Will the Fed cut interest rates? Here's what will change

17 September 2025 _ News

It has been an important week for the markets, which have reached new highs, driven by a mix of positive macro data, expectations of interest rate cuts, and solid corporate fundamentals.

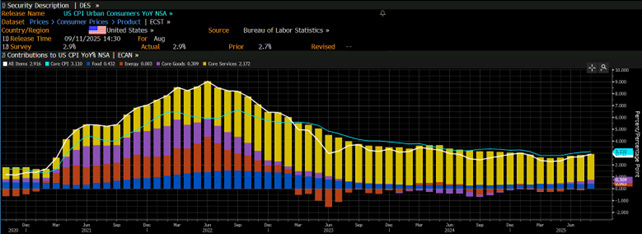

Let's start with an overview of the macroeconomic picture and the most eagerly awaited data of the week, namely inflation, with the core CPI for August coming in line with expectations at +0.3% on a monthly basis and +2.9% on an annual basis.

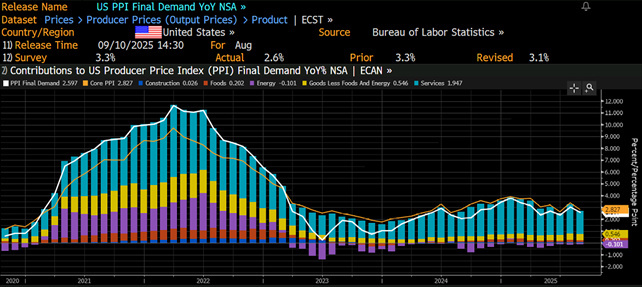

Still on the inflation front, the PPI, or producer prices, rose by only 2.6% compared to the expected 3.3% and are actually falling on a monthly basis.

While initial claims for unemployment benefits rose to 263,000, above expectations of 235,000, marking the highest level since 2023.

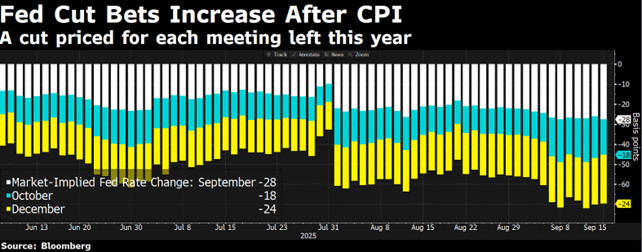

This combination of data has reinforced market expectations of a rate cut by the Fed as early as its September 17 meeting. A rate cut is now almost a certainty, with the implied probability of a 25 basis point cut next week now above 90%, and markets also beginning to price in two further cuts by the end of the year.

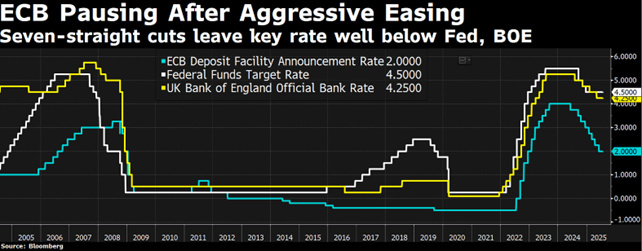

Meanwhile, the ECB left rates unchanged for the third consecutive meeting. President Christine Lagarde said that inflation is “where it should be,” but added that the overall situation and forecasts for the future remain highly uncertain, mainly due to the huge tariffs imposed by the US president since April. The Eurozone Governing Council will therefore follow a data-driven approach, whereby decisions will be taken on a case-by-case basis at each meeting.

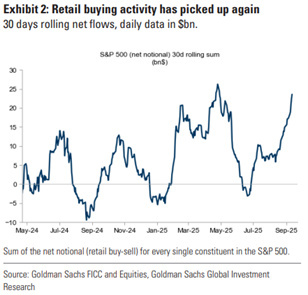

The main US stock indices have reached new highs: since the beginning of the year, the Nasdaq is up 13.3%, the S&P 500 is up 10.7%, and the Dow Jones is up 7.4%. Translated into euros, however, these performances are reduced by about 13%. The rally continues to be driven by a small number of stocks, with only a third of the companies in the index outperforming the S&P 500. This level of concentration is comparable only to the tech bubble of 2000 and the Nifty Fifty phenomenon of the 1970s.

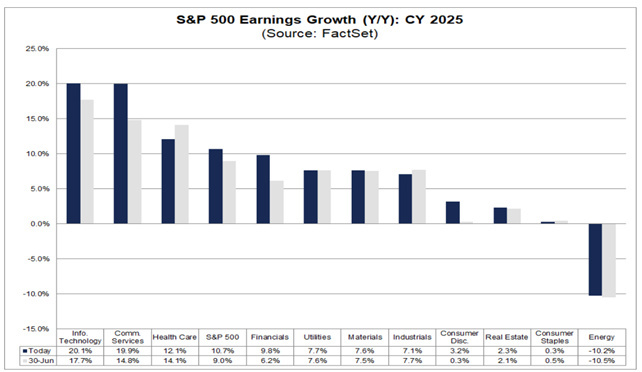

The good news is that the current upturn is not solely attributable to monetary policy factors, but is based on solid corporate data. Earnings growth accelerated after the tariff crisis in April, and the market consensus now expects earnings growth of around +11% for 2025, driven in particular by the tech sector.

The earnings revision index has risen from negative territory at the start of the year to +12% currently, indicating a sharp improvement in analysts' expectations and reinforcing the narrative of a stronger-than-expected recovery. Excellent signals also came from operating margins, which reached a new cyclical high of 14%, providing (for now) the key signal that despite the impact of tariffs, improved productivity and operational efficiency continue to support corporate profits. If you remember, back in April we pointed out how history shows that companies almost always manage to overcome difficulties and unexpected events of all kinds. A decisive factor is the ability of CEOs to adapt quickly to market conditions and turn challenges into opportunities for growth. This is a fundamental concept to keep in mind when investing in equities and is one of the reasons behind the inevitable growth of stock indices over the long term.

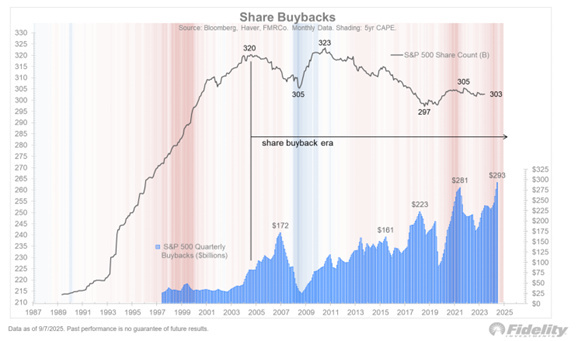

Another important driver for the stock markets is share buybacks. Share buybacks by S&P 500 companies in the last 12 months reached a new all-time high of 3 billion. This is a technical flow that continues to support the indices, even in the absence of net flows from institutional investors, who are instead showing greater caution.

Speaking of excess capital and contextualizing it not only from the perspective of companies that allocate it through buybacks, but also from the perspective of households, the Fed reported a trillion increase in household net worth in the second quarter, reaching a new record of 6.3 trillion. This reinforces the resilience of consumption even in the face of a decline in average hourly wages, thanks to the wealth effect generated by the stock market.

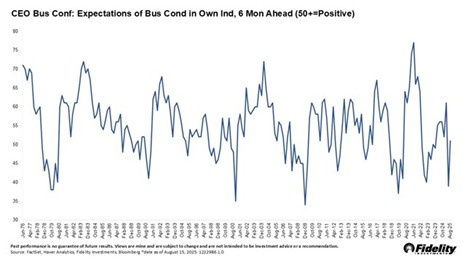

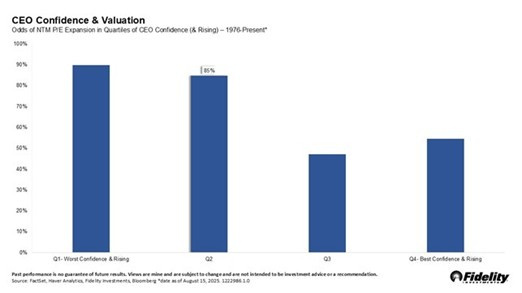

The scenario of markets supported by improving fundamentals and valuations that could remain high for longer than expected is reinforced by CEO confidence.

The CEO confidence index tracked by the Conference Board jumped 30% last month compared to the previous quarter, while remaining below the historical average.

When CEO confidence rebounds from depressed levels, it is usually because they are seeing concrete improvements in demand and greater visibility into the future. This, in turn, heralds a recovery in earnings. The lower the starting point, the stronger the positive signal. But it's not just about earnings: valuation also matters. Historically, when CEO confidence is low but rising, there is a 90% probability that market multiples will expand, even if they are already high. This is because the market tends to price in the durability of the recovery in advance, even before earnings fully materialize.

The issue of valuations deserves further consideration. Today, we find ourselves with market multiples returning to near historic highs, particularly in the tech sector.

While earnings growth partially justifies the current level, the risk of excess remains high. Historically, periods of expansion in multiples from already high levels require a very favorable macroeconomic environment and sustained earnings growth. In the absence of these factors, asymmetric risk increases.

In conclusion, we remain constructive on the medium-term outlook, supported by solid earnings, margins, and macro data. However, selectivity remains essential, especially in sectors with stretched valuations. As we have seen several times, valuations can remain high for a long time and longer than expected, but in portfolios we suggest favoring companies with pricing power, earnings visibility, and stable cash generation, paying particular attention to selectivity within the growth factor. Prudence, in this phase more than in others, is a strategic virtue.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.