED meeting, Donald Trump called Powell “stupid” and ironically wondered whether he could appoint himself president of the central bank. A surreal scenario, but one that reminds us how much the US political horizon is becoming an increasingly relevant variable for the markets.

With regard to tariffs, the Fed indicated that the full impact on consumer prices has not yet been seen. The transmission of effects along the supply chain takes time, and only in the coming months will we be able to assess the actual inflationary pressure. Meanwhile, macro projections were revised: GDP growth to 1.4% (from 2.1% in December) and inflation to 3% (up from 2.7%).

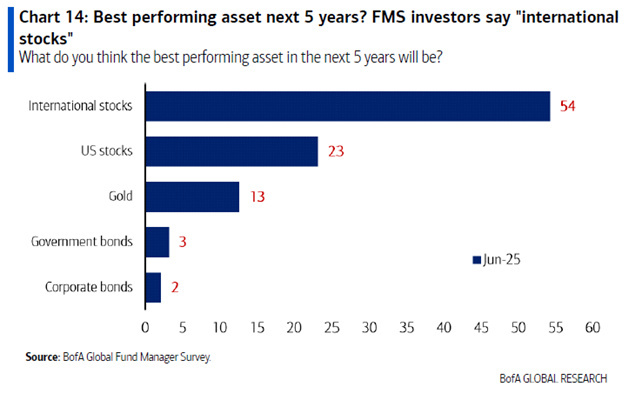

While waiting for mid-July, the start of the new reporting season for the second quarter, which might help the market to clarify the real effects of the duties on companies, we make one last reflection on global earnings trends. While earnings estimates in the US have been revised downwards since the beginning of the year due to the duties, developed markets outside the US are experiencing an unexpected upward revision of earnings expectations.

Coupled with the weakness of the dollar and the strong valuation differential (21x the S&P 500 versus 15x the rest of the world), we may continue to see a phase of convergence between markets. This is exactly in line with the findings of bank of America's latest Fund management survey in which as many as 54% of respondents said they expect international equities to be one of the best asset classes over the next five years.

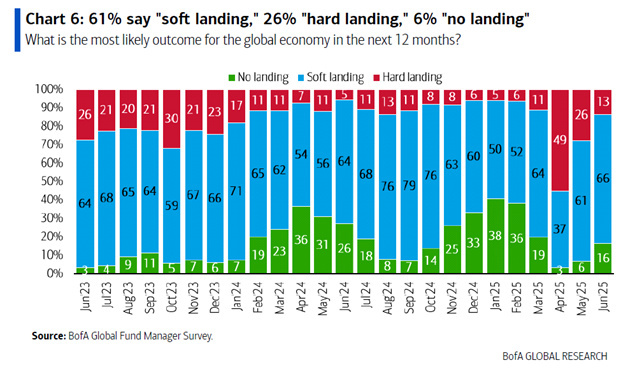

In summary, we are moving in a scenario dominated by complex variables of great uncertainty such as military escalations, reallocation of production chains, currency tensions, Fed moves and new trends in global flows. Despite this, markets have today returned to generous valuations. It would be excessive to consider the current valuations as priced for perfection, but we can certainly say that they do not leave much room for disregard. Suffice it to say that according to the Fund Management Survey, 66% of the managers surveyed said they expected a soft landing of the global economy, and in this respect, too, the new reporting season may help us better understand the effects of complex dynamics on corporate earnings.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.