The Classic Hated Young Bull Market

27 July 2023 _ News

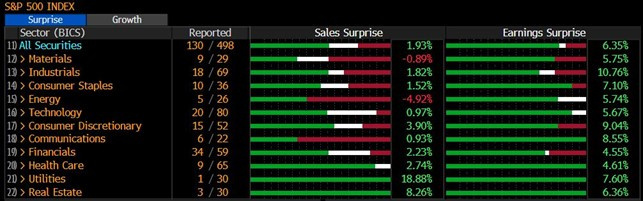

These days the American earnings season is coming into full swing and also in Europe many companies are reporting results for the second quarter of 2023. If we look in the U.S., so far 25% of companies in the S&P 500 have reported and 75% of them have beaten estimates by reporting earnings 6.5% above expectations.

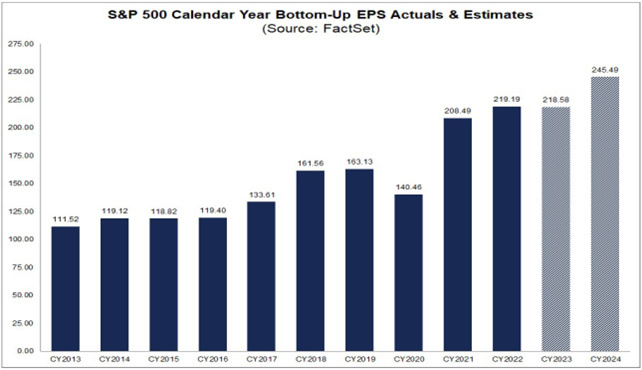

Consensus earnings are expected to decline by 9 percent for the second quarter (the third consecutive quarter of declining earnings) and are then expected to return to growth from the third quarter, bringing the same estimates to zero by the end of 2023 and to 12 percent by 2024.

If we had to find a title for this reporting season start we could use "when good results meet high expectations." The results reported so far have in fact been good overall, but what we can clearly see is that where the bar of expectations is already high and valuations are generous, it becomes very difficult for stocks to surprise further (this is the case with Tesla, Netflix, Microsoft, intuitive surgical just to name a few), all stocks with good reporting that were, however, met with negative performance on the day after the release of results; on the contrary where expectations and valuations are lower even results in line with expectations are translating into positive performance (this is the case of tech giant alphabet, several pharmaceutical stocks or some banks). These dynamics are very common on Wall Street, where it is often not enough to look at the consensus to assess the goodness of the reported results, but where one has to deal with the so-called "Whisper numbers" or expectations, often higher than the official ones, that circulate among portfolio managers and that represent the real number to beat for all companies reporting results.

Even in Europe, about 25 percent of companies have reported to date, showing very similar dynamics to those in the U.S. by recording a 4.8 percent earnings surprise.

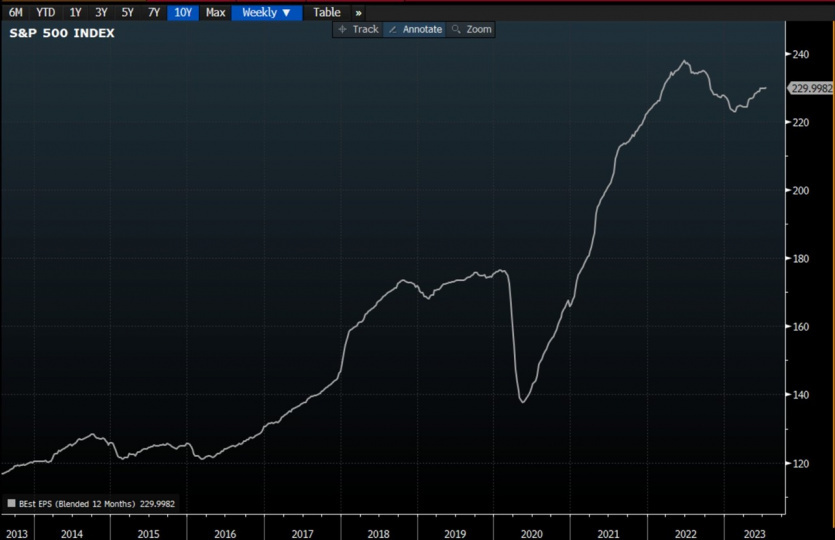

We will continue to monitor very closely the progress of both American and European reporting, which nevertheless seems so far to be showing good results and good corporate health, helping to support the view of a new upward earnings cycle that has just restarted, in which few seem to believe.

Moreover, young bullish markets tend to be widely hated. This is because many investors who sold during the previous bear market are unable to get back in. Let`s also add as very likely the fact that many of them let their emotions get the better of them and sold right near the market lows, at the moment of greatest discouragement, when value analysis would have suggested to buy instead of sell, and the current young bull market is certainly no exception.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.