Value as a focus for investors

21 September 2023 _ News

Investors often and willingly tend to focus their attention on Share Prices. This stems from the importance that financial literature has given to the market efficiency theory. This theory predicts that information is all there in market prices and that market participants behave rationally. The theory gave rise to one of the most widely used methods which has also been adopted by investors to face the markets: technical analysis.

On the opposite side of the market efficiency theory, we have value analysis. This type of analysis presumes that markets are efficient, but this efficiency tends to manifest itself in the long term. In the short term, in fact, you can create great opportunities for value that then tend to diminish over time. These opportunities are created because investors tend to panic and lose sight of rationality.

Sector rotations

Value theory can be applied to company and industry analysis alike. As for the sectors, this theory highlights how some sectors that are at a higher valuation discount, where the value is higher than the price, will then tend to outperform the stock market in the following months. The sectors that are more expensive, that is the value is inferior to the price, will then tend to underperform the market. These movements between outperformance and underperformance are called value rotations. To understand this rotation, we can look at sectoral performance during different time horizons.

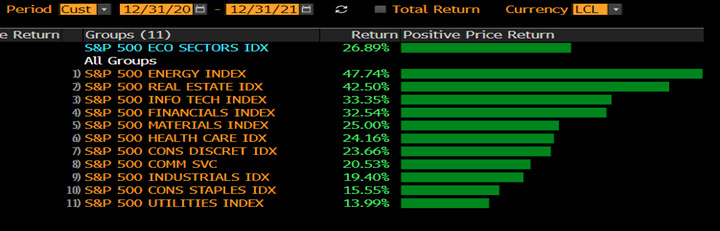

2021

In 2021, with the market showing a strong positive performance recovery, the defensive sectors, such as utilities and staples, showed a strong underperformance of more than -10%. This underperformance accompanied by the growth of earnings had created value in the defensive sectors:

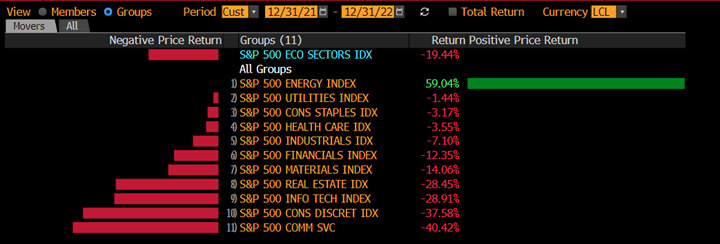

2022

After the euphoria of 2021, in 2022, the best sectors were defensive, with utilities and staples outperforming the market and becoming more expensive at the end of the year. On the other hand, we have the consumer discretionary-technology and communications sectors. With corrections above -30%, they had accumulated quite a bit of value.

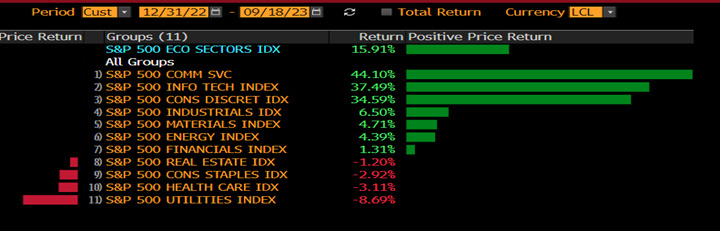

2023

In 2023, precisely the sectors that had accumulated more value, such as discretionary tech and communications, are outperforming the market. In 2023, the defensive sectors — discretionary health care and staples — appear to be the most valuable sectors and will therefore drive performance in the coming months.

In conclusion, value predicts equity performance. For this reason, the investor must maintain focus and keep up with the noise created by different strategists who change their minds with every market movement but continue to focus on value.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.