The reward of suffering: from euphoria to disappointments

13 June 2024 _ News

Opposite poles

We are approaching the end of the first half of the year with a stock market divided into two opposite poles. On one side we have the technology and communication sectors, and on the other side we have all other sectors. In fact, if we analyze the contribution to the performance of the S&P500 in 2024, we notice that technology and communication contribute about 70 percent of the market's performance.

This leads us to ask two questions, "How is this happening?" and "What to do in the future?"

What's it all about? Mr. Market's pendulum

Mr. Market's pendulum represents the tendency of markets, both stock and bond, to move from positive to negative excess. This stems from the fact that markets are a collection of people, and people consist of a strong psychological component. In fact, psychology too often swings to one extreme or the other, going from depression to euphoria, and spends relatively little time in the "right middle." For this reason, the pendulum is an ideal metaphor for understanding trends in any area influenced by psychology, not just in investments.

Returning to the performance of 2024, the positive outperformance hit the Tech and Communication sectors of 2024 and 2023, and this is precisely the effect of the market pendulum. The Tech and Communication sectors had been the worst performers in 2022, with negative performance of less than -30%. These sharp corrections had led leading companies to very attractive valuations, creating the so-called margin of safety, which drove positive performance in subsequent months.

The pendulum never stops in equilibrium, and in this case, we have gone from negative to positive excess. An example of the action of the pendulum we see from the ratio of valuations between technology and utilities. This ratio is affected by several variables, one among them the different growth of the two sectors, so it is normal to expect the multiple of technology to be somewhat higher than that of utilities.

While in late 2022 on the lows of Tech valuations were equal to those of Utilites, today we find ourselves on the other side with Tech valuations worth twice that of Utilities, a level not seen until 2021 (charts below).

What to do in the future?

- Beware of disappointments

As always, "history does not repeat itself but rhymes," quote. Mark Twain. A large chunk of the stock market has valuations at a steep discount while a few sectors are on valuations never seen in their history.

For example, technology is at 30x PE, a level never seen in the past 20 years. This high valuation has been driven by Mr. Market re-pricing the sector by significantly raising expectations for the Artificial Intelligence impact. In fact, Artificial Intelligence has been the most talked about topic by companies during earnings season, with about 200 companies in the S&P500 talking about it. When you raise expectations so high you put a lot of meat on the fire and then risk disappointing the market.

Let us look together at some past disappointments.

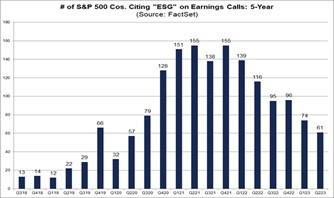

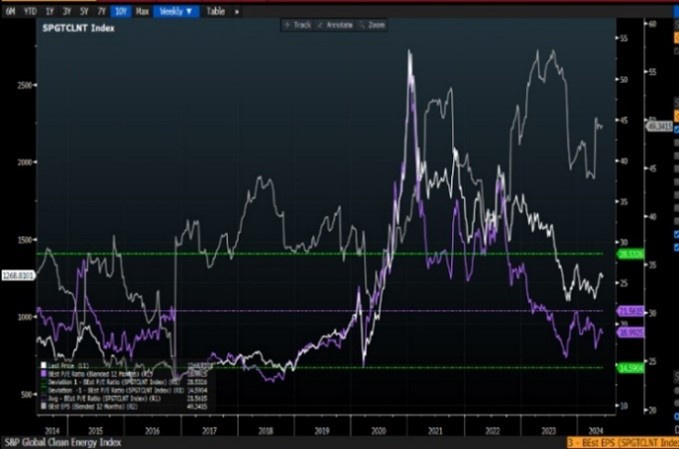

Let's start with the energy transition theme, an investor's mantra until 3 years ago, which had significantly raised investors' expectations of companies in the sector. In fact, one should not forget how the ESG theme was one of the most discussed during earnings season by companies, with some 155 companies in 2021 mentioning it. As whenever expectations are raised, we also tend to raise growth forecasts, inflate the potential market, and get caught up in euphoria. Once euphoria is reached, multiples inflate-in this case from 15x PE to 55x PE-and then comes disappointment (graphs below).

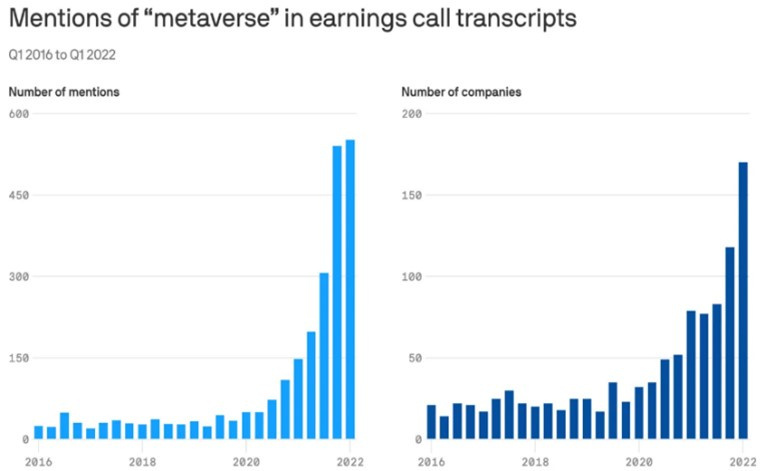

Another past disappointment was the Metaverse, which was one of the most mentioned themes during the earnings season at the end of 2021. Facebook also changed its name to Meta, and this change had led the company to invest heavily in the theme, increasing costs, reducing margins, and leading the company to correct by -75 percent. This theme had led companies to talk about it and create expectations that raised valuations that then led to the 2022 correction.

These are just some of the latest disappointments, but in reality they are always created in the same way: euphoria, evaluation and, at some point, correction.

What to do for the future?

2. Focusing on disappointments by seeking quality

"Mr. Market is there to serve us, not to give us advice," quote. Warren Buffett.

As Buffett says you have to take advantage of the market, looking for what he does not think is most attractive but instead after careful analysis presents qualities. By doing this one avoids staying in areas of the market where expectations are very high and which by nature will tend to fall back bringing disappointment.

Right now a large part of the stock market has these characteristics, namely excellent returns on capital with steep discount valuations present in some parts of the market.

Follow us on our socials to find out what sectors we are talking about.

Finally, in the bond market we believe that government bonds also exhibit this high level of exasperation-delusion that will reward the investor in the coming months.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.