The S&P 500: A Revealing Look Beyond the Surface.

12 May 2025 _ News

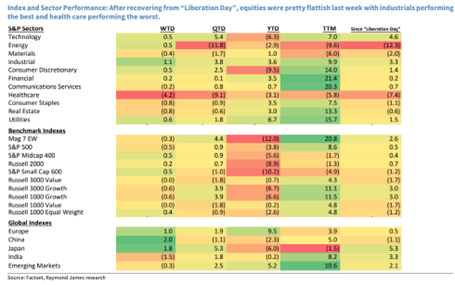

Once again this week, we review the factors influencing the dynamics of the global financial markets. Our focus is on the issue that has monopolised investors' attention: the trade tariffs imposed by the Trump administration, particularly their implications for the Federal Reserve, which is expected to make a decision on interest rates this week.

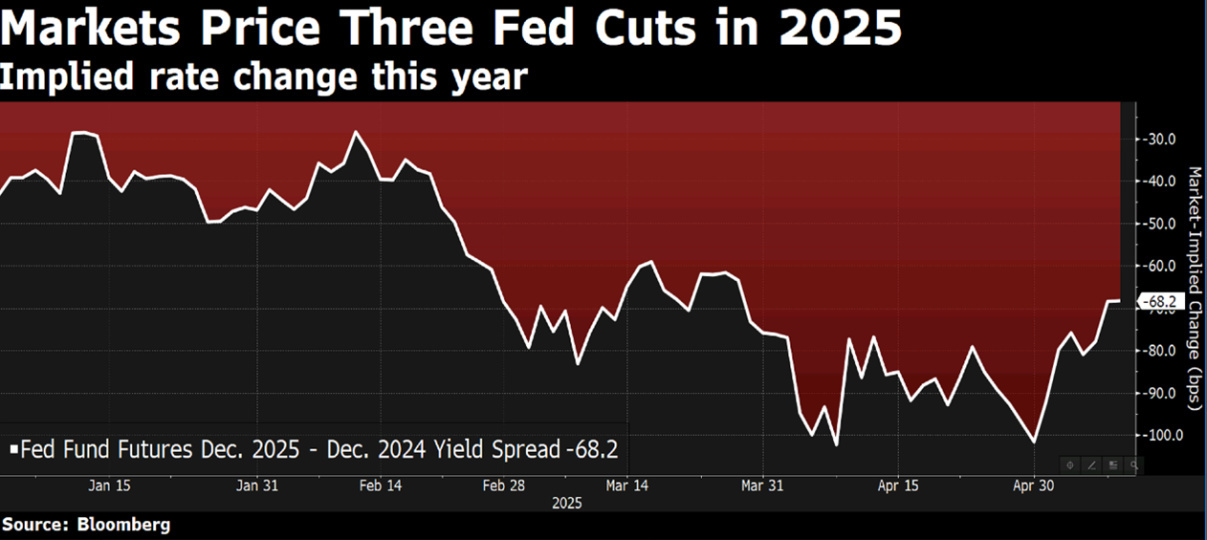

Let's start with the Fed, which, for the third consecutive meeting, decided to leave interest rates unchanged — a prudent decision in an increasingly uncertain environment. Chairman Powell reiterated that the economic impact of the tariffs is still difficult to quantify, and that both business and consumer sentiment has weakened. However, for the time being, real economic data is holding up. However, during the press conference, Powell warned the market about the prospect of stagflation becoming more concrete, stating that 'If the sharp increases in tariffs are sustained, they are likely to generate higher inflation, slower growth and higher unemployment'. Currently, the market is anticipating three rate cuts for 2025.

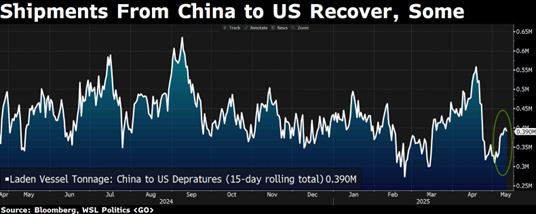

However, there is a new narrative bringing optimism to the markets, where we are talking about trade agreements rather than trade wars. President Trump is under pressure to declare victory in his trade wars and avert a recession that could cost the Republican Party control of Congress in 2026. Meanwhile, he is facing legal challenges regarding the legality of his tariffs. Even if the courts rule that Trump's tariffs are unconstitutional and shut them down, he could still come out on top by declaring victory in the trade wars. Investors were happy to learn that US and Chinese officials are meeting to discuss a trade deal, which has temporarily resulted in tariffs on China being reduced to 30 per cent for 90 days, from 145 per cent currently. They are also happy about the first trade deal with the UK being finalised. However, the negotiation and implementation of all future trade treaties cannot be completed in 90 days. Presumably, this will take us beyond the summer, but it cannot be ruled out that the markets will soon tire of hearing Trump's victory statements about closing tariffs.

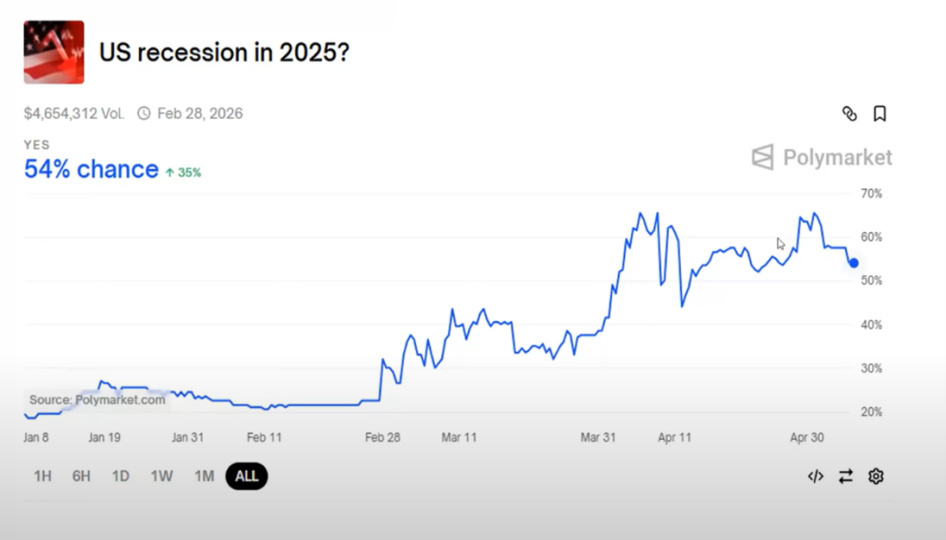

The debate over a potential recession in the United States has returned to centre stage in recent weeks.

Yet, when we look at the markets, they seem to tell a very different story. The S&P 500 has rallied by 18 per cent since April, while companies continue to report better-than-expected earnings and the unemployment rate remains at a historic low. But what does all this really tell us?

One of the most counterintuitive but crucial aspects for any investor to understand is that equity markets tend to move ahead of the economy. From this perspective, they are “leading indicators”, anticipating economic events. This means that markets often begin to rise well before a recession is officially declared over.

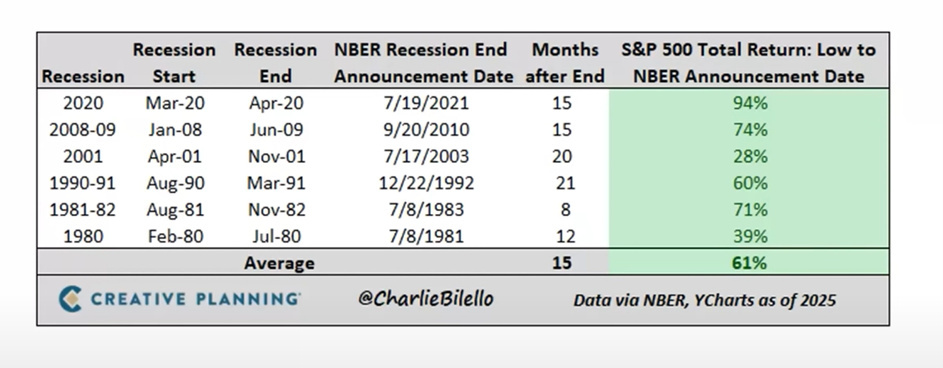

Looking at the last recessions officially recognised by the National Bureau of Economic Research (NBER), the body that certifies economic cycles in the US, the S&P 500 had risen by an average of more than 60 per cent by the time the recession was declared 'over'.

Many people believe that two consecutive quarters of negative gross domestic product (GDP) growth indicate a recession, but this is not necessarily the case. The National Bureau of Economic Research determines the beginning and end of a recession, considering a variety of indicators, not just GDP. For instance, the 2020 recession was declared to have occurred between February and April of that year, a period which does not coincide with two full quarters of GDP decline. Historically, the National Bureau has also not announced the beginning or end of recessions until several months later. For instance, it did not declare the start of the 2020 recession, which began in February, until June of that year. By the time it announced the end of the post-Covid recession, the market had already risen by 94 percent!

In this regard, the famous Warren Buffett quote, 'If you wait for the robins, spring will already be over', is very apt. The robin is a classic symbol of spring and improving conditions. Buffett says that if you wait for obvious signs that the crisis is over, by the time you see them, it will be too late to invest — prices will have risen and the most attractive opportunities will have disappeared. When Buffett wrote this in an editorial in the New York Times in October 2008, the global financial crisis was in full swing, the S&P 500 had already fallen by 50%, and widespread panic had driven many investors out of the market. However, Buffett's message was clear: even in times of fear and uncertainty, I am buying. Waiting for 'clarity' is often a losing strategy. By the time the data is positive and the mood is optimistic, the market has already reacted — the statistics prove it.

In this regard, the famous Warren Buffett quote, 'If you wait for the robins, spring will already be over', is very apt. The robin is a classic symbol of spring and improving conditions. Buffett says that if you wait for obvious signs that the crisis is over, by the time you see them, it will be too late to invest — prices will have risen and the most attractive opportunities will have disappeared. When Buffett wrote this in an editorial in the New York Times in October 2008, the global financial crisis was in full swing, the S&P 500 had already fallen by 50%, and widespread panic had driven many investors out of the market. However, Buffett's message was clear: even in times of fear and uncertainty, I am buying. Waiting for 'clarity' is often a losing strategy. By the time the data is positive and the mood is optimistic, the market has already reacted — the statistics prove it.

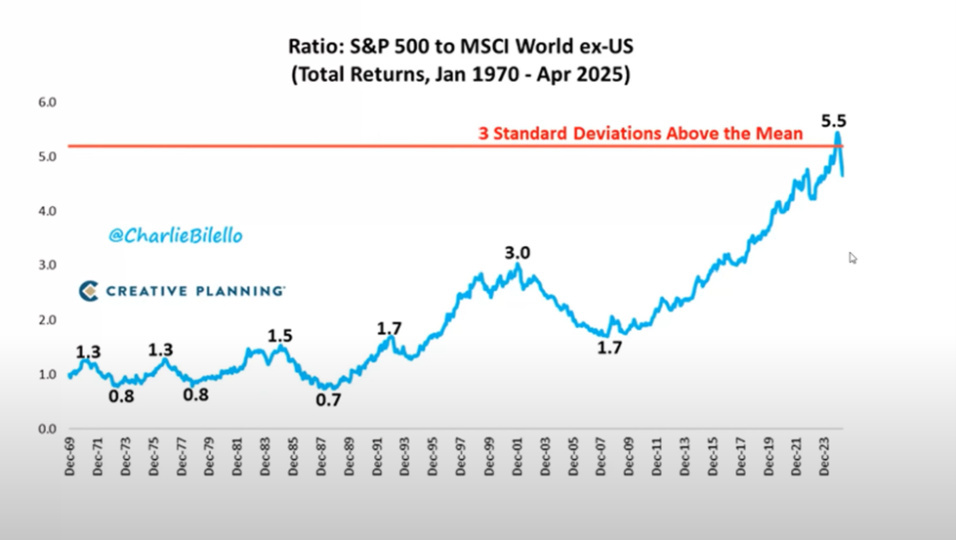

And now more than ever, after years of underperformance of international asset classes, assessing global exposure can reduce overall portfolio risk, with the European and even Chinese area still at a large discount compared to America.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.