The Value factor

27 September 2022 _ News

In this third in-depth study, the topic we aim to cover is the analysis of one of the factors most often discussed by experts, VALUE, and the dichotomy between the price of a stock and the intrinsic value of the related company.

The notion of VALUE has been, and continues to be, a cornerstone of a number of important academic studies (starting in the 1930s with Benjamin Graham) which have gone beyond the initial straightforward formulation, according to which, "cheaper" stocks outperform in the long run. This factor has different facets depending on the favoured economic indicators.

Price may be considered as a multiple of expected future profits or dividends distributed, price in relation to book value, or other parameters that consider prospective cash flows and enterprise value (the value of the company calculated as the price that a party who hoped to acquire the company without debt would have to pay).

In a perfect world, the value of a company divided by the number of outstanding shares should be very close to its stock price, but of course this is not always the case, and where this discrepancy is significantly in favour of value, the value manager expresses their preference.

Now we come to the most important question: when compared to passive investing, has the value approach resulted in outperformance in the long run?

The attached charts suggest to us that the answer is not unequivocally always yes.

As can be seen, from the 1970s until the collapse caused by subprime mortgages, the VALUE style revealed a clear and constant ability to outperform the parent index, MSCI WORLD. Starting with the Lehman Brother crisis and the increasingly significant presence of central banks in the economic-financial world, this gradually fading ability is evidenced by the narrowing gap between the two lines, which completely reversed during the two-year COVID period.

While it is true that value stocks have outperformed growth stocks more frequently, it is also true that, when growth stocks perform better, they do so by quite a bit more.

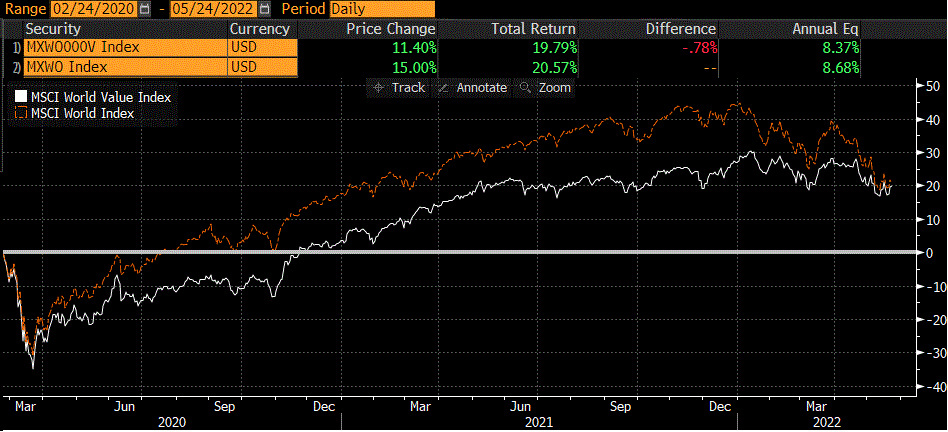

In fact, the next chart highlights the last two years, and it is clear that it was only in the last few months that the VALUE style has started to outperform, as soon as it became clearer that central banks would implement a more restrictive policy, resulting in higher rates and sharp declines in all growth stocks.

Thus, the eternal VALUE vs GROWTH dilemma arises again. Should we favour the former or the latter (characterised by significant growth prospects in terms of expected earnings or turnover, but with lower and essentially more volatile dividends, as they are more sensitive to changes in interest rates, having made greater use of leverage)?

The economic juncture in which we find ourselves is certainly the first element to consider. However, even in this case the answer cannot be unambiguous since the classification of a stock is never always in one or the other category. Companies that present new businesses, that present themselves as "game changers", that do not distribute dividends, as a large part of their profits are reinvested in the business, but prove to be already quite solid can be categorised under "growth", and the same companies, after the initial period of explosive but not constant growth, that have established themselves as premium brands, regularising the growth rate of earnings and distributing constant dividends, may be placed in the "VALUE" or "QUALITY" family.

But this is for another instalment.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.