Sustainability of US debt: truth or passing panic?

27 May 2025 _ News

The new focus of global investors returns to the sustainability of U.S. government debt. Already in the last installment, we pointed out that the bond market could become the real focus of investors' attention and that rate tensions could prove decisive for market equilibrium. A few days later, we can only see that that reflection was well founded.

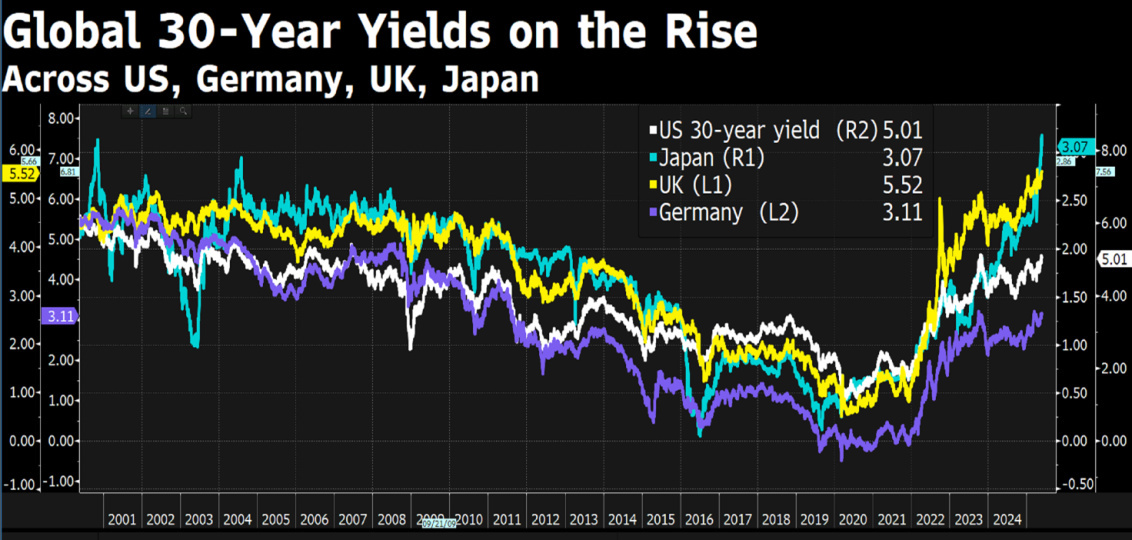

Indeed, signs of stress in the U.S. bond market have intensified in recent days, with the yield on the 30-year Treasury closing above 5.10 percent for the first time since last October, and it was especially Tuesday night's auction of 20-year Treasuries that set off alarm bells: low demand, higher-than-expected yields, low coverage, and a wide tail. All reflecting a growing hesitancy on the part of investors to finance American debt.

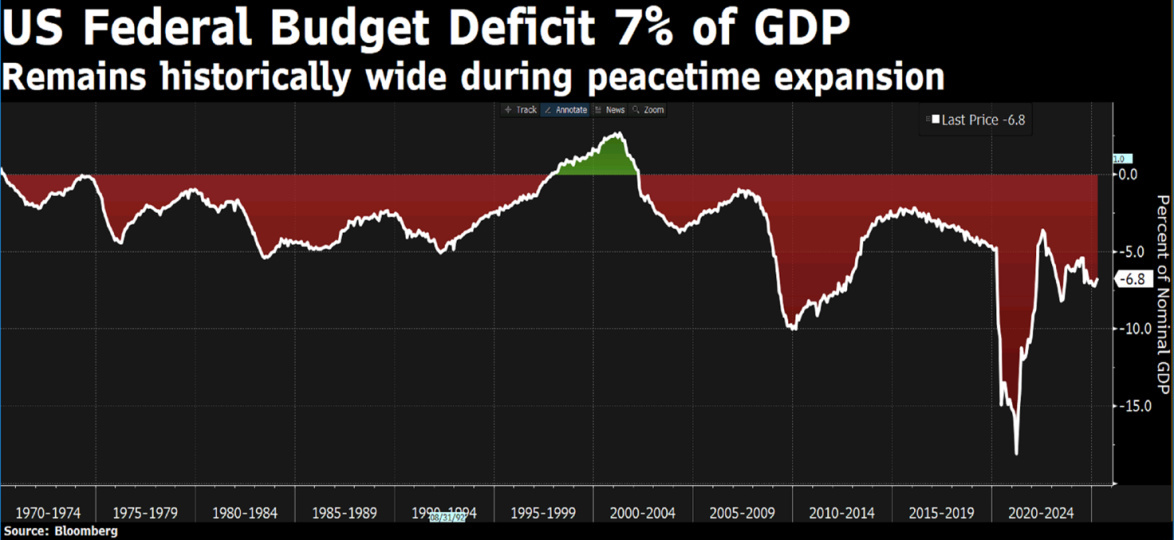

To make the picture even more delicate, after Moody's downgrade of the U.S. debt rating also came the news that with a tight vote of 215 in favor to 214 against, the House approved Trump's gigantic so-called “Big Beautiful Bill” tax and spending bill, which now goes to the Senate and could increase the deficit to well over 7 percent of GDP, with a cumulative impact on the national debt of between .5 and .7 trillion over the next decade.

The market is thus beginning to discount a scenario that until a few months ago seemed unthinkable: the risk of a crisis of confidence in the United States' ability to credibly and sustainably manage its public debt. The Bond Vigilantes-those investors ready to sell bonds massively in order to punish fiscal policies deemed unsustainable- thus seem to be back in action.

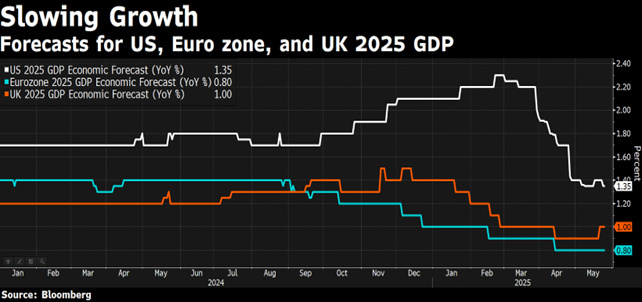

Internationally, pressure is also being felt on the interest rate world. Long-term yields have risen en bloc in Japan, the United Kingdom, Canada, and Australia, all countries with expansionary fiscal policies and still accommodative central banks. It is a global wake-up call that lays bare a clear dynamic: when deficits and debt combine with above-target inflation for central banks and tepid monetary policies, sovereign risk begins to be priced differently.

But is an American debt crisis, with obvious global consequences, really imminent? Or are we for the umpteenth time facing an overreaction?

For now, inflation data continue to show restraint. The Cleveland Fed's Inflation Nowcasting model estimates core inflation for May at 0.12 percent on a monthly basis, and headline CPI around 0.23 percent. Numbers that seem to rule out a sudden price explosion, even with the already implemented tariffs. Weak oil prices are helping to keep inflationary expectations in check. However, as reported by Fed Chairman Powel, we may have entered an era of more frequent and longer-lasting supply shocks, with greater instability in inflation dynamics.

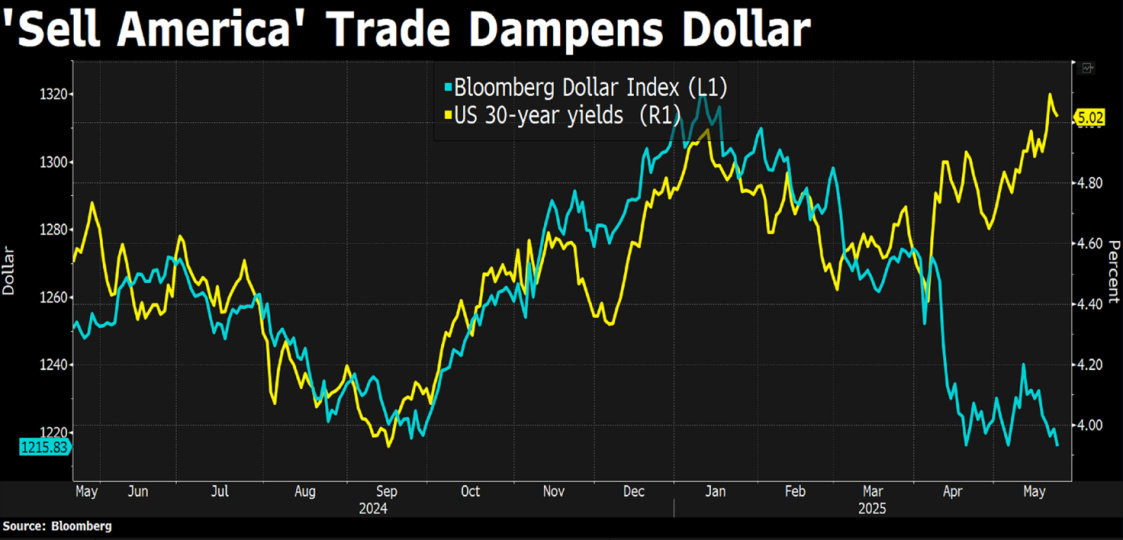

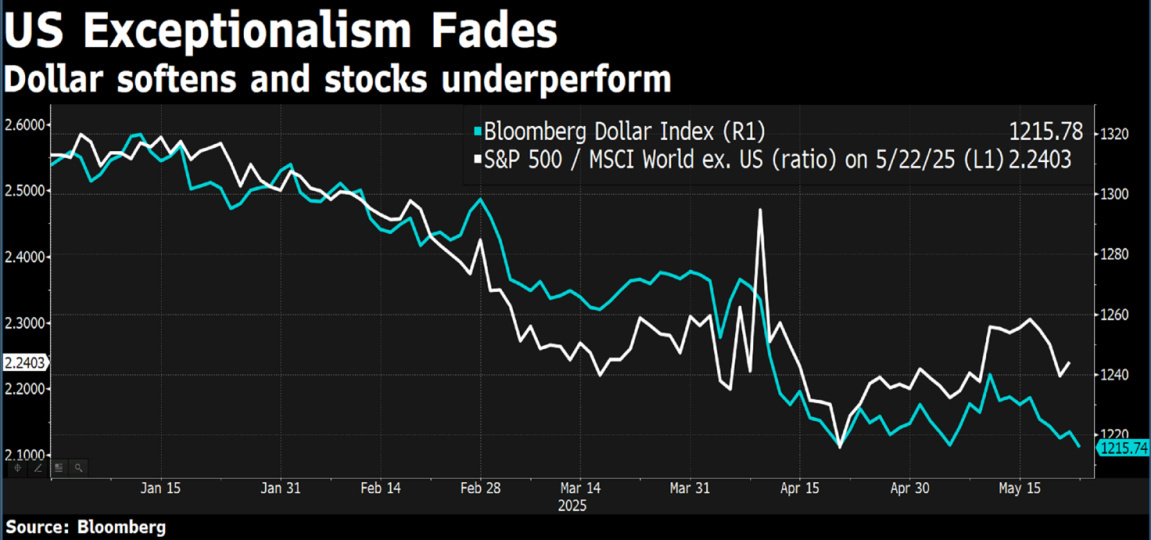

An interesting theme related to these narratives, which has attracted the attention of investors over the past month, has also been the anomalous behavior of the relationship between the dollar and interest rates: for several weeks, we have observed a rise in Treasury yields accompanied by a decline in the dollar.

A dynamic that has raised doubts about the soundness of the U.S. currency, fueled fears of a structural imbalance, called for de-dollarization and created debate about the end of American exceptionalism and their loss of confidence and credibility.

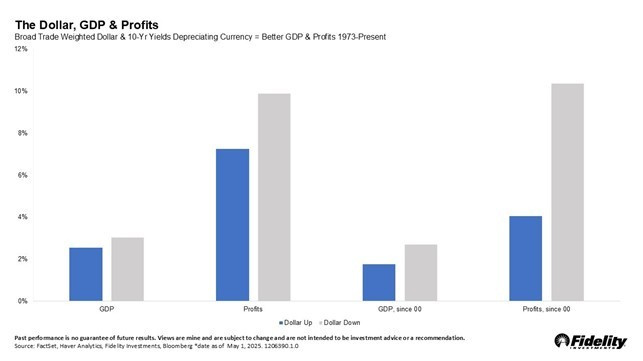

But a broader look suggests that this is much more likely to be a short-term anomaly than a structural change. Indeed, this is not the first time in history that this combination has occurred, and historically it has not been associated with particularly bad performance for the S&P 500. Indeed, it is precisely during phases of rising yields and a weak dollar that, on average, the index has shown the most attractive returns. That's because a weaker dollar encourages earnings growth for U.S. companies with strong international exposure-which account for about 40 percent of the S&P 500's sales-and generally coincides with a more favorable macro environment. So, and we will continue to remind, any dynamics in the markets should always be read and traced back to the effects on economic growth and in particular on corporate earnings growth.

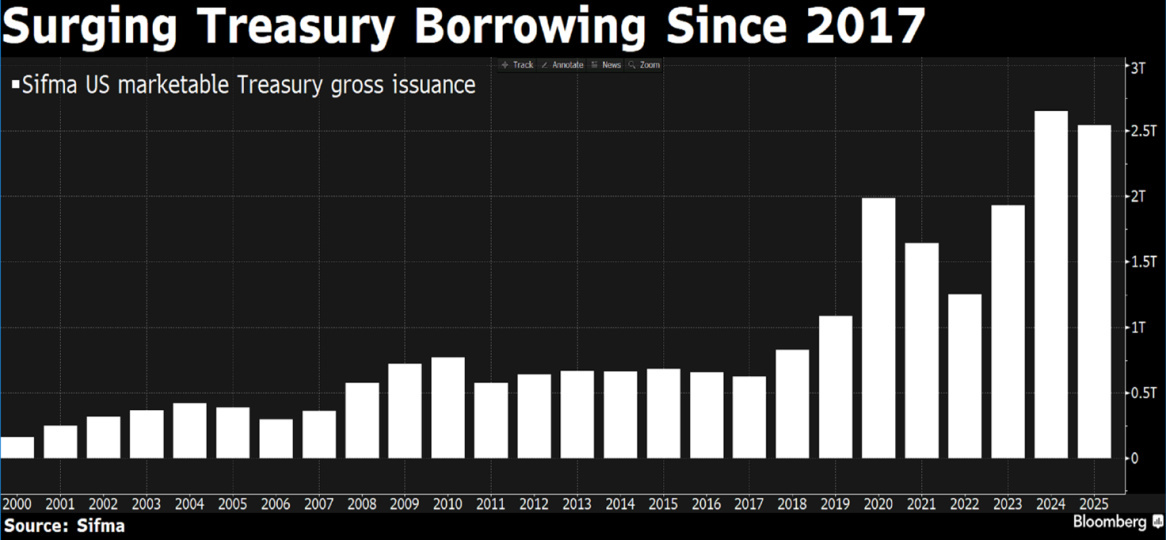

For the more skeptical, it is worth mentioning that the U.S. Treasury, in a further deteriorating scenario, would certainly not stand idly by and could decide, for example, to recalibrate the composition of issuance, favoring short-term securities to contain the impact on long-term yields. This is a kind of unspoken yield curve control that Janet Yellen had already experienced in late 2023. Moreover in case of an even more violent deterioration, Quantitative Easing as the instrument of last resort to ensure market liquidity would even come back into question.

Meanwhile, the stock market reacted, leading the S&P 500 to close the week down 1.6 percent, with the technology sector and growth stocks suffering the most. Indeed, debt tensions are pushing up real rates, affecting valuation multiples.

A market reaction that not surprisingly comes with Equity valuations now back in the mid-to-high range in all major geographies, suggesting that in the short term a consolidation phase is more likely than a further acceleration in prices. Markets will be focused on the upcoming corporate earnings season and will carefully assess the effects of tariffs on corporate performance and macroeconomic indicators.

As we approach the end of the year, however, the focus will shift to the possibility of future rate cuts by the Federal Reserve, in a context where trade tensions are likely to be overcome and the U.S. administration can refocus on more investor-friendly elements, chief among them deregulation (a theme particularly beloved by equity markets). Indeed, the Trump administration is increasingly realizing that the only way to make debt sustainable is to grow more, and the new measures in terms of deregulation are indeed pro-growth.

In conclusion, we cannot rule out the possibility that the issue of U.S. government debt will become a major market variable in the coming months. But as is often the case, crises can also become opportunities, and as has happened in the past, it could create attractive entry points for the patient investor.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.