China: opportunities within the revolution

16 September 2021 _ News

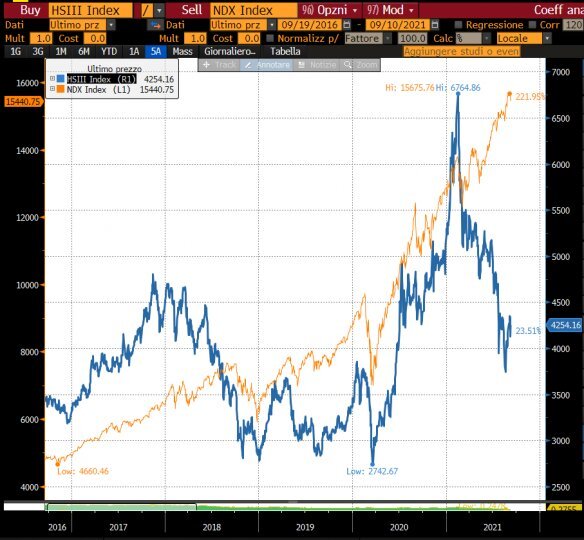

The regulatory tension that China is facing is also affecting market prices and in particular, as the chart below shows, the technology sector (blueline), creating a large gap with the US tech (yellow line):

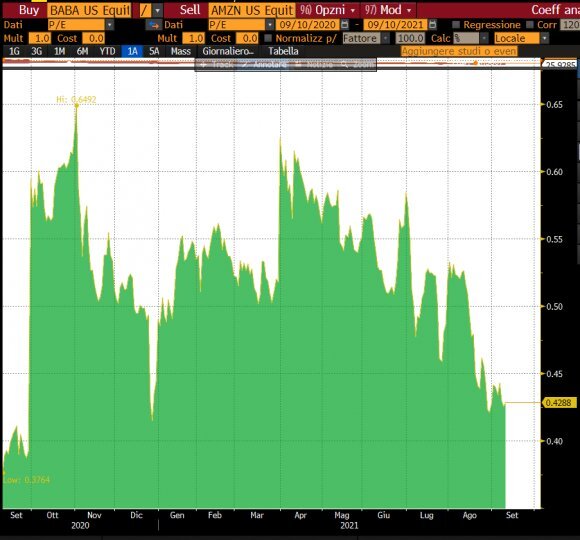

This performance gap is reflected in discounted market valuations, or rather Price Earnings (PE). If we compare Alibaba PE and Amazon PE, Alibaba has a discount of almost 60% to Amazon:

The difference in valuations is not justified even by the admittedly slight differences in the business models of the two companies, which operate in similar sectors, namely e-commerce and cloud.

The Chinese regulatory discount is therefore excessive, especially considering the US market and the similarities in the business models that can be found there.

Therefore, we decided to analyze three major Chinese technology companies, Alibaba, Baidu and Tencent, trying to define the potential adavntages and disadvantages of these three stocks.

Alibaba

- China's leading e-commerce company (87% of revenues), it is known for Taobao (C2C) and Tmall (B2C), thanks to which has a 61% market share in the online commerce sector. It is also the leader in the cloud sector (8.5% of revenues), replicating the growth trajectory of AWS, reaching in 2016, in just 8 years, 1 billion dollars in revenue, compared to the 6 years taken by AWS, which reached the same value in 2011. Alibaba Cloud is already the national leader with a 41% market share and fourth largest global player public cloud IaaS (6%) after AWS (32%), Microsoft (20%) and Google (9%)

- From a regulatory perspective, Alibaba was fined $ 2.75 billion for market abuse and anti-trust violations and was arrested before Ant Financial's Ipo. In addition, in order to meet the requirements of the Chinese government, it donated $ 15.5 billion for common welfare;

- From a regulatory point of view, we believe that 3 scenarios are possible:

- Positive scenario, with 20% sales growth and 20% margins: A 70% increase ($ 280)

- Neutral scenario, with sales growth of 15% and 17.5% margins: A 20% increase ($ 200)

- Negative scenario, 12% sales growth and 15% margins: 15% decrease ($ 145)

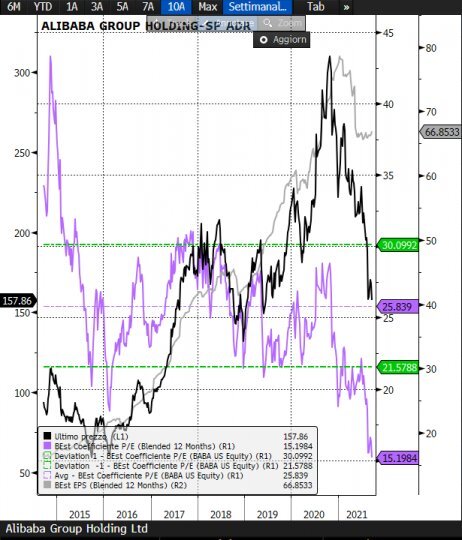

- In terms of valuations, the company, compared to its historical performance, is discounted in terms of PE (purple line), with earnings slowing the negative revision (grey line) and a share price that has corrected by 45%.

Tencent

- A leading online gaming and fintech company, its gaming revenues are greater than those of Nintendo-Electronic Arts and Activision combined. Microsoft considers Tencent the largest company in the sector, with estimated revenues of $ 19.4 billion and profits of $ 6.3 billion. The company’s fintech business consists mainly of Wechat, which integrates messaging tools with social networks features. It is possible to send messages, make video calls, share photos and videos, share location and at the same time follow other users or businesses.

- From a regulatory point of view, Tencent was fined $ 1.5 billion for market abuse and violation of antitrust laws and was also penalized by the government's decision to reduce the number of hours children can play online.

- From a regulatory point of view, there are 3 possible scenarios

- Positive scenario, with 20% sales growth of 30% 30% margins : A 60% increase ($ 100)

- Neutral scenario, with sales growth of 15% and 25% margins: A 10% increase ($ 70)

- Negative scenario, with sales growth of 12% and 20% margins: A 30% decrease ($ 45)

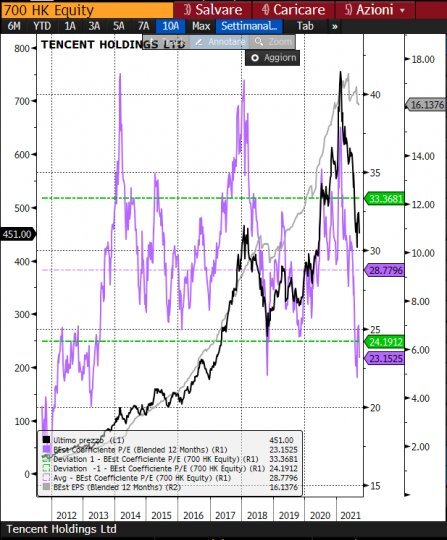

- Looking at valuations, the company, relative to its historical performance, is discounted in terms of PE (purple line), with earnings slowing the negative revision (grey line) and a share price that has corrected by 45%.

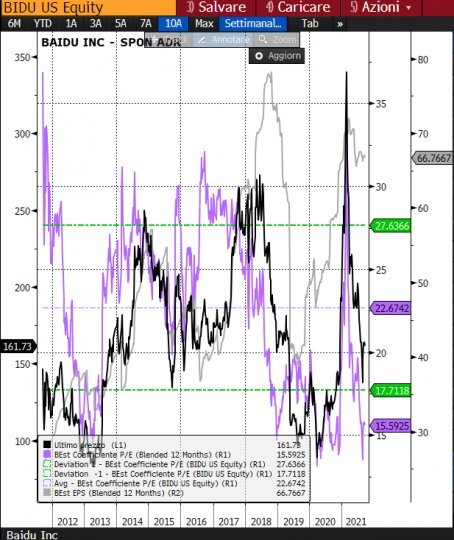

Baidu:

- A leading company in online search and Artificial Intelligence, it is the largest Internet search platform in China, operating since 2000. In two decades, Baidu has moved from a simple search platform to an ecosystem that offers a wide range of products and services via mobile, PC and other smart devices, with continuous product developments powered by artificial intelligence. In the field of AI, the leading autonomous driving software, Apollo, has more than 177 components, including suppliers and other partners. Apollo supports the development of third parties and infrastructure for intelligent transport system to cities with the aim of improving municipal traffic conditions, air pollution and road safety.

- From a regulatory point of view, Baidu has not yet been affected, but it may be affected by the new data protection legislation.

- Analysis of regulatory scenario:

- Positive scenario, with 20% growth and 15% margins : Upside of A 60% increase ($ 260)

- Neutral scenario, with 15% growth and 12.5% margins : A 15% increase180 $)

- Negative scenario, with 12% growth and 10% margins : A 15% decrease ($ 135)

- Again, the company is down in PE terms compared to its historical performance (purple line), but with recovering earnings (grey line) and a price per share that has corrected by 50%.

Investing is risky, and in this case the greatest source of uncertainty comes from the controlled economic growth model rather than the free market that China is adopting. However, the different scenarios show a very limited downside, with a certainly very attractive upside potential.

Information message - The information in this message is produced for information purposes only and therefore does not qualify as offer or recommendation or solicitation to buy or sell securities or financial instruments in general, financial products or services or investment, nor an exhortation to carry out transactions related to a specific financial instrument.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.

RELATED CONTENTS