Technology cooling down, defenses recovering.

04 December 2025 _ News

US stock markets continue to show unusually sluggish performance for a time of year that is traditionally characterized by strong seasonal support.

This moderation reflects growing uncertainty about the global financial system's ability to absorb the investment volumes needed to support the acceleration in artificial intelligence infrastructure.

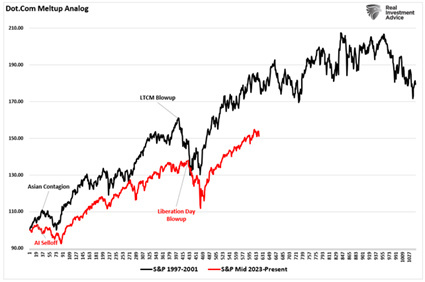

The prevailing narrative therefore oscillates between fears of overvaluation in the artificial intelligence sector and an economic environment that continues to show resilience: improving real growth, accelerating productivity, and expanding investment. Taken together, these factors are more reminiscent of the start of a structural pro-growth phase than the early signs of a cyclical reversal.

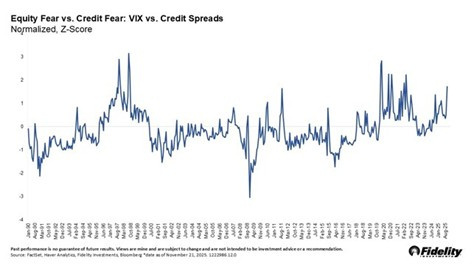

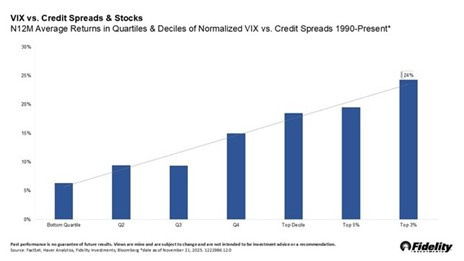

The current correction is fully within historical norms, with drawdowns of between 5% and 10% occurring cyclically and, in about three out of four cases, not preventing a positive year-end close. However, the significance of the current phase lies in the nature of the correction, not its intensity. Implied equity volatility, as measured by the VIX, shows an increase in risk aversion, while high-yield credit spreads remain compressed and far from levels that typically precede systemic stress.

This divergence between equity and credit risks being underestimated: in the major crises of recent decades, credit has almost always deteriorated before equities, while periods in which equities show greater nervousness—such as the current one—have often been followed by significant recoveries over 6–12 month horizons.

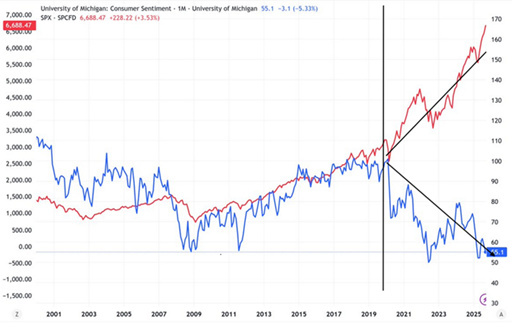

Sentiment indices are in a state of deep pessimism, in the lowest decile of the last forty years, and this is happening in a context of stock markets at their highest levels. From a macro perspective, the divergence between the strength of financial markets and the malaise felt by American households can be explained by the established “K” pattern. The upper segment of the K includes large corporations, technology, luxury goods, and more generally holders of financial assets, who continue to benefit from AI dynamics, improved productivity, and a cost of capital that, although higher than in the 2020-2021 period, remains sustainable for the most solid balance sheets. The lower segment includes low- and middle-income households, small businesses, and traditional sectors: categories penalized by persistent inflation in essential goods and services, high housing costs, and real interest rates that remain at restrictive levels. This polarization fuels political tensions, increases sensitivity to fiscal and tariff choices, and raises the likelihood of regulatory shocks in the coming quarters.

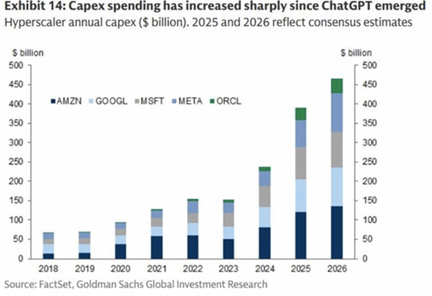

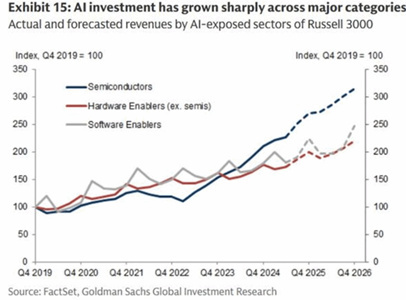

The central issue, however, concerns the risk of a bubble in artificial intelligence. The most obvious signs include very high valuations on some large caps, parabolic expansion of price charts, a growing flow of capital towards startups that are still unprofitable, and record levels of capex in data centers and semiconductors. However, elements characteristic of the terminal stages of a bubble are missing: there is no marked increase in systemic leverage, credit spreads do not signal a deterioration in risk, and structural volatility remains subdued. The current cycle therefore has two components: on the one hand, selective euphoria and aggressive repricing of assets most exposed to the AI narrative; on the other, real infrastructure investments and measurable improvements in productivity, elements consistent with a technology cycle still in its early stages.

Another aspect that the market is gradually incorporating concerns growing hardware competition. Nvidia's dominance in the AI chip segment, while still solid, is being eroded by the advance of proprietary chips developed by hyperscalers such as Google, Meta, and Amazon.

The goal is to reduce dependence on external suppliers, optimize hardware architectures, and, above all, improve the economics of their cloud and AI services. In the medium term, this could put pressure on the margins of some existing leaders and rebalance bargaining power within the supply chain. For investors, this is a call for caution: even among the “structural winners,” it is essential to assess the sustainability of multiples in the face of growing competition that is no longer purely theoretical.

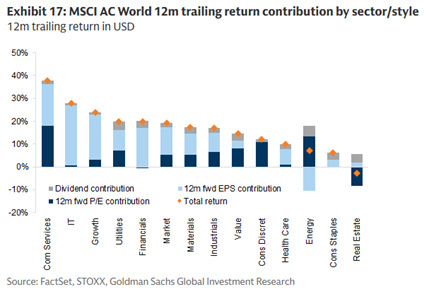

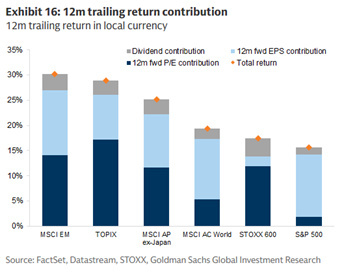

From an operational perspective, a few guidelines emerge. First, the current sentiment and positioning suggest that the conditions for a tactical rebound remain intact. If productivity dynamics continue to surprise on the upside and the labor market maintains an orderly pace of cooling, it would not be unrealistic to assume that the bullish cycle will continue. Second, exposure to AI requires sophisticated portfolio management: participating in the trend is important, but avoiding overly directional or unprotected positions is equally important. Third, the sector rotation currently underway—with technology and consumer discretionary among the oversold and healthcare and energy improving in momentum—is a typical sign of corrective phases, in which the market rebalances leadership after long periods of concentration.

In conclusion: the current market phase requires discipline, selectivity, and rigorous risk management. In major innovation cycles, participation is important, but survival is more so. Added to this is a particularly relevant factor today: the rotation underway and the shift in leadership in favor of defensive sectors, which began at the start of this quarter, may represent a phase of “healthy correction” for the market. The presence of non-tech sectors that are keeping the indices afloat is allowing technology to decelerate in an orderly manner, returning from excessive valuations to more sustainable and potentially more attractive levels in the medium term. This is contributing to an increasingly healthy market driven by fundamentals.

As long as there is a wall of concern to climb, and liquidity shows no signs of significant contraction, the bullish cycle remains on solid footing. The goal of professional investors remains to participate cautiously, avoiding asymmetric risks but without giving up the potential benefits of an innovation cycle that is still far from maturity.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.